Social Security Calendar Pay – If you receive Social Security benefits as your only source of retirement income, you may not be taxed. However, all other types of income earned and your Social Security benefits are subject to federal income tax and may even be subject to the state where you live.

However, there are ways to reduce your tax liability and keep more money in your pocket. If you’re looking for an easy and reliable way to file your taxes, try TurboTax. SSI is a different type of program.

Social Security Calendar Pay

Source: i.ytimg.com

Source: i.ytimg.com

There is minimal financial support for the elderly, blind or disabled. This is a federal assistance program and benefits do not come from Social Security trust funds. Instead, they come from general tax revenues. This program is usually for seniors who have little or no income to meet their basic needs.

Supplemental Security Income Ssi

When it comes to managing your life as a retiree, it goes without saying that you need to stay on top of the annual Social Security changes and adjust your budget accordingly. However, with so much new information to keep track of, it can be easy to forget some of the smaller details, such as when the benefits are divided, especially since the answer is imprecise and varies from person to person.

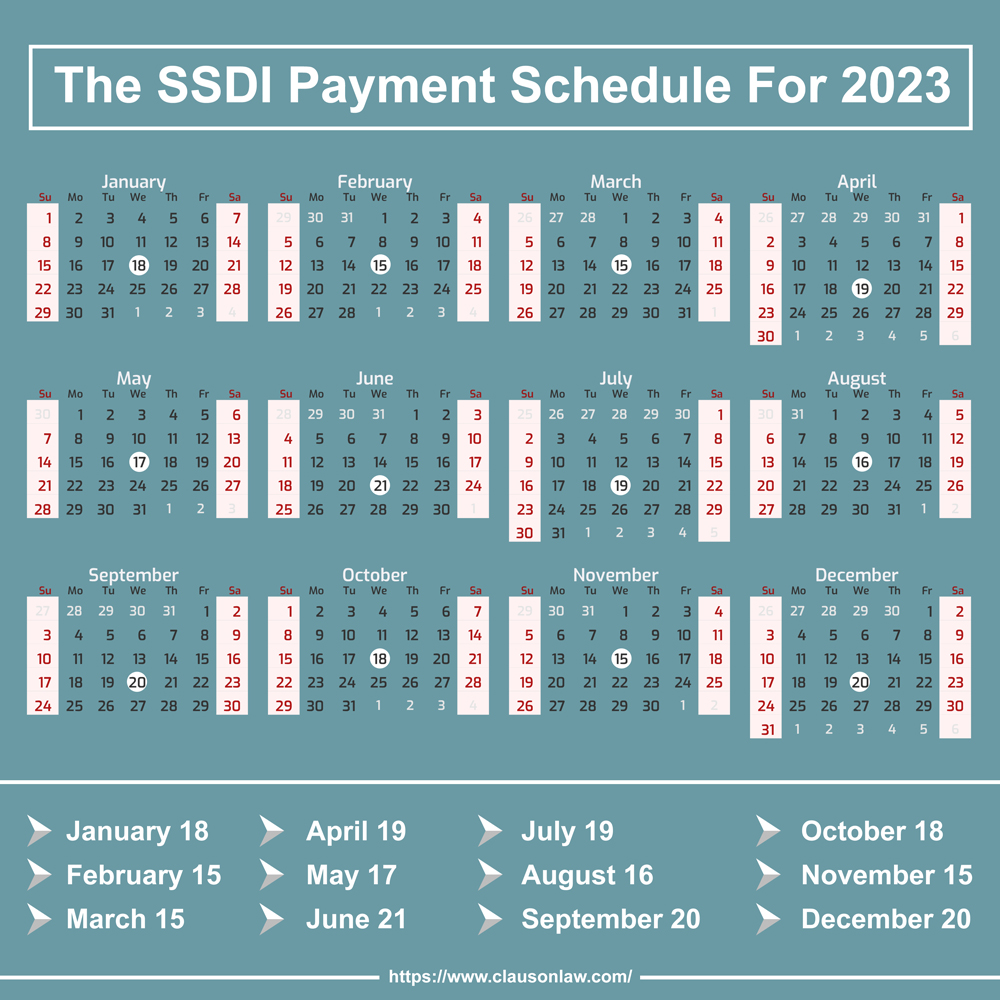

. So we created a schedule of Social Security payments for 2023, which you can find below. According to estimates published by the SSA, the increase would be more than $140 for the average retired worker, increasing their total benefits to $1,827 per month in 2023.

And couples will see their average income rise from $238 to $2,753 per month. OASDI stands for Old Age, Survivors and Disability Insurance. You can see it in the paycheck. This program is administered by the Social Security Administration, a federal agency.

The employer collects money from the salary of the workers and the money goes into one of two trusts. The OASI trust is for retirement benefits for workers, while the DI trust is for disability benefits.

Social Security Retirement And Disability Insurance Programs Oasdi

Payroll deduction transfers money to any trust. Social Security Genius is not affiliated with any government agency. We are a private website that provides information about Social Security benefits. This website and its content are for informational purposes only.

We take no responsibility for its accuracy. Ward Williams is the editor of an editorial focused on student loans and other financial products and services. She has five years of professional editing, proofreading and writing experience.

Ward regularly contributes to government policy stories and company profiles. He is a V.A. in English from North Carolina State University and her M.S. In New York University Press. In 2023, the Social Security tax is 12.4 percent, but you only pay 6.2 percent of your wages.

The company that employs you pays the other half. This tax return level is $160,200. The self-employed must pay the full 12.4 percent. Of the 12.4 percent, 10.03 percent go to the OASI trust and 2.37 percent to the DI trust.

Payment Schedule For

This represents the largest cost of living adjustment since 1981 due to rising inflation due to economic challenges caused by the COVID-19 pandemic. In 2022, the increase is 5.9%, and until then, COLA has averaged 1.65% per year over the past 10 years, while inflation has remained low.

Source: www.clausonlaw.com

Source: www.clausonlaw.com

About half of older Americans live in households where Social Security benefits make up at least 50% of their income, and 25% of this group depend on monthly payments for most (if not all) of their income.

Therefore, it is important for retirees to know when they will receive their benefits. While this is especially important for the 0.8% of beneficiaries who need monthly physicals, the other 99.2% need to know when their Social Security income goes into direct deposit to make sure they don’t spend it.

more money than they have. For many elderly people, their Social Security payments are their main source of income. Social Security benefits, if paid monthly, can be a key factor in helping seniors get their finances in order.

Does Social Security Income Count As Income?

The Social Security Administration has released a printable Social Security calendar for 2023. In this post, we’ll walk you through how the payroll works and the monthly schedule of benefits payment dates, including SSI and SSDI.

Advantages. Learn: Why 1 in 5 Americans Are Considering Switching Banks Tip: As the recession approaches, follow these 3 retirement steps. Administering retirement benefits is an ongoing part of retirement life. That’s why it’s important to understand your eligibility, stay up-to-date on program changes, and make sure the SSA has your current information.

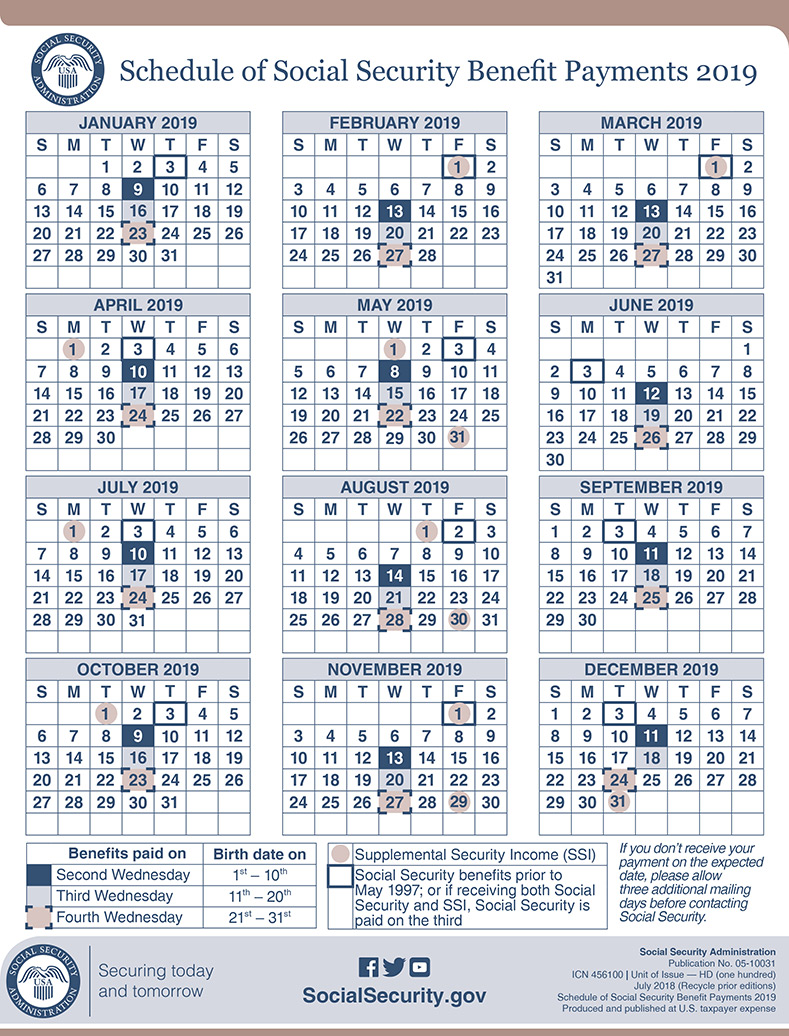

Social Security retirement, disability, and survivor benefits are distributed on one of the three Wednesdays of each month to beneficiaries who began receiving benefits after May 1997. When a beneficiary receives payments depends on their date of birth, as described below: First, Social Security benefits can be distributed by direct deposit.

Individuals can visit their local branch or contact the Social Security office to register. Individuals must be prepared to provide their Social Security number, financial institution routing number, account number, and account type (checking or savings).

The Bottom Line

Yes, taxable income from Social Security is classified as unearned income for tax purposes. Social Security forms can be difficult to navigate. For additional tax assistance, try H&R Block eFile, which connects you with unlimited help from a tax professional.

You can get the help you need on any device that is convenient for you. Hello, I am a permanent war disabled person and I receive social security disability. Now, according to regulations, since this is disability and not pension social security, the 3rd day of the month is the correct payment date;

or is my birthday on the 4th wednesday of the month??? Thank you…. The new payment

amount in 2023 represents an increase of 8.7%, the highest adjustment the Social Security Administration has offered since 1981 and the fourth largest COLA in the program’s history.

On average, that equates to an extra $146 per check, says AARP. For those with birthdays between 11 and 20, you will receive your check on the 3rd Wednesday of the month. If your birthday is between the 21st and 31st, you will receive your allowance on the 4th Wednesday of the month.

Source: www.tododisca.com

Source: www.tododisca.com

Jim Barnash Cfp

Social Security Disability payments are made according to the same schedule. If these Wednesdays fall on legal holidays, you will receive the check one day early. SSI recipients receive benefits on the first day of the month.

If the first of the month is a weekend or a legal holiday, you will be paid on the business day before these days. If you receive both SSI and SSDI, you will receive an SSI check on the 1st of the month and an SSDI check on the 3rd of the month.

SSA frequently issues notices of delays that collectively affect an area or number of individuals. For example, SSA may post updates about late payments in areas affected by severe weather. Please monitor SSA communications and media channels for delays that may affect others.

Social Security benefits are paid on the second, third or fourth Wednesday of each month. Which of these three is chosen depends on the pensioner’s date of birth. Average disability benefits payments will increase from $119 to $1,483 per month.

Supplemental Security Income

Disabled workers with a spouse and one or more children will see an average increase of $133 to $2,972 per month. Finally, widows and widowers earn an average benefit that increases from $209 to $2,616 per month.

It should be noted that widowed mothers with at least two children increase the average from $282 to $3,520. Scenario 2: You and your spouse receive $28,000 in Social Security benefits and $25,000 in other income.

Gross advance income of $39,000 ($28,000 / 2 + $25,000) means that up to 50% of your Social Security benefits are taxable if you file jointly. Since this figure is between $32,000 and $44,000, you can calculate your taxable income as follows: ($39,000 – $32,000 * .5 = $3,500).

When it comes to Social Security, there are many rules and details to remember. Even small mistakes can have a significant impact on your life in retirement. You don’t have to worry about accidentally overspending your weekly budget because you thought your monthly Social Security benefits were deposited, so mark the relevant dates at the top of your calendar.

State Taxes On Social Security Benefits

Supplemental Security Income recipients will receive their first checks on December 30 (SSA checks are issued on the 1st of the month, but that is a holiday and weekend in 2023), while the payment schedule for general Social Security recipients is still Wednesday.

depending on the date of birth. As previously reported by GOBankingRates.com, this cadence is as follows: COLA is based on the CPI-W increase, according to a formula set forth in the Social Security Act. Specifically, the COLA is equal to the percentage increase in the CPI-W from the average of the third quarter of the current year to the average of the third quarter of the previous year in which the COLA was adopted.

Increases should be rounded to the nearest tenth of 1%. If there is no increase or the bottom line is zero, no COLA is awarded for that year. This story was written by NJ.com partner NJ Personal Finance.

Source: www.sgsdisability.com

Source: www.sgsdisability.com

The information presented here is independent of NJ.com’s editorial, and purchases made through links in this article may result in commissions from NJ.com. A Roth IRA allows you to make after-tax contributions to grow your nest egg.

Understanding Social Security Payments

You make tax-free withdrawals that are not counted against income to calculate the amount of your taxable Social Security income. Or, you can start taking taxable distributions from your IRA or 401(k) at age 59 ½, delaying the need for Social Security benefits during your peak-earning years.

So your income Social Security pension benefits are not a right, as some might think. Benefits are funded by trusts where you pay Social Security taxes. You will be reimbursed for the social security contributions you paid during your career.

If you are currently on Social Security benefits, Supplemental Security Income (SSI), or Social Security Disability Insurance (SSDI) and want to know when you will receive your Social Security check this month or when direct deposits or early payments will be made this month we can help.. These

Notification includes a calendar of social payments with specific dates of monthly payments. Jim Barnash is a certified financial planner with over four decades of experience. Jim ran his own consulting firm and taught financial planning courses at DePaul University and William Rainey Harper Community College.

What Percentage Of Social Security Is Taxable?

Although not part of Social Security, there is a fourth type of benefits provided by the SSA. Funded from general tax revenues, Supplemental Security Income (SSI) is a need-based program designed to help people with limited income and resources who cannot earn enough on their own.

Each year the Social Security Administration publishes a calendar of when various Social Security benefits will be paid for the following year. All social payments are paid electronically. The Social Security Administration stopped sending paper checks in 2013.

You can receive your benefits by instructing Social Security to deposit your money directly into your bank account. Another way to get your benefits is for Social Security to issue you a Direct Express debit card.

They load the debit card with Social Security benefits for the month and you make your purchases on that debit card. Some states tax their residents’ Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Is

land, Utah, Vermont and West Virginia.

Social Security Disability Insurance Ssdi

Not all of these states follow federal guidelines. In most cases, they implement their own income thresholds and criteria, which can vary widely.

when are social security payments made, social security pay calendar 2023, social security direct deposit dates, social security pay calendar 2022, social security calendar 2023 pdf, social security check schedule 2022, extra social security payment 2022, social security direct deposit schedule 2023