Trading Econ Us Calendar – Customer agreement and terms of use | Privacy notice | Cookie notification (). Later today, the release of the ISM services PMI will dominate the headlines in the S&P report, which is little watched in the US.

This report is key for the market, as the US is primarily a service-led economy, and while expectations are for a fall in February, the numbers remain in growth territory. The trading day ended with many Fed speakers likely to continue their aggressive tone despite the absence of PMI data.

Trading Econ Us Calendar

Source: allhomestuff.sg

Source: allhomestuff.sg

The 2-year US Treasury yield shown below peaked in the November 2022 swing at 4.881%, but quickly retreated below that. The Treasury market is currently at a major inflection point that could be in doubt before another rally, with US stocks likely to continue to decline due to weakening valuations.

Mixed Ig Client Sentiment

Conversely, yesterday’s long upper heart is usually associated with the next decline and may indicate a peak in the new Fed interest rate repricing. IG Client Sentiment (IGCS) data shows that retail traders are currently LONG the S&P 500, with 53% of traders currently holding long positions (as of this writing).

Source: ftmo.com

Source: ftmo.com

At DailyFX, we tend to take the opposite view of public sentiment; However, due to recent changes in long and short positions, we will have a short-term cautious bias. Focusing on the shorter daily chart, the 200-day MA (blue) has been a stable port for the bulls, who have defended this zone in three separate sessions recently.

Weak fundamentals can trigger a breakout, while a close above 4000.00 can cancel a short-term decline. We use different cookies to give you the best browsing experience. By continuing to use this website, you accept the use of cookies.

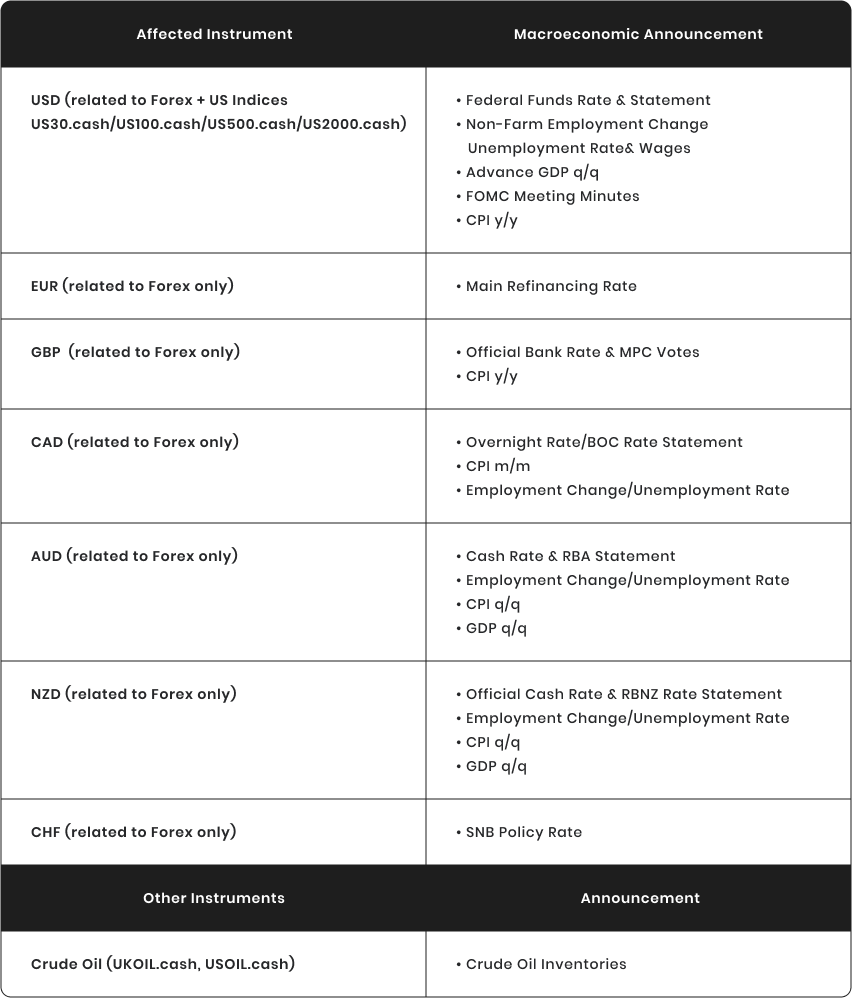

You can find out more about our cookie policy here or by following the link at the bottom of any page on our site. See our updated privacy policy here. Every trader needs to know the release dates of important economic data, including labor market figures, interest rate decisions, inflation and gross domestic product.

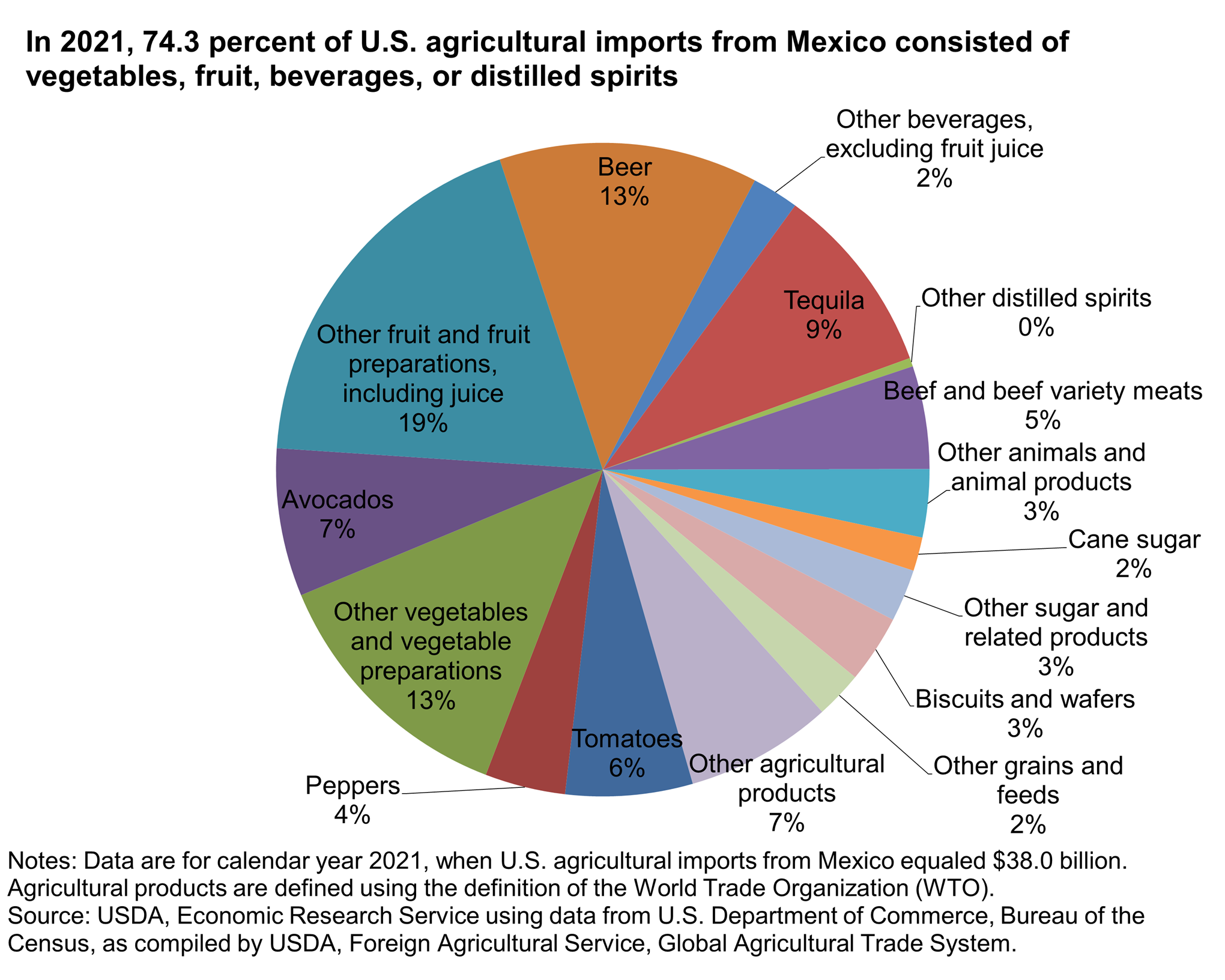

Source: www.ers.usda.gov

Source: www.ers.usda.gov

Spx Fundamental Backdrop

This is especially important for day traders and short-term traders. Stocks: 15-20 minute delay (Cboe BZX real-time), ET. The volume reflects the combined market. Futures and Forex: 10 or 15 minute delay, CT. Market information is provided by Barchart Solutions.

The underlying data is provided by Zacks and Morningstar. The S&P 500 remains under pressure (US stock futures again indicated a red open) despite the reversal of yesterday’s trading session, which saw a significant retreat after the Fed speech.

Governor Christopher Waller suggested that the Federal Reserve should raise interest rates higher than they have been priced in (see table below). This comes after better-than-expected jobless claims data added to an already tight US labor market.

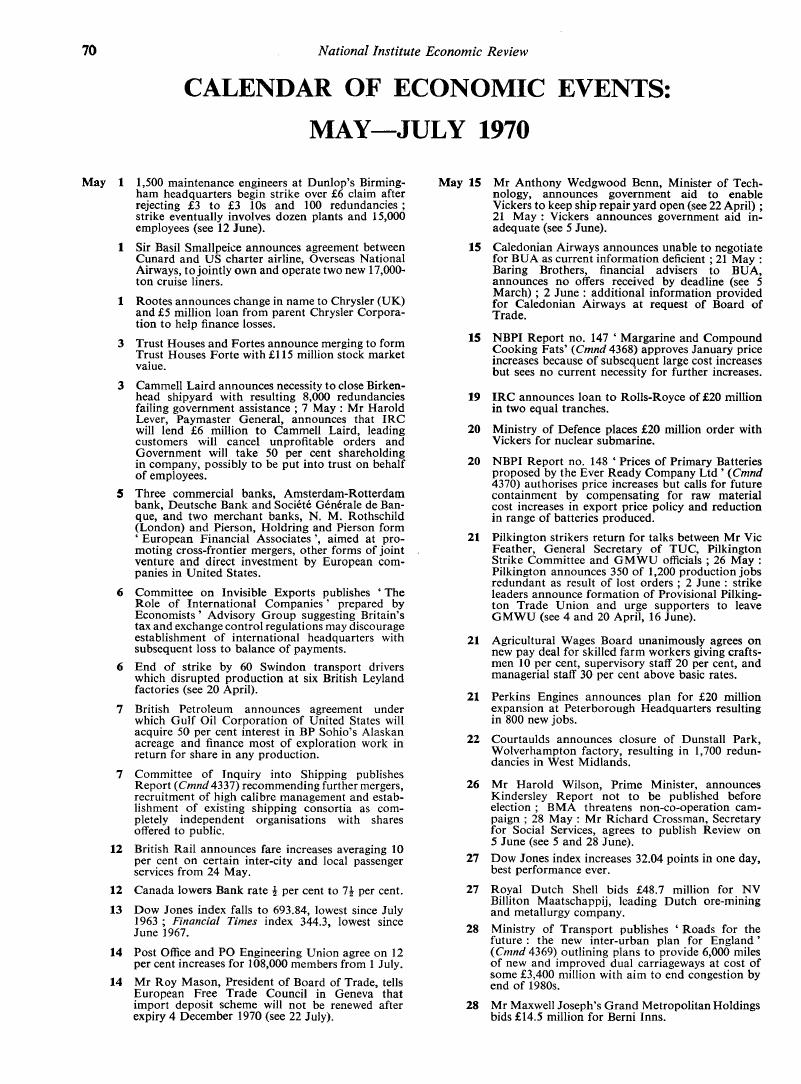

Source: static.cambridge.org

Source: static.cambridge.org

Make sure your browser supports JavaScript and cookies and that you are not preventing them from loading. You can get more information by reading the terms of use of the Service and the cookie policy. The importance of individual events is shown by the number of bull heads.

Why Did This Happen?

You can use filters to exclude events related to individual currencies or to determine the importance of the displayed stock market events. Intraday information is provided by FACTSET and is subject to terms of use. Recent historical and current data provided by FACTSET.

All offers are in local currency. Real-time closing sales data for US stock prices includes only trades reported through Nasdaq. Intraday data is delayed by at least 15 minutes or according to exchange requirements. The weekly SPX index chart above shows a flirting bullish wedge chart pattern (black) with a break down, and this week’s candle close is the key to next week’s directional bias.

A close drop may open a move down to the psychological level of 3900.00.

economic calendar this week, 2022 us economic calendar, us economic calendar this week, trading economics calendar china, economic calendar marketwatch, news trading calendar, economic indicator calendar, economic events calendar