2023 Accounting Calendar – January 31: Form 1040/1040-SR | Form W-2 (for employees) | Form W-3 (from SSA) | Form 1099-NEC (to recipients and the IRS) | Forms 1097, 1098, 1099, 3921, 3922, W-2G (to recipients) | Form 8300 (to recipients) |

Form 8809 Download and customize this landscape layout calendar with US holidays for fiscal year 2023 into a one-page Excel spreadsheet template. The calendar year accounting period starts from February 2019. This period of 4-4-5 months includes weekly numbers.

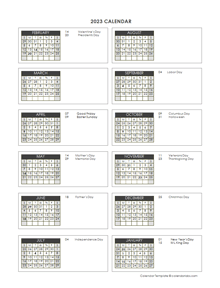

2023 Accounting Calendar

Source: annystudio.com

Source: annystudio.com

Download Custom You can use the Ledger Calendar page to view details of the fiscal calendar, fiscal year, and periods used by your organization. You can also change the status of periods and select which users can perform accounting operations in which periods.

Maintain Periods For Your Organization

For example, at the start of a new period, you may want one group of users to complete the posting of financial transactions for the previous period, while other groups work only on the new period.

In the register form select the financial calendar you want to use for your legal entity register. A financial calendar should be selected for each legal entity on the “Book of Accounts” page. After selecting a fiscal calendar, you can set up period conditions and authorizations for any of the periods that are part of the fiscal year on the General Ledger Calendar page.

Source: www.calendarpedia.com

Source: www.calendarpedia.com

Financial calendars provide the basis for an organization’s financial activities. Each fiscal calendar has one or more fiscal years, and each fiscal year has several periods. Fiscal calendars can be based on a calendar year from January 1 to December 31 or any date you choose.

For example, some organizations choose a fiscal calendar that begins on July 1 of one year and ends on June 30 of the following year. When you create an end period, select a period with an open status and the dates you want to use.

Select A Fiscal Calendar For Your Legal Entity

The new end period will copy the start and end dates from the current period. The original round will continue. For example, you select period 12, which is the last period of the fiscal year and has dates from August 1 to August 31.

You enter a name for the closing period, such as Close. After creating a new end period, you have a start and end period. Both have dates that start on August 1 and end on August 31.

Source: www.someka.net

Source: www.someka.net

You can select a fiscal calendar for a fixed asset ledger, and that fiscal calendar will be used by fixed assets that use the selected ledger. You can select any of the financial calendars specified on the Financial Calendars page.

The budget cycle is the period during which the budget is used. Budget cycles may include part of a fiscal year or multiple fiscal years, such as a two-year biennial budget cycle or a three-year triennial budget cycle.

Select A Fiscal Calendar For Fixed Assets

The budget cycle period determines the number of periods that are included in the budget cycle. To define budget cycle time frames, use the Budget Cycle Time Frames page. Financial calendars are used for depreciation of fixed assets, financial transactions and budget cycles.

When you create a financial calendar, you can use it for many purposes. You can select a fiscal calendar for a fixed asset book to make it a fixed asset calendar. You can select a financial calendar to make a book a book calendar.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

And you can select the fiscal calendar for the budget cycle to make it a budget calendar. You can use the same financial calendar for all of them. Our 2023 tax calendar gives you a quick reference to the most common tax forms and deadlines for 2023 for individuals, companies and tax-exempt organizations.

Integrated with the IRS Calendar – See month-specific deadlines for filing tax forms, paying taxes and other actions required by federal tax law. Bookmark this website to track key deadlines until 2023 and avoid fines and late fees.

Define Budget Cycle Time Spans

The closing period is used to isolate general ledger transactions that arise after the close of the fiscal year. When closing transactions refer to the same financial period, it is easy to create financial statements that include or exclude different types of closing entries.

If a fiscal year is divided into 12 fiscal periods, the closing period is usually the 13th period. However, a closed period can be created from any period that has an open status. There is no limit to the number of fiscal calendars you can create, and there is no limit to the number of fiscal years you can create for a fiscal calendar.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

Each financial calendar is independent of your organization and can be used by multiple legal entities within the organization. For example, an organization has eight departments, and each department is a separate legal entity. Five of them have the same fiscal calendar, and three have different ones.

You can create one fiscal calendar for five legal entities that use the same fiscal calendar, and then

create separate fiscal calendars for the other legal entities. Below is a list of the best printable accounting calendar templates for 2023 in xls/xlsx, pdf and word formats.

Free Accounting Calendar Template Service

Retail billing calendars are available with 4-4-5, 4-5-4 and 5-4-4 week accounting periods. The full reporting period closing calendar is editable and free to download. Personalize or brand and print to your liking. Make sure the copyright text and attribution below is not removed.

printable 4 5 4 calendar, 2023 13 period calendar, 2023 accounting period calendar, 454 calendar 2022, fiscal calendar 2022, 2022 accounting calendar, 5 4 4 accounting calendar 2023, accounting pay period calendar 2023

At Printable Calendar, we are committed to providing our customers with the best possible experience. We value your feedback and are always looking for ways to improve our products and services. If you have any questions or comments, please don’t hesitate to contact us. We are always happy to help!

Thank you for choosing Printable Calendar. We look forward to helping you stay organized and on track!”