Chase Freedom Reward Calendar – Chase’s website and/or phone terms, privacy and security policies do not apply to the site or application you are visiting. Please review its terms, privacy and security policies to see how they apply to you. Chase is not responsible for (and does not offer) any products, services or content on this third party site or application, except for products and services bearing the Chase name.

Editor’s Note All reviews are prepared by CreditCards.com staff. The views expressed therein are solely those of the reviewer and have not been reviewed or endorsed by any publication. Information, including card rates and fees, displayed in the review is correct as of the review date.

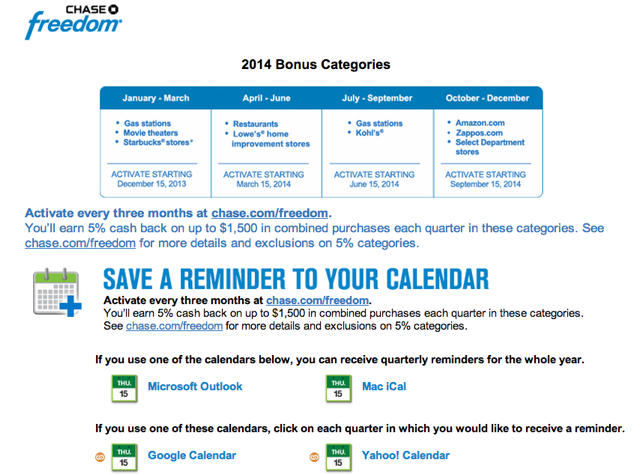

Chase Freedom Reward Calendar

Source: monkeymiles.boardingarea.com

Source: monkeymiles.boardingarea.com

Check the data at the top of this page and the bank’s website for current information. Most or all of the products shown here come from our paid partners. This affects the products we list and the location and appearance of the product on the page.

Spend Strategically

However, this does not affect our opinion. Our thoughts are our own. Here is a list of our partners and how they make money. Let’s face it – there are a lot of buzzwords and bureaucracy in the credit card industry.

Our experts have studied the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch ™ and in-depth advice from our editors, we provide you with game information to help you make the best financial decisions.

After reading the “Details”, you will get to the screen with the button to click “withdraw” or you will receive a 5% bonus. In the example below, the categories for monthly budgets are retail stores (except Target and Walmart) and eBay.

Editorial integrity is important to every article we publish. Fairness, independence and authority remain the core principles of our editorial guidelines. For more information about automated content on CreditCards.com, email Lance Davis, VP of Content, at [email protected].

How Do I Redeem Reward Points?

It’s small, but important, to get that 5% rate. You must “work” the bonus points on the card every quarter. To do so, log into your Freedom Flex account and click on the little text that says “Details” next to where it says 5% cash back and current months per quarter.

Reward points can often be purchased through your credit card portal or mobile application. If you’re working hard to earn and accumulate points, don’t forget to check if there’s an expiration date associated with the points you’ve earned.

Chase is a consumer and commercial finance business. of JPMorgan Chase & Co. (NYSE: JPM), a leading financial services company based in the United States with assets of $3.8 billion and operations worldwide. Chase serves more than 66 million American families and 5 million small businesses with a variety of financial services, including personal banking, credit cards, loans, auto loans, investment advice, business loans

low and cost processing. Customers can choose how and where they want to fund: More than 4,700 branches in 48 states and the District of Columbia, 16,000 ATMs, mobile, online and phone. For more information, visit chase.com.

Credit Score Needed For The Ink Business Cash Credit Card

Both Chase and Discover offer credit cards with 5% cash back on up to $1,500 in quarterly spending in bonus points that rotate quarterly and 1% back on all purchases. To receive a loan, you must enter, or “withdraw”, a portion each quarter.

Source: damhyul3s75yv.cloudfront.net

Source: damhyul3s75yv.cloudfront.net

For example, if the department stores include grocery stores, most supermarkets sell gift cards to places like Amazon, restaurants, and grocery stores. Then you might want to put some money on a gift card to cover your next night out or a special gift.

Or, if you have the time, spend $1,500 on household items like paper towels, toilet paper and cleaning products for a year. We believe that everyone should be able to make financial decisions with confidence. And while our site does not cover every company or financial product on the market, we are proud of the guidance we provide, the information we provide and the tools we create.

objective, specific, clear – and free. Chase Freedom Flex earns 5% cash back on up to $1,500 in quarterly transactions (must be activated), 5% on travel purchased with Chase Ultimate Rewards®, 3% on restaurants and drugstores and 1% on all other purchases.

What Is Included In The Grocery Store Category?

The information on this page is correct as of the date of posting; however, some partner offers may be discontinued. Please browse our list of the best credit cards or use our CardMatch™ tool to find a card that matches your needs.

Disclaimer: NerdWallet makes every effort to keep its information accurate and up-to-date. This information may differ from what you see when you visit a financial institution, service provider or product site. All financial products, marketing products and services are presented without license.

When reviewing an offer, please review the financial institution’s Terms and Conditions. Pre-qualification offers are non-binding. If you notice any discrepancies with your credit score or information from your credit report, please contact TransUnion®. Before we dive in and explain how to maximize this opportunity, it’s important to know that while many Chase cards have “Freedom” in their name, the Chase Freedom Flex℠* is the only Freedom card

available to new customers offering a 5% spin. bonus. return clause. The Chase Freedom Unlimited® and Chase Freedom® Student credit cards have a unique payment structure and do not offer different financing options. “To help cardmembers start 2023 off on the right foot, we’re excited to introduce Target as a new category this quarter, bringing back favorites like department stores and

Comparing Chase And Discover Bonus Categories

fitness club and gym memberships,” says Brent Reinhard, CEO of Follow the Trend. Citi’s credit ca

rd with similar terms – the Citi Rewards Card – is no longer available to new applicants. It pays 5% on the rolling bonus points you spend and 1% on other purchases.

There is no quarterly spending limit, but the total cash back you can get each year is limited to $300. When applying for a Chase Ink Business Cash credit card, you need to know what credit scores are required.

This information can help you decide whether or not to bid or offer when upgrading your score. Now that you’ve unlocked the 5% bonus points, it’s time to trade. But maybe the way to spend money is not the same as where you can get 5%.

Now is the time to think outside the box and fill some of your marketing needs with financial resources in ways you may not have imagined. Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card.

Source: thepointsguy.global.ssl.fastly.net

Source: thepointsguy.global.ssl.fastly.net

How To Maximize Cash Back

Our team is made up of diverse people with diverse expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re here to provide you with the best advice and the latest information on the entire credit card space.

Chase Freedom Flex℠* has no annual fee, earns 5% industry-leading cash back on $1,500 in roundtrip travel every three months (must be activated), 5 % on travel purchased with Chase Ultimate Rewards®, 3% on food and beverages.

drug store and 1% on all other purchases. This high payout level means that if you plan your spending, you can only get cash back from the bonus points. Robin Saks Frankel is a credit card and personal finance writer for Forbes Magazine.

Previously, he covered credit card and related news for other national web publications including NerdWallet, Bankrate and HerMoney. He has been featured as a financial expert on outlets including CNBC, Business Insider, CBS Marketplace, and has appeared or contributed to Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC

Bottom Line

and CBS TV affiliates nationwide. Follow him on Twitter at @robinsaks. It is important to understand that it is necessary to increase the bonus points if you can pay your credit card in full and on time each month.

If you spend money to increase your monthly installments, you will pay more in interest than the value of the payments you have received. If you haven’t applied for one of these cards yet, the Discover it Cash Back Contest might be enough to entice you to apply for the Discover it Cash Back.

The issuer will match all the cash back you get after your first year with the card (meaning if you get $300 in cash back, Discover will give you $300 back as a bonus). Almost all of the sales came from supermarkets, which Chase says are “grocers that offer a full grocery line that includes food and baking” and small grocery stores that count toward the discount.

If the delivery service is marked as a merchant, based on the merchant category code, you will receive a 5 percent bonus. Customer Experience CreditCards.com is an exclusive, advertising-supported comparison service. Contributions from this site come from companies that receive credit from CreditCards.com.

Which Card Offers The Better Deal?

This payment may affect how and where products appear on this site, including, for example, the order in which listings appear. Other factors, such as our website’s ownership rules and the likelihood of a candidate’s credit approval may influence how and where results appear on the site.

CreditCards.com does not cover all areas of credit that are available or offered. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. So how do we make money?

Our partners pay for it. This may affect the products we review and write about (and where those products appear on the site), but in no way affects our recommendations or recommendations, which are based on thousands.

![Chase Freedom Unlimited Vs. Freedom Flex Card [2022]](https://upgradedpoints.com/wp-content/uploads/2021/05/Chase-Freedom-Unlimited-vs-Chase-Freedom-Flex-Upgraded-Points-LLC.jpg) Source: upgradedpoints.com

Source: upgradedpoints.com

of research hours. Our partners do not pay us to provide positive reviews of their products or services. Here is a list of our partners. See online credit card applications for information on application terms and conditions.

Compare Chase Categories With Discover

Every effort is made to keep the information accurate. However, all credit card information is disclosed without warranty. When you click the “Apply Now” button, you can review the terms and conditions of the credit card on the issuer’s website.

Chase isn’t the only card issuer to offer 5% cash back. Discover also allows cardholders to earn 5 percent cash back on revolving points opened each quarter (up to $1,500 in spending, then 1 percent) through Discover it® Cash Back.

Here’s a look at Discover’s bonus features for 2023 compared to those offered by Chase. After you reach $1,500 for a quarter, all other spending in eligible financial categories earns 1%—a rate that can easily be earned on other cards.

Your Chase account has a graph that measures how much money you have left before you reach the $75 maximum. This is especially useful if you have linked your Freedom to another card. Once you reach that spending limit, you can switch to a card that offers a higher rate than the 1% you get from Freedom Flex when you make purchases outside of the bonus levels.

Q4: Amazon.com, Audible.com, Diapers.com, Zappos.com. (Note: In a special promotion offered in 2015 only, $1,500 in quarterly spending is eligible for bonus payments defined as of November 23, which means you will receive Chase Freedom® cardholders have a “new” $1,500 to spend on cash back. From November 23rd to December 31st of that year, 10% cash back on Amazon.com spending instead of

5%.) In addition to monthly bonuses, Freedom Flex offers 5 percent cash back on trips booked through the Chase Ultimate Rewards portal, and 5 percent back on Lyft through March 2025 and 3 percent to buy food and

drugs.

All other purchases earn 1 percent discount. WILMINGTON, Del., December 15, 2022 – Today, Chase Freedom announced the first revolutionary features for the quarter of 2023 for Freedom and Freedom Flex card members: grocery stores (excluding Walmart), fitness clubs and

gym memberships and Target. A new year means setting new resolutions to focus on self-care – like exercise or financial health. With Chase Freedom Q1 points, cardmembers can do three things and earn 5% cash back on up to $1,500 in combined purchases in these points from January 1 to March 31,

2023. Our main goal is clear: We want to help you reduce your search to stress-free by getting your next credit card. Every day, we work hard to bring you peace of mind as you work to achieve your financial goals.

chase 5% cash back calendar, chase freedom unlimited, chase freedom 5% calendar 2022, chase freedom q1, chase freedom cash back rewards, chase 5% calendar 2022 q2, chase bonus activation page, chase freedom card rewards calendar 2023