Payroll Calendar Template 2023 – Even though monthly payroll is the easiest option since you only have to process payroll 12 times a year, mistakes are still possible. That’s why a free monthly payroll template is worth exploring. You can simplify how you calculate your employees’ payments on a monthly basis. A bi-monthly payroll is when you pay your employees on two specific recurring dates. Typically, these dates are the first and 15th of each month or the 16th and last day of each month. They will receive 24 paychecks a year. If you want to make payroll processing even easier, check out Hourly. The payroll platform automatically calculates wages and pays your workers, and takes care of your payroll taxes—reducing the time, energy and resources needed to manage payroll. As the business owner, this is entirely up to you—but the most popular payroll schedule is biweekly. But what exactly does this pay schedule entail? And is there a calendar you can follow? We’ll go into all that and more, so read on! When choosing which payroll, there are several factors to consider—including the amount of administrative work involved, industry standards, and employee preferences. Here are the most common and some things you may want to consider when choosing which one to go with: This may not be simple. And it’s not—especially when you have more than two employees. That’s why we recommend using a payroll solution like Hourly, which adds hours and calculates pay automatically for you. Plus, they send paychecks too! To make the most of payroll templates, make sure all the information you enter is accurate or the outputs you receive will be meaningless. Also, don’t be afraid to modify them to meet your unique business needs. For more information, check out our payroll compliance best practices guide. Since some months are longer than others, Payday may occur three times instead of two. The specific months depend on your pay schedule. If your first pay of 2023 is on Friday, January 6, for example, March and September are your pay quarters. Official websites use .gov A .gov website belongs to an official government organization in the United States. Weekly schedules are also good for hourly workers in particular. They often have variable work schedules and find it much easier to see how much they have earned so far by being paid weekly. This can help them determine if they’re on track to pay their rent, bills and any other expenses—or if they need to take on more work before the month is out. Finally, depending on the type of workers you employ and where you do business, you may actually be required to pay your employees more than once a month (You can view the full payment requirements state on the US Department of Labor website.) In California, for example, you must pay employees at least twice a month. A bi-weekly payment schedule means that you pay your employees every other week on a particular day of the week. For example, you can send paychecks to employees every Friday. Since one year has 52 weeks, the weekly pay schedule has 26 pay periods during the calendar year. When using a bi-weekly schedule, most years have 26 pay periods. However, some years they will have 27. Why is this? Also, calendar math can be complicated. Here’s why it happens. (And heads up, we’re about to get a bit technical.) If the first January paycheck starts on January 6th, then there will be three paychecks spread over June and September. If the first January paycheck is distributed on January 13, there will be extra pay distributed in July and December. So if you have an hourly worker paid $15 an hour who has worked 60 hours on his timesheet, his gross pay would be $900. Then, you have to withhold payroll taxes, which include FICA (for Social Security and Medicare) and federal income tax. Since the payroll templates are pre-formatted, all you have to do is fill them in with your information. In most cases, they function as a calculator and contain formulas that calculate a number of important figures, such as gross pay and net pay. In 2023, if you will be managing a traditional weekly pay schedule, those who are paid weekly will receive 26 paychecks. Employees will receive two wages in 10 of the 12 months and three in two months. If you have a consistent monthly income, you may find it easy to budget with semi-monthly pay schedules because the wages remain consistent throughout the year. On the other hand, a biweekly pay schedule simplifies the calculation of overtime pay for hourly workers since work weeks align with pay periods. Simply put, a semi-monthly pay schedule is the way to go if your employees are primarily salaried. But if you have hourly workers, every week sounds better. For hourly team members, you can calculate their pay this way: Take the total number of hours worked between the start date of the pay period and the date of -the end of the pay period—and then multiply that by their hourly rate. Monthly payroll can be a more affordable option for companies that run payroll themselves, which takes time and resources, or those that work with a payroll service provider that charges them every once they run the payroll. (If you have Hourly, however, you can do unlimited pay runs—and pay your employees as much as you want.) For example, let’s say you have a full-time office worker who receives a salary of $44,200. When you divide $44,200 by 26, you get $1,700 of gross pay per period (Gross pay is the total amount paid to your employee before withholding payroll taxes.) Pay schedule per mid-month is where you pay workers twice a month on specific pay dates—usually the 1st and 15th or the 15th and last day of the month. This means that employees get 24 paychecks every year. What is ICS? The universal calendar format (ICS) is used by several email and calendar programs, including Microsoft Outlook, Google Calendar, and Apple iCal. Allows users to publish and share calendar information on the Web and via email. To make the most of this free weekly payroll template, you’ll need to enter each employee’s unique information and edit it as needed. You can use it to monitor working hours and calculate deductions. Since anything over 40 is considered overtime, you will be paid for 28 regular hours in the previous pay period and 12 regular hours and 4 overtime in the current pay period. Add that to the other hours they worked in each pay period—and you have their pay. As much as it may seem initially that choosing a payroll calendar is not a big deal, the reality is that it can have a big impact on your workers and your business. Before deciding how often to pay your employees, consider all your options and compare their benefits and drawbacks. Also, think about your unique workforce and state laws. For example, let’s say you run a restaurant and you have an employee who works 44 hours in a typical work week. You are scheduled to pay them on March 30th. But that’s Thursday—right in the middle of their work week! So what do you do? You split their pay over two periods. A weekly payment schedule can make it easy for them to see how much they’ve earned so far. They can determine if they are on track to pay their bills and if they need or want to take more shifts. A bi-weekly pay schedule is when you pay your employees every two weeks, or 26 pay periods a year. Most employers who follow this payroll calendar distribute payroll every Friday. This is the most commonly used option because it can keep most workers happy without an excessive amount of administrative work. Anna Baluch is a freelance writer from Cleveland, Ohio. She enjoys writing about a variety of health and personal finance topics. When she is away from her laptop, she can be found working, trying new restaurants, and spending time with her family. Connect with her on LinkedIn. In general, there are four options you can consider for your payroll calendar, which is essentially a schedule that helps you pay your employees. You can pay your workers weekly, biweekly, bimonthly and monthly. Here

are some details about each option as well as their pros and cons. A monthly payroll calendar is where you pay your employees at the beginning or end of each month. This results in 12 payment periods per year. While it is the most affordable and least labor intensive option, most employees do not prefer it. This is why it is not as common as other more frequent payment schedules. As an employer, you don’t need to plan too much for this as it happens automatically due to your payment schedule. However, it is good to be aware as your wage costs will appear higher for those two months. If you deduct benefits from your workers’ pay, a bi-monthly schedule is a smart choice. Since many types of benefits, including health insurance benefits, come with premiums that are billed monthly, a bimonthly schedule will make their processing easier. Paycor’s payroll software is an easy-to-use yet powerful tool that gives your team time back. When you’re able to automate your payroll processes and get help in complicated areas like payroll tax compliance and workers comp, you can spend more time making strategic decisions. Contact us today to learn more about how our expert payroll processing and tax solutions can help any business owner pay employees on time and avoid compliance missteps.

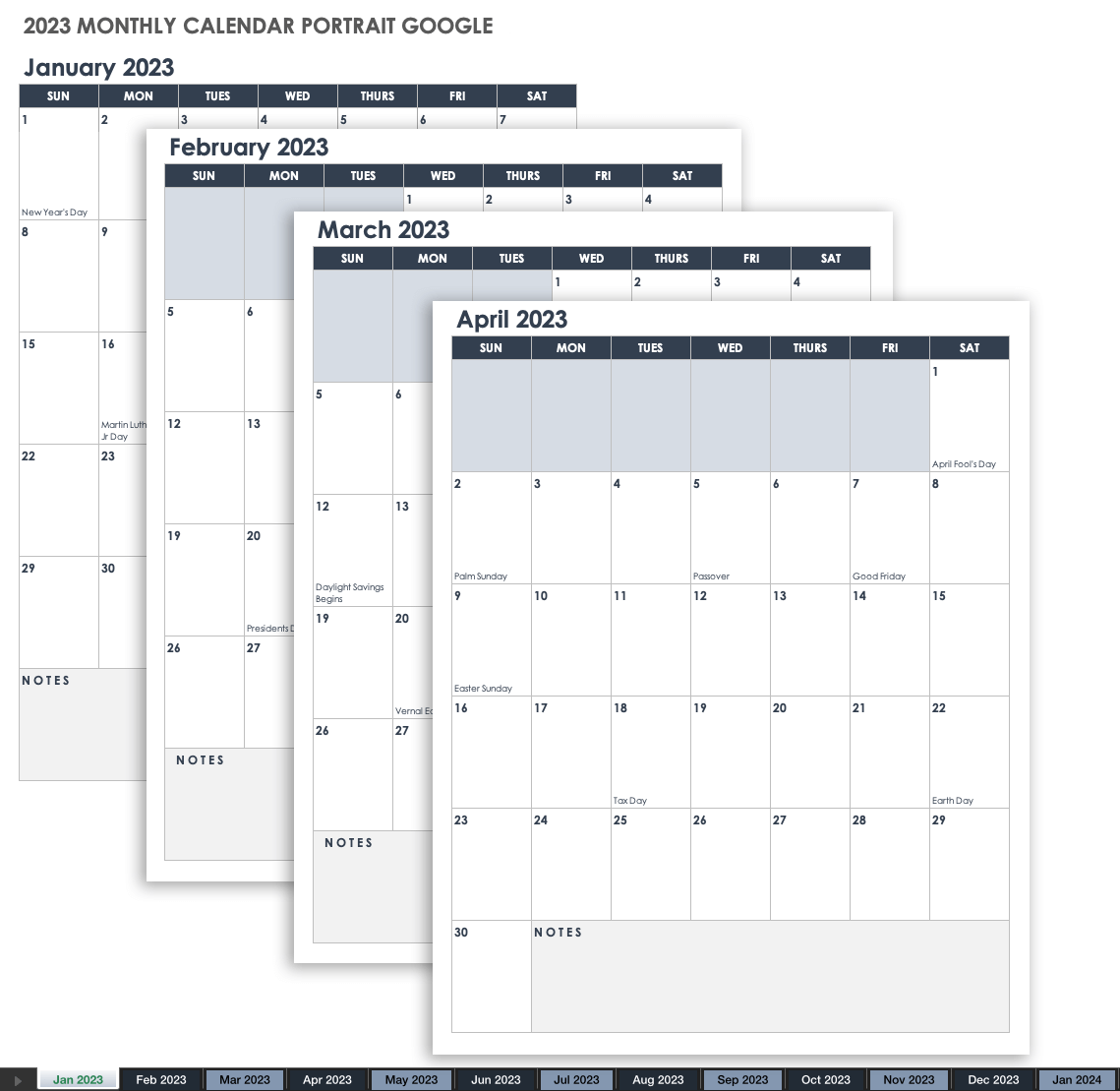

Payroll Calendar Template 2023

Source: www.smartsheet.com

Source: www.smartsheet.com

biweekly payroll calendar template 2023, 2023 calendar template word, 2023 federal payroll calendar printable, free calendar template 2023, payroll calendar 2023 template excel, 2023 monthly calendar template printable free, 2023 payroll and holiday schedule, 2023 federal pay calendar

At Printable Calendar, we are committed to providing our customers with the best possible experience. We value your feedback and are always looking for ways to improve our products and services. If you have any questions or comments, please don’t hesitate to contact us. We are always happy to help!

Thank you for choosing Printable Calendar. We look forward to helping you stay organized and on track!”