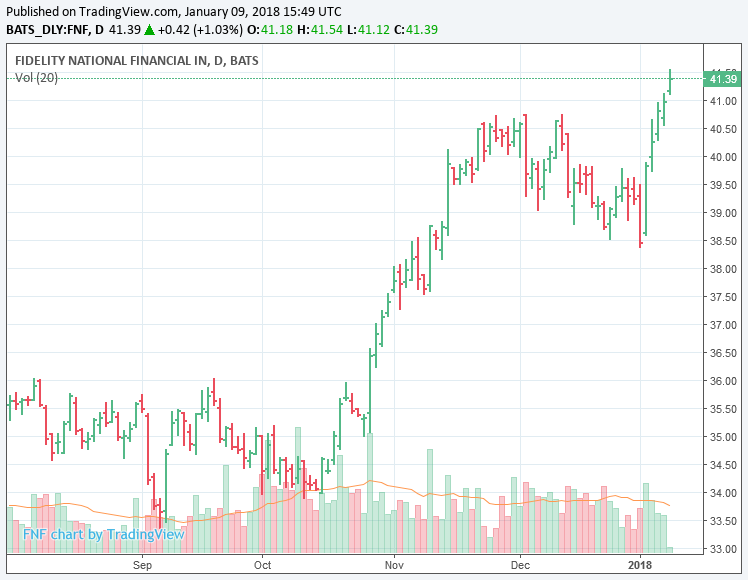

Fidelity Economic Calendar – Intraday data is provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. All prices are in local exchange time. The latest real-time sales data for US stock prices reflect transactions reported only through Nasdaq.

Intraday data is delayed by at least 15 minutes or due to trading conditions. Any company screenshots, graphics, or trading symbols mentioned are provided for illustration purposes only and should not be construed as an offer to sell, solicitation of an offer to buy, or recommendation of securities.

Fidelity Economic Calendar

Source: assets.bwbx.io

Source: assets.bwbx.io

All indices are unmanaged and index performance includes reinvestment of dividends and interest income, unless otherwise stated. Indices are not illustrative of any particular investment and it is not possible to invest directly in an index.

Elevated Global Recessionary Pressures To Begin

Do you prefer commodities, stocks or indices? Our economic calendar shows important events to help you trade these markets as well. You can also delve into global financial trends and events with our latest news and analysis articles.

Learn more about how to read the economic calendar. Making smart investment decisions is directly related to being better informed. After economic events provide predictability of market movements. Econoday Enterprise Solutions demystifies the relationship between economic announcements and market reactions so investors can seize opportunities first.

February 14, 2023 Fed Vice Chairman Brainard Will Be Biden’s Top Economic Adviser Fed Vice Chairman Lael Brainard will leave the Board of Governors effective February 20. He will then join the Biden administration’s National Economic Council as director… [Read more] Friday morning brought some new inflation data to the fore, with the Personal Consumption Expenditure (PCE) price index increasing 0.6% in January.

This was higher than economists expected and indicates that some measures of inflation are still accelerating. This capped 4 volatile days in which the S&P 500® index had its worst week of the year yet, down 2.7%.

Source: www.brokerage-review.com

Source: www.brokerage-review.com

Using The Economic Calendar

In cryptocurrencies, meanwhile, bitcoin followed suit, ending the week down 4.8%. The consumer staples, healthcare and utilities sectors were the best performers last week, while the consumer discretionary and communications services sectors were the worst performers.

Any company screenshots, graphics, or trading symbols mentioned are provided for illustration purposes only and should not be construed as an offer to sell, solicitation of an offer to buy, or recommendation of securities. February 14, 2023 A Look at the CPI for Services Less Housing Sometimes it’s hard to see what Fed policymakers mean when they talk about inflation for services other than housing.

The CPI report contains a special CPI total for services less rental housing… [Read more] Many major economies are facing maturing business cycle trends due to persistent inflationary pressures, slowing industrial activity, and tighter conditions, conditions

monetary and financial. The United States is in the expansion phase of the end of the cycle, with a growing probability of a recession looming on the horizon in 2023. Europe may have tipped into recession, but the lifting of restrictions due to the COVID and China’s stimulus policy offers hope for a

recovery in 2023. The median forecasts that MarketWatch publishes every week of the calendar come from the forecasts of the 15 economists who scored the highest in our contest over the past few years. Tipster of the Month Contest.

Economists in our consensus forecast: Jim O’Sullivan of TD Securities, Christophe Barraud of Market Securities, Ryan Sweet of Moody’s Analytics, Andrew Hollenhorst of Citigroup, Seth Carpenter’s team at UBS, Richard Moody of Regions Financial, Ian Shepherdson of Pantheon

Source: static.seekingalpha.com

Source: static.seekingalpha.com

Macro, Team Michelle Meyer at Bank of America, Chris Low at FHN Financial, Lou Crandall at Wrightson ICAP, Team Jay Bryson at Wells Fargo, Stephen Gallagher at Societe Generale, Peter Morici at the University of Maryland, Stephen Stanley at Amherst Pierpont and Brian Wesbury

and Bob Stein of First Trust Advisors. February 13, 2023 Economic Data Highlights Scheduled for the Week of February 13 There are two reports in the week of February 13 that will be closely scrutinized for clues about the direction of monetary policy and the state of the economy in the United States.

.. [Read more] Subscription Agreement and Terms of Use | Privacy Notice | Notice cookies (). February 27, 2022 High point for economic data scheduled for the week of February 27. While the week beginning February 27 includes the first Friday of March 3, this day is not a Labor Friday.

The February employment situation will not be released until Friday, March 10… [Read more] February 14, 2023 Podcast: Labor market surprises hopes for rate cut. for central bank relief later this year. So how strong are the underlying pressure on prices?

Intraday data is provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. All prices are in local exchange time. The latest real-time sales data for US stock prices reflect transactions reported only through Nasdaq.

Intraday data is delayed by at least 15 minutes or due to trading conditions. We use a variety of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

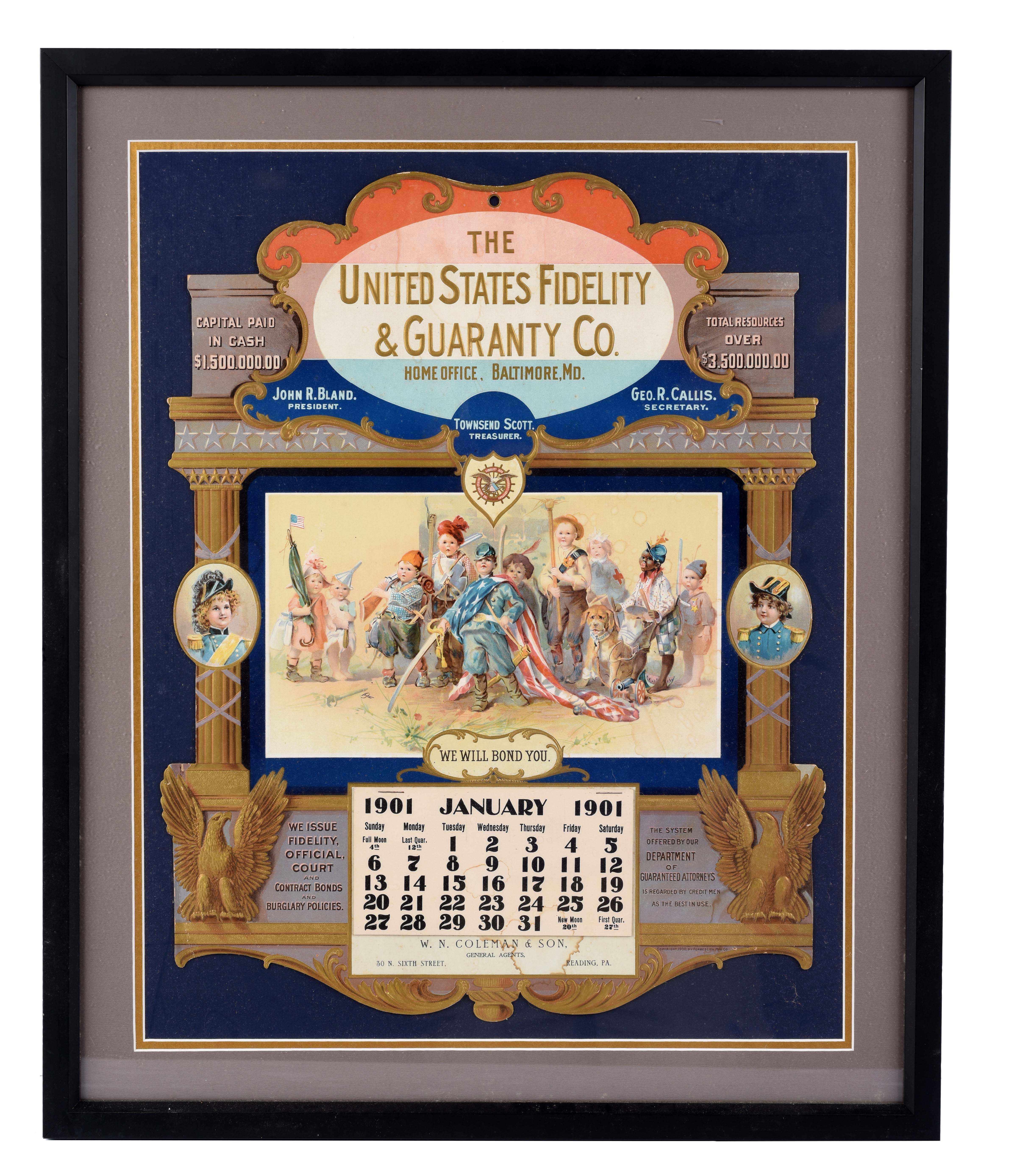

Source: auctions.morphyauctions.com

Source: auctions.morphyauctions.com

You can find out more about our cookie policy here, or follow the link at the bottom of any page on our site. Please see our updated Privacy Policy here. Important legal information about the email you are about to send.

By using this service, you agree to enter your real email address and send it only to people you know. It is a violation of the law in some jurisdictions to falsely identify yourself in an email.

Any information you provide will be used by Fidelity only for the purpose of sending the email on your behalf. The subject line of your email will be “Fidelity.com:” Copyright © 2023 MarketWatch, Inc. All rights reserved.

Subscription Agreement and Terms of Use | Privacy Notice | Cookie Notice Asian Market Currency US Market Outlook Our forex economic calendar is fully customizable, helping you keep track of the exact data that matters to you.

Select specific time zones and currencies of interest and apply filters to refine the results according to your strategy.

economic calendar marketwatch, weekly economic calendar, fidelity investments holiday schedule, fidelity econoday, best economic calendar for traders, fidelity earnings report, us economic data calendar, fidelity bond calendar