Wells Fargo 2023 – After a successful sold-out tour in 2022 and starting in February 2023, critically acclaimed comedian Adam Sandler will expand The Life of Adam Sandler to seven additional cities in the United States due to popular demand.

Produced by Live Nation, the upcoming 2023 league kicks off on April 13 at the Prudential Center in Newark, NJ before concluding on April 21 at CFG Bank Arena in Baltimore, MD with games in Philadelphia, Detroit, Cleveland and other stops across the United States.

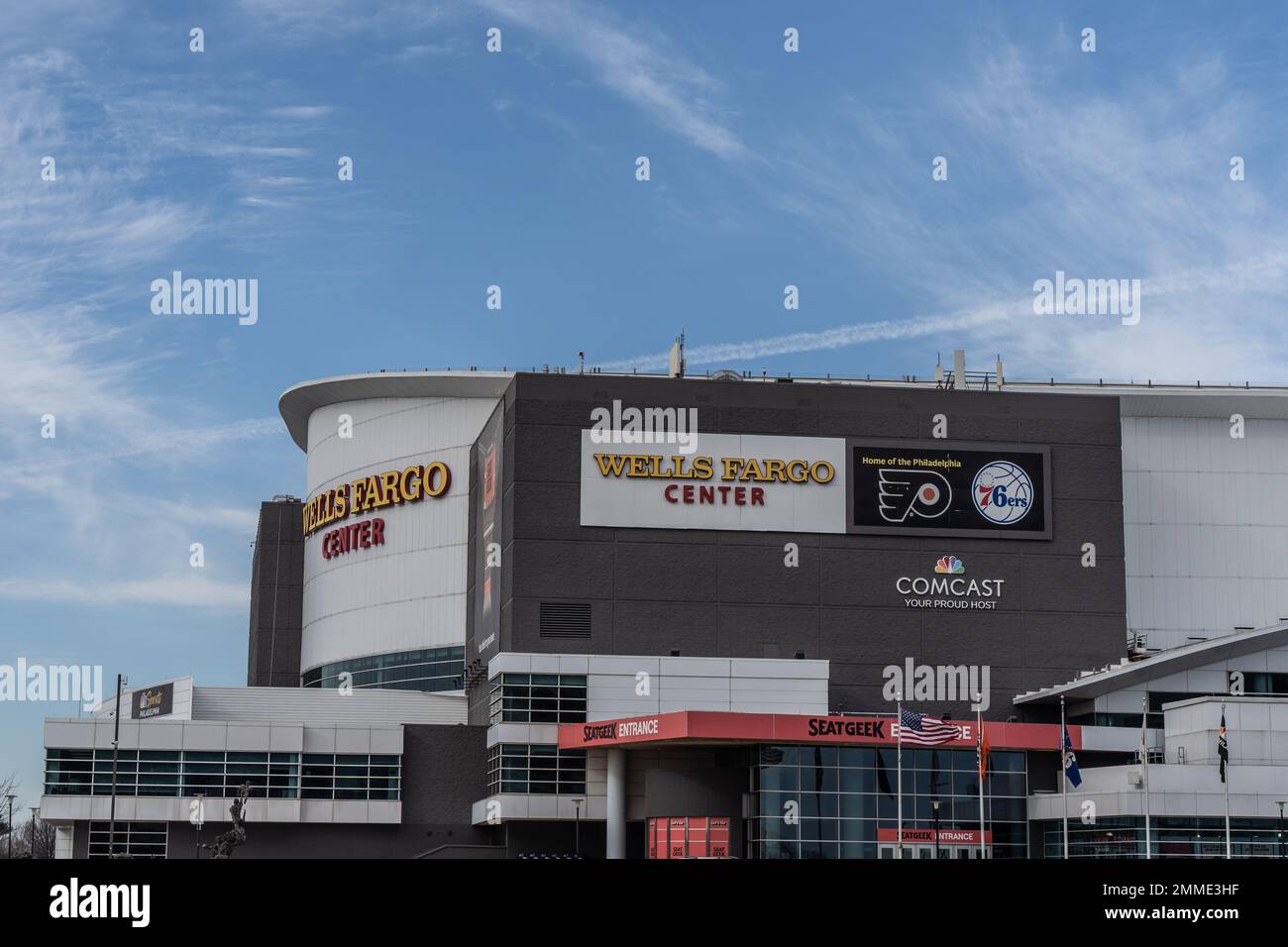

Wells Fargo 2023

Source: i0.wp.com

Source: i0.wp.com

Countries. Wells Fargo Wealth and Investment Management, a division of Wells Fargo & Company Enterprises, provides financial products and services through Wells Fargo & Company’s banking and consumer affiliates. Trading products and services are offered through Wells Fargo Clearing Services, LLC, a registered dealer and non-bank subsidiary of Wells Fargo & Company.

Alternative Investments

Banking products are offered through Wells Fargo Bank, N.A. Rather than timing the markets with major allocation changes, we prefer modest strategic adjustments. Our guidance includes a quality approach to equities, a barbell between short-term and long-term fixed income assets, some less correlated strategies and asset – rebalancing the need for long-term supply in these markets.

1. You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® score, and be enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include savings, loan, and credit accounts, but other consumer accounts may be eligible.

Contact Wells Fargo for details. Availability may be affected by your mobile carrier’s location. Your carrier’s message and data rates may apply. Market volatility has increased in 2022, reflecting investor uncertainty in an environment where stocks and bonds move in the same direction – an unusual market trend.

A typical portfolio of 60% equities and 40% fixed income (a 60/40 portfolio) has not delivered its usual lows amid inflation, rising interest rates, and expectations of a global recession. U.S. government securities they are backed by the full faith and credit of the federal government as payments of principal and interest are made at maturity.

Managing Volatility In Uncertain Markets

Although they have no credit risk, they are exposed to interest rate risk. We believe the Fed will move away from raising borrowing costs in 2023 after signs of inflation have subsided and the recession has taken hold.

The Fed will play an important role as it begins to reduce policy rates in the second half of the year to help the economy recover. Rather than timing the markets with major allocation changes, we prefer modest strategic adjustments.

Our guidance includes a quality approach to equities, a barbell between short-term and long-term fixed income assets, some less correlated strategies and asset – rebalancing the need for long-term supply in these markets. Sources: Bloomberg and Wells Fargo Investment Institute, as of November 30, 2022. 2023 targets are based on Wells Fargo Investment Institute forecasts as of December 6, 2022. GDP = Gross Domestic Product.

Source: images.moneycontrol.com

Source: images.moneycontrol.com

Forecasts, targets and estimates are based on certain assumptions and our current views on market and economic conditions, which are subject to change. The index is not regulated and is not available for direct investment. Past performance is no guarantee of future results.

Sharp U-Turn Ahead

Based on our view of a recession in early 2023, we like to stay safe in stocks, with high-quality US large-cap and mid-cap equities in addition to small and global equities and US markets, information technology, health.

Care, and energy sectors. We continue to favor US large-cap and mid-cap over small-cap and international equities. This defensive position will likely benefit investors early in the crisis. However, equity markets are trending higher and should start pricing in a recovery before the crisis ends.

All investments involve risk, including potential loss of principal. There is no guarantee that any investment strategy will be successful. Investments fluctuate due to market and economic conditions and various environmental factors, some of which may be unpredictable.

Each asset class has its own risk and return characteristics. The level of risk associated with a particular investment class or asset class is generally related to the rate of return that the investment or asset class can earn.

Sharp U-Turn Ahead

Payment rates will vary. To repossess a car, you can be paid a minimum of $4,000. Another $77.2 million will be paid to about 3,200 customers who had difficulty working with the company to adjust their loan payments to avoid foreclosure.

Sources: Wells Fargo Investment Institute and Bloomberg, December 6, 2022. *Latest economic and market data as of November 30, 2022. Forecasts, targets, and estimates are based on certain assumptions and our current market and economic views, which are conditions.

It can be changed. Past performance is no guarantee of future results. Wells Fargo customers may be covered by the agreement from 2011 to 2022. Wells Fargo is required to notify its customers when they are included but if you believe you are eligible for payment and you have not received a letter, you should first contact Wells Fargo at 844-484-5089.

If this does not resolve the issue, you can submit a complaint online. Based on our view of a recession in early 2023, we like to stay safe in stocks, with high-quality US large-cap and mid-cap equities in addition to small and global equities and US markets, information technology, health.

Source: www.wellsfargocenterphilly.com

Source: www.wellsfargocenterphilly.com

Real Assets

Care, and energy sectors. We believe the Fed will move away from raising borrowing costs in 2023 after signs of inflation have subsided and the recession has taken hold. The Fed will play an important role as it begins to reduce policy rates in the second half of the year to help the economy recover.

Real assets are subject to the risks associated with real estate, commodities, and other investments and may not be suitable for all investors. Commodity markets, including investments in gold and other precious metals, are considered speculative, carry significant risk, and experience periods of high volatility.

Investing in a volatile and uncertain stock market may cause the portfolio to rapidly increase or decrease in value, which may result in significant stock price volatility. Investing in commodities may be affected by changes in overall market movements, volatility in commodity indices, changes in interest rates, or factors affecting a particular industry or commodity.

Commodity investing products may use more complex strategies, which may expose investors to additional risks. Investing in marketable securities involves risks, such as potential volatility of underlying assets, credit risk, interest rate fluctuations, and the effects of various economic conditions.

Reconsider Portfolio Allocations

We continue to favor US large-cap and mid-cap over small-cap and international equities. This defensive position will likely benefit investors early in the crisis. However, equity markets are trending higher and should start pricing in a recovery before the crisis ends.

Wells Fargo & Company (NYSE: WFC) is a leading financial services company with assets of approximately $1.9 trillion, proudly serving one in three US households and more than 10% of small businesses in the United States.

, is also a leading provider of middle market banking. In the United States, we provide banking, investment, mortgage products and services and services, as well as consumer and commercial finance, through our four reporting operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

Wells Fargo is ranked 37th on Fortune’s 2021 list of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future by supporting housing affordability, small business growth, financial health, and a low-carbon economy.

General Market Risks

News, views and insights from Wells Fargo are also available on Wells Fargo Stories. Personal credit strategies continuously improve the company’s capital structure, often through debt restructuring and mitigation measures. Such investments are subject to potential defaults, limited creditworthiness, creditworthiness of the private company, and limited availability of private company credit ratings.

Source: c8.alamy.com

Source: c8.alamy.com

Investing in distressed companies is speculative and involves a high degree of risk. Due to their distressed nature, these securities may be illiquid, have a low trading value, and are subject to significant interest rate and credit risks.

Private equity investing is complex, predictable investment vehicles are not suitable for all investors. They are not subject to the same regulatory requirements as registered investment products and involve energy and other aggressive investment practices. There is often limited (or no) funding and a lack of transparency regarding the underlying assets.

As investors prepare for 2023, we believe now is the right time to reassess the balance between income and growth. Investors seeking income over the past few years may have relied on a mix of dividend payments, income from real estate and other assets, and coupons from fixed income assets to support income needs.

Managing Volatility In Uncertain Markets

Now with the change in the interest rate environment, bonds currently offer a very attractive source of income. Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act.

Wells Fargo and Fair Isaac do not provide credit repair services or advice or assistance in rebuilding or improving your credit record, credit history, or credit rating. Stock markets, especially foreign markets, are volatile. Stock prices may fluctuate due to general economic and market conditions, the prospects of individual companies, and industry sectors.

International investments involve additional risks, including risks related to currency fluctuations, political and economic instability, and differing accounting standards. This may cause further volatility in stock prices. These risks are heightened in emerging and frontier markets.

Investing in small and medium-sized companies has additional risks, such as limited liquidity and high volatility. Some investments are not suitable for all investors and are open only to “eligible investors” or “qualified investors” within the meaning of the US securities laws.

Lock In Higher-Yielding Bonds

They are speculative, illiquid, and designed for long-term investments rather than trading vehicles. The popular actor, writer, producer, and singer has performed on stage to sold-out audiences across the United States and Canada. In 2018, 100% Fresh was released on Netflix as Sandler’s first comedy special in 20 years and was filmed on his last concert tour.

In partnership with Netflix, Warner Bros. Records released an audio companion to Sandler’s Netflix special. The information contained herein includes general information and is not intended, designed, or made for any particular investor or potential investor.

Source: i.insider.com

This report is not intended to analyze or recommend a particular merit or best interest of the client; an offer to participate in any investment; or recommendations to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions.

Do not choose

an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs, and investment time horizon. Sources: Wells Fargo Investment Institute and Bloomberg, December 6, 2022. *Latest economic and market data as of November 30, 2022. Forecasts, targets, and estimates are based on certain assumptions and our current market and economic views, which are conditions.

Why Did This Happen?

It can be changed. Past performance is no guarantee of future results. Sources: Wells Fargo Investment Institute and Bloomberg, December 6, 2022. *Latest economic and market data as of November 30, 2022. The index is not managed and is not available for direct investment.

Forecasts, targets and estimates are based on certain assumptions and our current views on market and economic conditions, which are subject to change. Past performance is no guarantee of future results. Investments in fixed income securities, including municipal securities, are subject to market, interest rate, credit, liquidity, inflation, prepayment, maturity, and other risks.

Bond prices tend to fluctuate inversely with changes in interest rates. Therefore, a general increase in interest rates can lead to a decrease in bond prices. High yield fixed income securities are considered speculative, involve greater default risk, and are more volatile than investment grade fixed income securities.

Municipal securities may be subject to certain minimum tax and minimum legal and regulatory risk, which is the risk that changes in the tax code may affect taxable or non-taxable income. Market volatility has increased in 2022, reflecting investor uncertainty in an environment where stocks and bonds move in the same direction – an unusual market trend.

Sector Investing

A typical portfolio of 60% equities and 40% fixed income (a 60/40 portfolio) has not delivered its usual lows amid inflation, rising interest rates, and expectations of a global recession. Investment products and services are offered by Wells Fargo advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, SIPC member, registered broker-dealer and non-banking subsidiary of Wells Fargo & Company. Short-term fixed income is attractive today, as the 12-month Treasury yield rose to more than 4.0% from 0.1% last year.

If the Fed cuts rates next year as we expect, short-term rates should fall. We believe long-term yields are close to highs and represent good value, so we prefer to add to long-term bonds. Please ensure that your browser supports JavaScript and cookies and that you do not prevent them from loading.

For more information you can review our Terms of Service and Cookie Policy. The information in this report is provided by WFII’s Global Investment Strategy (GIS) Division. The views represent the view of GIS as of the date of this report;

Lock In Higher-Yielding Bonds

for general information purposes only; and is not intended to predict or guarantee the future performance of any individual security, market sector, or markets generally. GIS does not advise you of any changes in its opinions or information in this report.

Wells Fargo’s subsidiaries and affiliates may publish reports or have opinions that differ from this report and reach different conclusions.

wells fargo 2023 holidays, 2023 wells fargo championship, wells fargo 2023 calendar, wells fargo 2023 summer internships, wells fargo 2023 holiday calendar, wells fargo 2023 holiday schedule, 2023 wells fargo bank holidays, wells fargo 2023 summer analyst

At Printable Calendar, we are committed to providing our customers with the best possible experience. We value your feedback and are always looking for ways to improve our products and services. If you have any questions or comments, please don’t hesitate to contact us. We are always happy to help!

Thank you for choosing Printable Calendar. We look forward to helping you stay organized and on track!”