Right Of Rescission Calendar – 2. Politics. To waive or modify the right to cancel, the customer must provide a written statement that specifically waives or modifies the right and includes a brief description of the emergency. Each user who has the right to cancel must sign the release statement.

In a transaction involving multiple clients, such as a husband and wife using their home as collateral, the release must be signed by both parties. 1. Need for elimination. To waive the right to cancel, the user must have a clear personal financial emergency that must be met before the cancellation period expires.

Right Of Rescission Calendar

The existence of a waiver by the defendant will not by itself relieve the defendant of the non-recourse right. 1. Negotiations for a residential mortgage loan. Any business to construct or acquire a principal residence, whether real or personal property, is exempt.

How Does The Seller Collect The Rescission Fee?

(See comment to § 1026.23(a)) For example, a credit transaction for the acquisition of a mobile home or houseboat to be used as the consumer’s primary residence would not be exempt. 1. Exchange of ownership. Once the debtor fulfills its obligations under § 1026.23(d)(2), the consumer must deliver to the debtor any property or money that the debtor previously delivered to the consumer.

At the user’s option, the property can be extended to the location of the property. For example, if you have delivered wood or building materials to the customer’s home, the customer can give them to the creditor, making them available for pickup at the home, rather than returning them to the creditor’s home.

The money already given to the consumer must be deposited at the registered office of the debtor. 3. Actions During the Waiting Period. Section 1026.23(c) does not prohibit the debtor from taking any other action during the stay other than actually starting work.

Unless otherwise prohibited, such as by state law, the creditor may, for example: 4. Time to give notice. The notice required by § 1026.23(b) need not be given before the transaction is completed. The debtor may give the notice after the transaction is completed, but the statute of limitations will not begin to run until the notice is given.

When Does My Rescission Period Start And End?

For example, if the debtor gives the notice on May 15th, but the notices are given and the transaction is completed on May 10th, the 3-day cancellation period will start on May 15th. After seeing partners BOLers rave about a 12-page calendar that calculates deadlines, BOL’s Andy Zavoina decided Excel could make this easy.

With a little scripting help from fellow Internet users, the final product is here. There are older versions for modifying older loans. Shop Notary Organization Notary Organization Notary Organization Signing Organization (2) Control or consolidation by the same creditor of the extension of credit already secured by the consumer’s main residence.

However, the right of withdrawal will apply to the newly financed amount in excess of the unpaid principal balance, any unpaid finance charges on existing debt and amounts attributable to renewal or consolidation costs. C. Sale of the consumer’s interest in the property, including a transaction in which the consumer sells the home and receives back the purchase price and deposit or retains legal ownership through a mechanism such as an installment sale agreement.

(4) An advance, other than an initial advance, on a series of advances or on a series of single payment contracts treated as a single transaction under § 1026.17(c)(6), if notice is required by paragraph (b) of

Can My Real Estate Licensee Receive For A Seller Or Provide For A Buyer The Notice Of Rescission?

this section and all material displays have been given to the customer. 3. Negotiating common purpose. A loan for the acquisition of a principal residence and for improvements to that residence is exempt if treated as a business.

Source: www.deprismedia.com

Source: www.deprismedia.com

If, on the other hand, the loan for the acquisition of the first home and the subsequent advances for improvements are treated as more than one business, then only the business financing the acquisition of the home is allowed.

(2) To exercise the right of cancellation, the customer informs the creditor of the cancellation by post, telegram or other means of written communication. Notice is given when sent, when deposited for transmission by telephone or, if sent by other means, when sent to the designated creditor’s place of business.

You will enter the loan date and the repayment period is calculated according to Reg Time Tables Z. This allows for Sunday and public holiday financing as this is not uncommon in many banks today. If you are not booked on these days, please move it to the next business day.

Is My Real Estate Licensee Required To Give Me Information On The Hbrp?

(i) The financial statement and other disclosures relating to the financial statement (such as the amount financed and the annual percentage rate) shall be deemed sufficient for the purposes of this section of the financial statement disclosed: 1. General.

The tolerance for disclosure of finance costs depends on the accuracy of the total finance cost and not on the cost of its components. For transactions subject to § 1026.19(e) and (f), the tolerance for the total exemption of payments is based on the accuracy of the total payments, taken as a whole, and not on the cost of its components.

3. Content. The notice must contain all of the information described in Section 1026.23(b)(1)(i) through (v). The requirement in § 1026.23(b) that the transaction is identifiable can be satisfied by providing the date of the transaction. The creditor may provide a separate form that the consumer can use to exercise the right of withdrawal, or the form may be combined with other withdrawal notices, as described in Appendix H. The notice may contain additional information about the required information, such as

e.g. : This Excel file is ready for use by compliance, audi

ting, lenders, loan officers, etc., but you must allow the macro to run for this application to work. This may require you to lower the security setting in Excel Tools/Macro/Security Options (Developer Tab/Code in Office 2007) before downloading the file.

I Am Entering Into A Real Estate Transaction But Am Not Represented By A Real Estate Licensee The Party On The Other Side Of The Transaction Is Will Their Real Estate Licensee Provide Me With Any Information On The Hbrp?

(i) Customer may exercise the right to cancel by midnight of the third business day following termination, delivery of the notice required by paragraph (b) of this section, or delivery of all material views, whichever occurs first;

last one. If the required notice or material disclosures are not delivered, the right to cancel will expire 3 years after completion, upon the transfer of all users’ interests in the property, or upon sale of the property, whichever occurs first.

In case of certain administrative proceedings, the cooling-off period is extended in accordance with article 125 point f) of the law. This FAQ explains the home buyer period (“HBRP”) for buyers in British Columbia purchasing certain types of residential real estate.

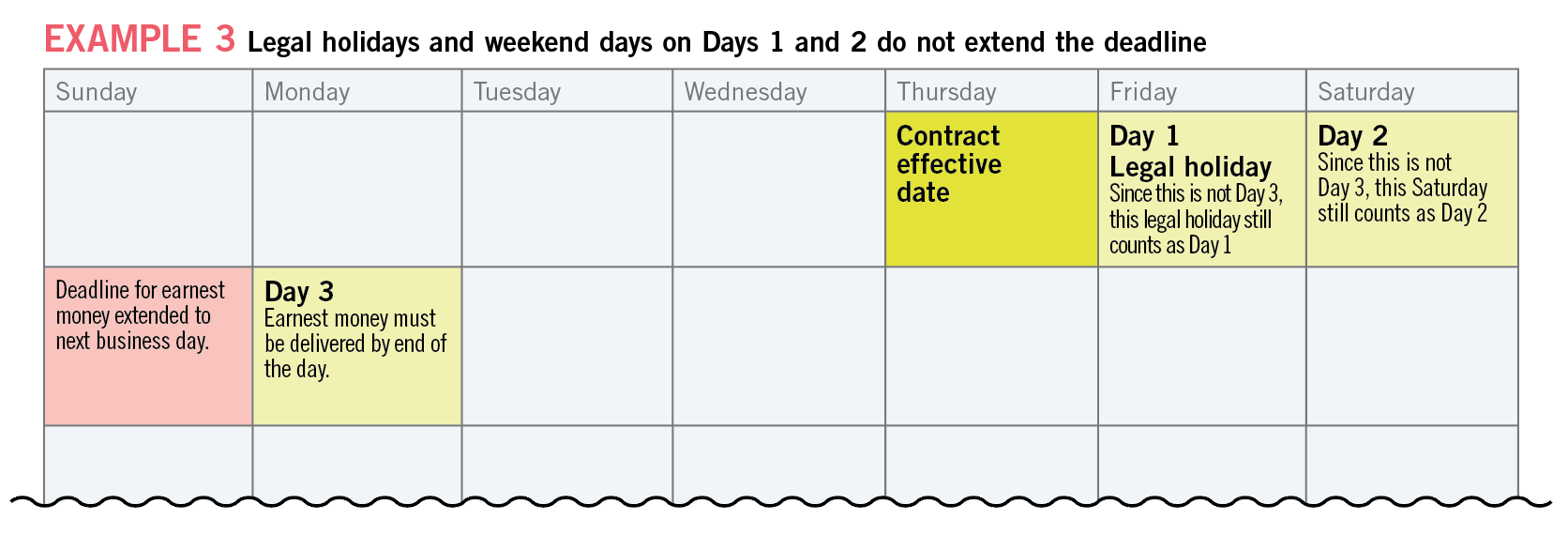

The specifics of the HBRP are set out in the Property Act Regulations (“PLA”) and Home Buyer Delivery Period (“HBRP”). The law takes effect on January 3, 2023. In some cases, Saturday may not be considered a business day.

Source: webshop.asus.com

Source: webshop.asus.com

What Is The Hbrp?

Some lenders may use different dates when calculating their refund, so if in doubt, call them. In the event that registration occurs on a federal holiday, the cancellation period will begin on the next business day.

The withdrawal period ends at midnight on the third business day. To cancel the loan, the borrower must cancel before midnight of that day. (3) If the debtor has delivered money or property, the customer may retain the property until the debtor fulfills its obligation under paragraph (d)(2) of this section.

When the debtor has complied with this paragraph, the customer will deliver the money or property to the debtor or, where this would be unfair or unjust, deposit money in the correct amount. At the user’s option, property cooling can be done at the property location or at the user’s residence.

The financial guarantee must be located at the designated place of business of the lender. If the creditor does not receive the money or property within 20 calendar days of the consumer’s suspicion, the customer can keep it without further obligation.

iii. Although statutory obligations are not security interests for purposes of disclosure under § 1026.2, this section specifically includes them in the definition for purposes of subrogation rights. Therefore, although an interest in the customer’s residence is not a required disclosure under § 1026.18(m), it may create a right of rescission.

If, as a buyer, you provide the estate agent with a deposit upon acceptance of your offer and exercise your right to cancel within the time allowed, the estate agent will pay a 0.25% cancellation fee, the seller clears it and returns the remaining deposit to

you, the buyer. (c) Suspension of Debtor Service. Unless a customer waives the right to cancel in accordance with paragraph (e) of this section, no money shall be paid except in escrow, no services shall be performed, and no materials shall be delivered until the termination is complete and the creditor is reasonably satisfied that the

consumer has not withdrawn. 3. Calculation of termination rate. The debtor must take all necessary steps to prove that the security has lapsed. These steps include canceling the documents that created the security interest and entering the issues of issuance or termination in the public record.

In a transaction involving partners or suppliers who also have security rights related to the credit transaction, the debtor must ensure that the termination of their interests is also shown. The 20-day period for service of the debtor refers to the period within which the creditor must initiate the process.

It does not require that all necessary steps be completed within this time frame, but the borrower is responsible for completing the process. (1) In a credit transaction in which a security interest is held or will be taken or will be taken in the consumer’s principal residence, any customer who has or will be subject to a security interest shall have the right to cancel the transaction, except for the transaction of

described in paragraph (f) of this section. For purposes of this section, an addition to an existing security obligation in the consumer’s principal residence is a transaction. The right of withdrawal applies only to the addition of a security right and is not an existing obligation.

Source: www.texasrealestate.com

Source: www.texasrealestate.com

The obligor shall provide the notice required by paragraph (b) of this section, but shall not be required to make any new material disclosures. Delivery of the required notice will begin the cancellation period. The cancellation period begins on the next full business day after receiving an offer.

For example, if the seller accepts your offer on Monday afternoon, the cancellation period ends at 11:59 p.m. on Thursday. If your offer has subject terms (for example, financing, home inspection, etc.) these will run concurrently with the cancellation period.

The grace period does NOT begin after the subject is withdrawn. 2. Reasonable value. If returning the property would be too burdensome for the customer, the customer can give the debtor a reasonable amount instead of returning the property himself.

For example, if the furniture is delivered to the customer’s home, the customer can pay a reasonable amount. This calendar is provided as reference material by the Notary Education Center for use by Loan Document Signatories.

We are not aware of any inaccuracies in the document, but we are not responsible for any inaccuracies appearing in it. 4. Special rule for the main residence. Notwithstanding the general rule that consumers may own a primary residence, when a consumer acquires or builds a primary residence, any loan subject to Regulation G that is

secured by equity in the consumer’s current primary residence (for example, a bridge loan)

subject to the right of cancellation regardless of the purpose of the loan in question. For example, if a customer whose primary residence is A builds B, which will be occupied by the user at the end of construction, the construction loan from financing B and secured by A is subject to a right of withdrawal.

The loan secured by A and B is also cancelled. (i) The financial statement and other disclosures relating to the financial statement (such as the amount financed and the annual percentage rate) are deemed sufficient for the purposes of this section of the financial statement disclosed: BankersOnline is a free service made possible by

to the generous support of advertisers and sponsors. Advertisers and sponsors are not responsible for the content of the website. Help us keep BankersOnline FREE to all banking professionals. Support advertisers and sponsors by clicking to learn more about their products and services.

(1) Notice of right of cancellation. In a transaction subject to cancellation, the creditor will deliver two copies of the cancellation right notice to each customer entitled to cancel (one copy to each if the notice is delivered in electronic form in accordance with the consumer’s consent and other applicable provisions of the

law on electronic signals). The notice shall be on a separate document identifying the transaction and shall clearly and distinctly state the following: 2. Status of title. The mortgage’s security status is not relevant for purposes of the exemption in § 1026.23(f)(1).

The fact that a loan is in a subprime position does not in itself prevent this exception from applying. For example, a home buyer can take an existing first mortgage and create a second mortgage to finance the remainder of the purchase price.

Such transaction will not be a waiver.

3 day right of rescission calculator, right of rescission calculator, right of rescission calendar 2023, how to count rescission days, right of rescission calculator 2022, right to cancel calendar 2022, 3 day right of rescission calendar, tool monkey rescission calculator