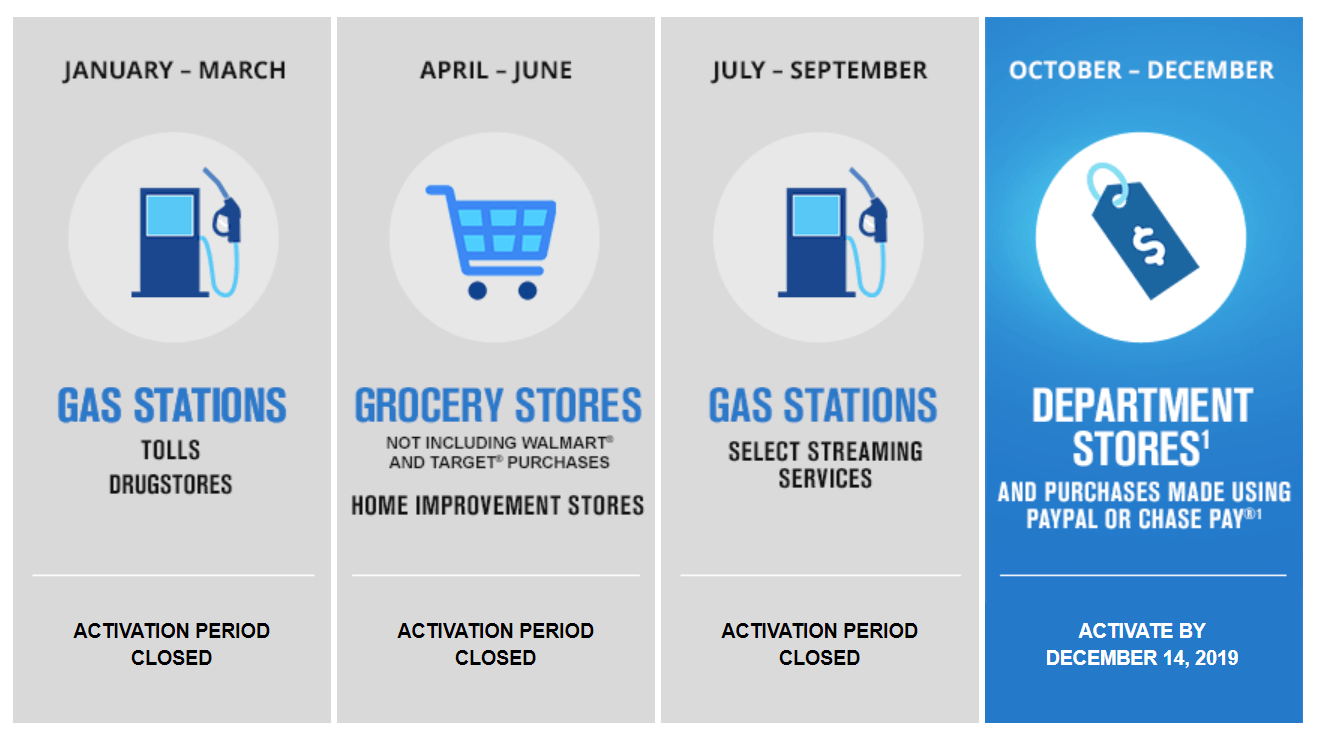

Chase Flex Calendar – After clicking on ‘details’, you will be taken to a screen where you can click on a button that will ‘activate’ or select the 5% bonus income for that quarter. In the example below, the bonus categories for the season are grocery stores (except Target and Walmart) and eBay.

For example, although the bonus categories include grocery stores, many supermarkets usually sell gift cards, as do Amazon, restaurant chains and retail stores. That way, you can put a few bucks on a gift card to treat yourself to dinner the next night or a gift for a special occasion.

Chase Flex Calendar

Source: 149647998.v2.pressablecdn.com

Source: 149647998.v2.pressablecdn.com

Or, if you have storage space, $1,500 for a year’s worth of household items such as paper towels, toilet paper, and cleaning supplies. Chase Freedom Flex℠* is very similar to Freedom Unlimited, but earns 5% cash back in categories that rotate quarterly (requires activation), 5% on travel purchased through Chase Ultimate Rewards®,

Chase Freedom Flex

3% on dining, pharmacies and another 1% on. buy When it’s time to redeem your rewards, transfer them all to an account that offers a cash back bonus. For example, the Chase Sapphire Preferred® card rewards cardholders with a 25% bonus when you redeem points for travel on the Chase Ultimate Rewards® portal.

Disclaimer: NerdWallet strives to keep its information accurate and up-to-date. This information may differ from what you see when you visit a particular financial institution, service provider or product page. All financial products, products and services are offered without warranty.

Please refer to the financial institution’s terms and conditions when evaluating proposals. There is no need for pre-prepared proposals. If you find any discrepancies with your credit score or information on your credit report, contact TransUnion® directly.

Kase limits the total amount you can transfer in a 30-day period to $15,000, or whatever credit limit you have on your account, whichever is lower, and you must also to include a balance transfer fee within that credit limit.

Comparison Chase Freedom Flex Rotating Categories Vs Discover It Cash Back Bonus Categories

Discover it® Cash Back also offers rotating bonus categories, and like Freedom Flex, you can earn 1 percent cash back for a total of 5 percent on quarterly bonus category purchases (and 1 percent when to be implemented) plus 1 percent.

money to pay for everything else. In 2022, open cash categories such as gas stations, Target, fitness clubs/gyms, restaurants and Amazon.com. While we don’t know what the future holds, it’s safe to assume that the lineup will cover some sectors for the rest of 2023. At Bankrate, we focus on the areas in which

consumer interest is greatest: rewards, welcome offers and bonuses, APRs, and the overall consumer experience. Any publisher discussed on our site will be based on their value to users at each of these levels. We check ourselves to prioritize accuracy every step of the way, and we’ll continue to be here for each of you next.

Money Launderers content is for informational and educational purposes only and should not be construed as professional financial advice. If you need such advice, you should consult a qualified financial or tax advisor. Links to products, offers, and prices from third-party sites often change.

Source: money.slickdeals.net

Source: money.slickdeals.net

How To Maximize Cash Back

We will do our best to keep these updates, the numbers shown on this page may differ from the actual numbers. We may have financial relationships with some of the companies mentioned on this website. Among other things, we may provide free products, services and/or compensation in lieu of a certain condition of supported products or services.

We strive to write accurate and truthful reviews and articles, and all opinions and views expressed are the sole responsibility of the authors. If you like the idea of earning bonuses in rotating categories every quarter, consider Chase Freedom Flex℠.

Like its predecessor, Chase Freedom® (no longer open to applicants), Chase Freedom Flex℠ has no annual fee and offers 5% cash back in rotating categories upon activation, to often different from Discover in the same season.

Chase Freedom bonus categories for the first quarter of 2023 are grocery stores, Target, fitness clubs and gyms. So how can we make money? Our partners are compensated. This may affect the products we review and write about (and where those products appear on the site), but has no effect on the recommendations

How To Activate Chase Freedom Flex Bonus Cash-Back Categories

or our advice, on which we spend thousands of hours. Our partners cannot guarantee favorable reviews of their products or services. Here is a list of our partners. Once you reach $1,500 for the quarter, all remaining spend in the relevant categories will receive a 1% bonus – which can easily be used with other cards.

There is a graph that shows how much is left in your Chase account before you reach the maximum profit of $75. This is especially useful if you have paired your Freedom with another card. Once you reach that spending cap, you can use a card that earns more than the 1% you earn on Freedom Flex to make purchases outside of the bonus categories.

Discover it® Cash Back and Discover® Student Cash Back are two of our favorite credit cards for students, college graduates and people who don’t know credit. Cardholders earn 5% cash back and 1% on other purchases up to $1,500 spent in bonus categories (and 1% thereafter) every three months activated.

You have money questions. Bankruptcy has answers. Our experts have been helping you manage your money for four decades. We always strive to provide clients with the knowledge and tools they need to succeed in life’s financial journey.

How The Cash Back Tiers Compare

Since it’s all automated, you don’t need to select or activate your categories manually. Because department activations are permanent—they technically should change, but rarely do—you can pl

an your spending further than any other revolving credit card.

Each billing cycle, you automatically earn 5% bonus cash on your highest spending category for that period. Citi caps the monthly bonus cash back at $500 or $25 in rewards, which is the Freedom Flex and Earn Back quarterly rate.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BCEPO23FNJDLZGEZACYBY7IYLM.webp) Source: gray-wxix-prod.cdn.arcpublishing.com

Source: gray-wxix-prod.cdn.arcpublishing.com

If this happens, you can only earn 1% even when you buy from merchants in the bonus section. To be safe, do not use these programs to buy bonus shares unless the 5% bonus share per quarter is clearly included.

All purchases redeemable for cash earn 1% cash back with no limit or earning limit, except for a few permanent categories that earn more than 1% cash back: Made through Chase Ultimate Rewards (5%) travel purchases.

Where The Chase Freedom Flex Wins

, shopping at restaurants (3%) and shopping at drugstores (3%). But before you apply, consider how to get the most out of your rewards and the important Chase 5/24 rule, which limits the number of personal credit cards you can open in two

a year Here’s what you need to know before getting the Chase Freedom Flex℠ Credit Card. You must manually activate your bonus cash back to earn 5% cash back on up to $1,500 in combined category purchases this quarter.

Log in to your account or open the Chase mobile app and click Activate next to the 5% cash back icon. Chase Freedom Flex℠* has no annual fee and earns 5% cash back up to $1,500 in quarterly rotating categories (requires activation), 5% on travel purchased through Chase Ultimate

Rewards, 3% on dining and drugs and other purchases. This generous bonus level means that if you plan your spending correctly, you will only get a lot of money from the bonus categories. Your cash back benefits should appear on your credit card immediately after the redemption.

Make Your Chase Freedom Flex Cash Back Go Even Further

If you check your application, you will see bonus category awards listed as “5% 1st Quarter Category Bonus. As long as your account is open and in good standing, your points will not expire. The original Freedom card earned 5% cash back with a small number of spending categories that changed (restricted) each quarter.

This was his only bonus level. All the other purchases were fine at the time, but they earned the 1% money they don’t make decisions about anymore. For more information about the Chase Freedom Flex card, see Chase Freedom Flex Credit Card.

If you’re looking, check out our review of its sister card, the Chase Freedom Unlimited Credit Card. The Freedom Flex’s 5 percent revolving share structure has several advantages over the Custom Cash card’s style of rewards.

In particular, the Freedom Flex bonus categories have no spend per pay cycle. Instead of spending $500 per billing cycle, you get $1,500 in spending per quarter. While the total spending per card each quarter is the same, the Freedom Flex approach makes it easy to increase cash back if you make larger purchases each month or have a billing cycle with a lot of spending.

Source: monkeymiles.boardingarea.com

Source: monkeymiles.boardingarea.com

Bottom Line

In addition to earning 5% cash back on rotating categories, the Chase Freedom Flex also comes with a trio of fixed bonus categories. With Chase Ultimate Rewards, you can earn 5% cash back on travel reservations, 3% cash back on dining (including service offerings) and 3% cash back at drugstores.

All other purchases earn 1% cash back. If you want to travel, buy a Chase Sapphire Preferred or Chase Sapphire Reserve to go with your Chase Freedom Flex and convert your Freedom Flex money into travel points, add value and open up several additional payment options.

Chase Freedom Flex℠ offers a special rate of return on most spending categories. But there are also bonus spending categories that pay up to 5% cash back – if you act on time. These categories change every season.

Here’s what you need to know about Discover it Cash Back: Discover’s Cashback Match program matches everything you earn in your first year as a cardholder. Spend more of your bonus share spending and say you earn $75 in cash each quarter over the course of the year.

Plan Bonus Category Purchases In Advance

Discover will match $300 with another $300 in cash rewards. With Chase Freedom Flex, you get 5% back (5x Chase Ultimate Rewards® points) on up to $1,500 spent in bonus categories in the quarter after activation (1% later)

, 5% back on travel purchases made through Chase Ultimate Rewards . , 3% on drug and food purchases, and 1% back on other items. Like Discover, you can get credit, cash back, gift cards, merchandise and more from Chase Freedom Flex.

Two other popular cash-back cards have a 5% cash-back division: the Discover it® Cash Back Credit Card and the Citi Custom Cash℠ Card. Another one you can choose from has flexible 3% cash back categories: the Bank of America® Fixed Cash Rewards Credit Card.

Finally, Chase Freedom Flex credit cards offer 1% cash back and 4% bonus cash back. So if Chase made a registration error or didn’t credit you for the bonus money you should have earned, you’ll see it right there on your statement or in your online account.

Chase Slate Edge

Looking for a $0 annual fee credit card with great bonus spending categories? Look no further than Chase Freedom Flex℠, a solid Chase travel card for beginners that offers up to 5% in bonus reward categories that change every three months.

If you activate on the 14th day of the last month of the quarter (ie March 14, June 14, September 14 and December 14), all bonus shares up to the quarter’s share can be redeemed for the quarter’s earnings.

first day This is a huge advantage over the same Discover it® Cash Back card, which has no cash back.

chase credit card rewards calendar, chase cash back calendar, chase freedom unlimited, chase fre

edom rewards calendar, chase freedom flex rotating categories, chase freedom 2023 calendar, chase freedom 5% calendar 2022, chase 5 calendar 2023