2023 Biweekly Payroll Calendar Template – • Easier to calculate overtime: If you have employees who work overtime, the Fair Labor Standards Act (FLSA) requires you to pay them an hour and a half of overtime. It will be much easier when you track overtime every week.

Every company has its own rationale for rewarding employees when they do. While some states require billing periods, other employers may choose the frequency that best suits their cash flow or specific business needs. Typical billing periods include weekly, bi-weekly, semi-monthly and monthly.

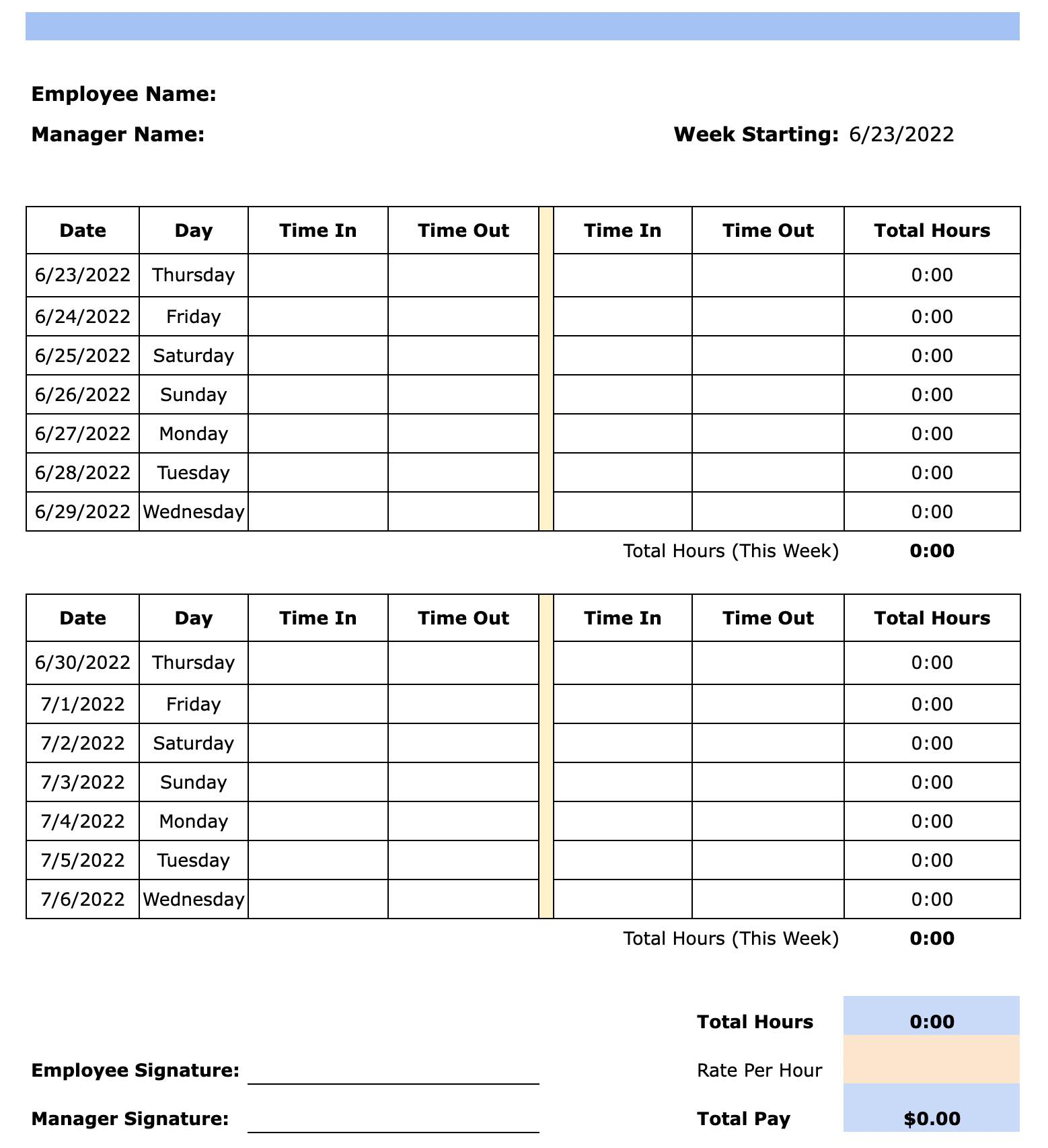

2023 Biweekly Payroll Calendar Template

Source: i.ytimg.com

Source: i.ytimg.com

Two-week pay dates are most common, with 36.5% of private US companies paying employees this way. We offer these payroll calendar templates to help you keep track of your pay dates and pay days. It may sound simple, but tools and resources like these 2023 payroll calendar templates can make a big difference for HR teams.

Biweekly Pay Periods

If you want to know when your 27-year period falls, you can talk to a human resources specialist who can review your past records and let you know when you’ll need to add another payday to your schedule.

For example, let’s say you have a full-time clerical worker who makes $44,200. When you divide $44,200 by 26, you get $1,700 in gross wages for each period (gross wages are the total amount paid to your employee before payroll taxes are deducted).

When using the bi-weekly schedule, most years have 26 billing periods. But some years they will be 27. Why is that? Well, calendar math can be complicated. Here’s why. (And beware, we’ll get to the technical stuff in a moment.) what is ICS?

The Universal Calendar Format (ICS) is used by several email and calendar programs, including Microsoft Outlook, Google Calendar, and Apple iCal. Allows users to publish and share calendar information online and via email. Depending on where you are located and who you employ, you may also be required by law to pay your employees more than once a month.

Why Do Some Years Have Paydays?

But if you work with a lot of freelancers or independent contractors and your state allows monthly wages, it can be beneficial. You will save time and money by not letting your employees down, as many of them are used to waiting at least 30 days to get paid.

A bi-monthly payroll means that you pay your employees on two specific recurring dates. These dates are usually the first and 15th of each month or the 16th and last day of each month. They will receive 24 payments per year.

While monthly payroll is the easiest option because you only have to process payroll 12 times a year, mistakes are still possible. That’s why you should check out our free monthly payroll template. It can simplify the way employees’ monthly payments are calculated.

Source: assets-global.website-files.com

Source: assets-global.website-files.com

For hourly team members, you can calculate their pay as follows: Take the total number of hours worked between the start date of the billing period and the end date of the billing period, then multiply it by their hourly rate.

For Hourly Employees

The current year has 52 weeks and the 2023 Bi-Weekly Payroll Template has a bi-weekly pay period. So if you plan to implement a bi-weekly pay schedule in 2023, you will have 26 pay periods. It is also the most commonly used method.

That means it’s a schedule familiar to many employees. So when you hire new employees, it’s more likely that they’ve already experienced this pay frequency, so that part of their transition will be seamless. Choosing the right payroll for your small business is important in managing administrative work and employee satisfaction.

Regardless of the schedule you choose, it’s a good idea to have a calendar handy so you can plan your payouts in advance. If the first January payment falls on January 6, then three payments will be distributed in June and September.

If the first January payment is paid on January 13, the additional payment will be made in July and December. A biweekly pay period generally means you pay employees twice a month, some months may have three pay periods.

Your Payroll Process Is Up To You

It depends on when your first billing period of the current year was. If your first billing cycle was January 6th, your three-month billing cycle is March and September. However, if the first billing period fell on January 13, June and December will be your three billing months.

The most popular is the bi-weekly payslip. This is not only satisfactory for most employees, but also administratively and financially feasible. Most workers are used to being paid biweekly, so this option may make sense if you want to stick to the norm and ease the transition.

That said, the bi-weekly payout plan is one of the most popular options for a reason. It’s doable for employers and helps employees feel more financially secure since you’re paying them more often. If you think this is the right choice for you, get started with our free template today!

Although weekly payroll may be more costly and time-consuming than other payroll schedules, it is sure to please your employees. Since it gives them more cash flow, it will be easier for them to budget and cover their expenses.

Source: comptroller.usc.edu

Source: comptroller.usc.edu

Bottom Line

Also, if you have overtime employees, you’ll find that a weekly payslip will simplify your calculations. To get the most out of your payroll templates, make sure all the information you enter is accurate or your results will be meaningless.

Also, don’t be afraid to customize them to fit your unique business needs. For more information, see our Payroll Compliance Best Practices

Guide. Monthly payroll can be a cheaper option for companies that run payroll themselves, which takes time and resources, or for those that work with a payroll provider that bills them each time they run payroll.

(However, if you use the Hourly feature, you can run an unlimited number of payrolls—and pay your employees as often as you want.) Anna Baluch is a freelance writer in Cleveland, Ohio. He enjoys writing about a variety of health and personal finance topics.

When she’s away from her laptop, she can be found working out, trying new restaurants, and spending time with her family. Connect with her on LinkedIn. While it may seem like a no-brainer at first, choosing a payroll can actually have a big impact on employees and the business.

Which Months Have Three Pay Periods In Them?

Before you decide how often to pay your employees, consider all your options and compare the pros and cons. Also think about your unique workforce and state laws. A bi-weekly payroll is a payroll schedule that lists all pay periods for the current year.

These billing periods occur every two weeks and fall on Fridays. Using a bi-weekly payroll means that you will essentially be paying your employees twice a month. Some months are longer than others, which means that the payout can be made three times instead of two.

If you start your bi-weekly pay plan on Friday, January 6, 2023, your three pay months will be March and September. Paying employees every other week means you have two weeks or 14 days to get your period.

If you look at how many pay periods there should be in a year, it turns out to be a little over 26. So if you have an hourly worker who is paid $15 an hour, who clocks in 60 hours, his gross

A Gps Time Tracker That Ensures Accuracy

salary would be $900 US DOLLAR. Then you’ll need to withhold payroll taxes, which include FICA (for Social Security and Medicare) and federal income tax. If you’re a small business owner with employees, a payroll template might come in handy.

Source: www.timedoctor.com

Source: www.timedoctor.com

It’s an easy way to avoid miscalculations, track time sheets and keep your payroll budget under control. In addition, a template can save your business a lot of time and effort. To make payroll processing easier for you, we’ve created some free payroll templates below.

If you want to make payroll processing even easier, check out Hodinové. A payroll platform automatically calculates wages and pays your employees and takes care of payroll deductions – reducing the time, energy and resources needed to process payroll.

The monthly payroll is where you pay your employees at the beginning or end of each month. This gives 12 billing periods per year. Although it is the most affordable and least labor-intensive option, it is not preferred by most workers.

How Paycor Helps

Therefore, it is not as common as other, more frequent loan payment terms. Each month has at least 28 days, so all months in a calendar year have four weeks. While all months have more than 28 or 29 days except February, they don’t count as a week because those extra days are less than 7. As an employer, you don’t have to plan too much because it happens automatically.

to the repayment schedule. However, it should be remembered that during these two months, wage expenses will be higher. A weekly pay schedule can make it easier for them to keep track of how much they’ve earned so far.

They can determine if they are on track to pay their bills and if they need or want more change. Because some months are longer than others, the payout may be made three times instead of two.

The specific months will depend on your salary plan. For example, if your first paycheck in 2023 falls on Friday, January 6, then March and September are three pay months. Assume the employee’s withholding tax is 7.65% for Social Security and Medicare (FICA tax) and 12% for federal income tax.

Bottom Line

This means that you deduct a total of 19.65% of your gross pay, which is $176.85. Your employee’s net pay after taxes for this period is $723.15.

bi weekly payroll calendar 2023, 2023 biweekly payroll calendar excel, 2023 bi weekly pay schedule, bi weekly payroll calendar 2022, biweekly pay date calendar generator, 2023 bi weekly pay period calendar, biweekly pay period calendar 2023, biweekly pay periods 2023