Adp Biweekly Payroll Calendar 2022 – Monthly payroll can be a cheaper option for companies that manage payroll themselves, which takes time and resources, or for those that work with a payroll service provider that pays them every time they do payroll.

(However, if you have one, you can make an unlimited salary and pay your employees as much as you want). These downloadable payroll schedule templates provide examples of typical processing days and payroll. If these dates match your calendar, use these calendars to help keep track or share with employees so they know when they get paid.

Adp Biweekly Payroll Calendar 2022

Source: payrollcalendar.net

Source: payrollcalendar.net

In other words, if you take the 365 days of the year and divide each period by 14 days, you get 26,071 (not equal to 26) payment dates per year. That extra .071 is less than 10% of a single pay period.

How To Use This Payroll Calendar Template?

After about 14 years, that extra amount is a whole extra pay period. A bi-weekly payroll means that you pay your employees once a week on a certain day of the week. For example, you can send payslips to employees every other Friday.

Since there are 52 weeks in a year, a two-week pay schedule has 26 pay periods in the calendar year. For example, let’s say you have a full-time office worker who earns a salary of $44,200.

If you divide $44,200 by 26, you get $1,700 in gross wages per period (gross wages are the total amount paid to your employee before tax is withheld). If you want to know when your 27 years will end, you can talk to a human resources specialist who will review your past records and find out when you need to add an extra salary to your schedule.

If you want to make rent processing even easier, check out the schedule. The payroll platform automatically calculates wages and pays your employees, and takes care of your payroll taxes, reducing the time, energy and resources needed to run payroll.

What Is Biweekly Pay?

There can be 52 pay periods per year or 12. Finally, the number is determined by the employer, unless the workplace or the employee is in a situation with specific salary conditions. It is important for business owners to strike a balance between the cost of payment and the financial needs of their employees.

Employers who choose this schedule can pay their employees on the first and 15th of the month or on the 16th and last day of the month. A monthly salary has 24 periods and is mostly used with salaried employees.

![]() Source: www.360connect.com

Source: www.360connect.com

Many companies use HR software to streamline the payroll process and prevent errors, but for professionals who don’t, manual payroll processing can take anywhere from 3-10 hours to complete each period. Curious about what it takes to never worry about payroll again?

Paycor can help. It is also the most used method. This means that it is a familiar schedule for many workers. So when you hire new employees, chances are they’ve experienced paid frequency before, making this part of the transition seamless.

How Many Pay Periods Are In A Year?

When choosing which payroll plan to use, there are several factors to consider, including the amount of administrative work, industry standards, and employee preferences. Here are the most common and some things you want to keep in mind when choosing: If you use a biweekly schedule, most years have 26 payment periods.

However, in a few years there will be 27 of them. For what? Well, calendar math can be complex. Here is why it happens. (And watch out, we’re about to get a little technical.) Every company has its own reason when it comes to employees.

While some states mandate pay periods, other employers may choose the frequency that best suits their cash flow or business needs. Common payment periods are weekly, bi-weekly, semi-monthly and monthly. Biweekly pay periods are the most common, with 36.5% of private companies in the United States paying their employees this way.

Download your free copy. And if it doesn’t match your salary, it can cost your business big in fines and lawsuits. When managing payroll information, you must consider not only state and federal taxes, but also Family and Medical Leave Act (FMLA) policies;

Semimonthly Pay

and also the Fair Labor Standards Act FLSA. Paycor Payroll Software is an easy-to-use yet powerful tool that gives your team back time. If you’re able to automate your payroll processes and get help with complicated areas like payroll tax compliance and workers’ compensation, you can spend more time making strategic decisions.

Contact us today to learn how our expert payroll processing and tax solutions can help all business owners pay employees on time and avoid compliance issues. Paying your employees every other week means you have two weeks or 14 days per period.

Source: www.bizzlibrary.com

Source: www.bizzlibrary.com

If you look at how many salaries should be per year, it is just over 26 years. As a business owner, you don’t need to plan too much for this because it happens automatically because of your payment plan.

However, it is good to know because your wage costs will appear higher in those two months. Say you started your business five years ago and your friend started three years ago. Each of you will have a different time to flip.

Which Pay Schedule Should You Use?

Ultimately, your 27-year paycheck depends on whether you started using the biweekly pay schedule. We provide these payment schedule templates to help you keep track of payment periods and payment days. It sounds simple, but tools and resources like this 2023 payroll calendar template can make a world of difference for HR teams.

For hourly team members, y

ou can calculate their salary as follows: Take the total number of hours worked between the start date of the pay period and the end date of the pay period, and multiply that by their hourly rate.

Finally, depending on the type of workers you hire and where you do business, you may be required to pay your employees more than once a month (you can see the full state wage requirements on the US Department of Labor website).

In California, for example, you must pay your employees at least twice a month. As a business owner, this is up to you, but the most popular pay schedule is the bi-weekly. But what exactly is this wage plan?

Why Do Some Years Have Paydays?

And a schedule you can follow? We dive into all that and more, so read on! You don’t need us to tell you that a business can’t function without a salary. Employees donate their valuable time in exchange for consistent pay.

But even if it often seems unremarkable on their end, the management of the salary requires a lot of attention to detail. There are state and federal taxes to consider, holidays, vacations, direct deposits, overtime calculations, payroll records and more.

Source: i.pinimg.com

Source: i.pinimg.com

This option is great for employees. It gives them an incentive to keep working every week and makes them feel more financially secure. Instead of her bank account decreasing throughout the month, it steadily increases each week, which is a huge comfort.

ADP recruits in over 26 countries around the world for an amazing variety of careers. We reinvent what it means to work, and we do it in a profound way. At ADP, we always say that we are Designing for People, starting with us.

Biweekly Pay Periods

So if you pay an hourly employee $15 an hour who logged 60 hours on his schedule, his gross pay would be $900. Next, you must withhold payroll taxes, including FICA (for Social Security and Medicare) and federal income tax.

That said, the bi-weekly pay plan is one of the most popular options for a reason. It’s manageable for employers and helps employees feel more financially secure as you pay them more often. If you think this is the right choice for you, get started with our free template today!

Weekly schedules are also great especially for hourly workers. They often have flexible work schedules and it is much easier to see how much they have earned so far by being paid each week. This can help them determine if they are on track to pay rent, bills and any other expenses or if they need to do more work before the end of the month.

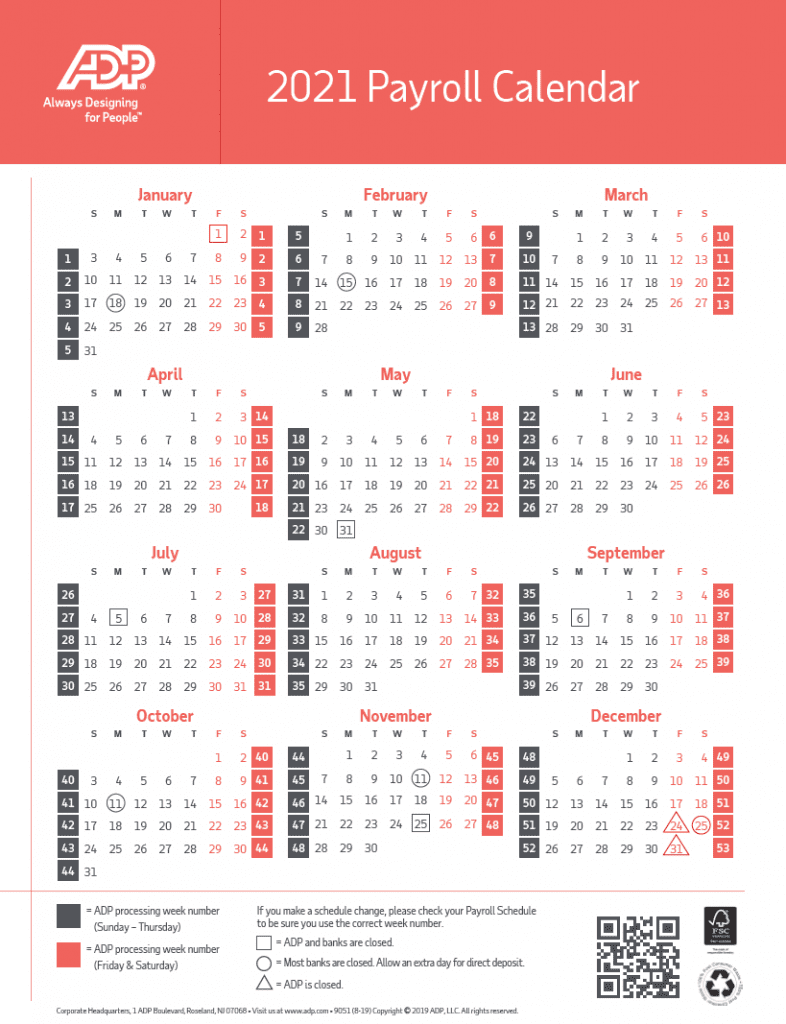

ADP’s payroll is a complete guide to pay periods in 2023. It clearly states the processing week number and all federal holidays, so employers can plan their payroll accordingly, whether it’s a bi-weekly, semi-monthly or other frequency.

Why Is It Important To Keep Accurate Payroll Information?

Some months are longer than others, meaning that payday can happen three times instead of twice. If you start your payroll on Friday, January 6, 2023, your three pay months will be March and September. In 2023, if you run a regular bi-weekly pay schedule, biweekly payees will receive 26 paychecks.

The employees receive two salaries in 10 of the 12 months and three months in two. If the first payment of January is made on January 6, three payments will be distributed in June and September.

If the first salary for January is distributed on January 13, the extra salary will be distributed in July and December. Choosing the right payroll plan for your small business is important to managing your administrative workload and maintaining employee satisfaction.

Whichever schedule you choose, it’s helpful to have a calendar handy to plan your paydays in advance.

How Paycor Helps

bi weekly payroll calendar 2022, 2023 payroll schedule, 2022 biweekly payroll schedule template, 2023 adp payroll calendar, bi weekly pay schedule 2022, 2023 biweekly payroll calendar, bi weekly pay periods 2022, bi monthly payroll calendar 2022