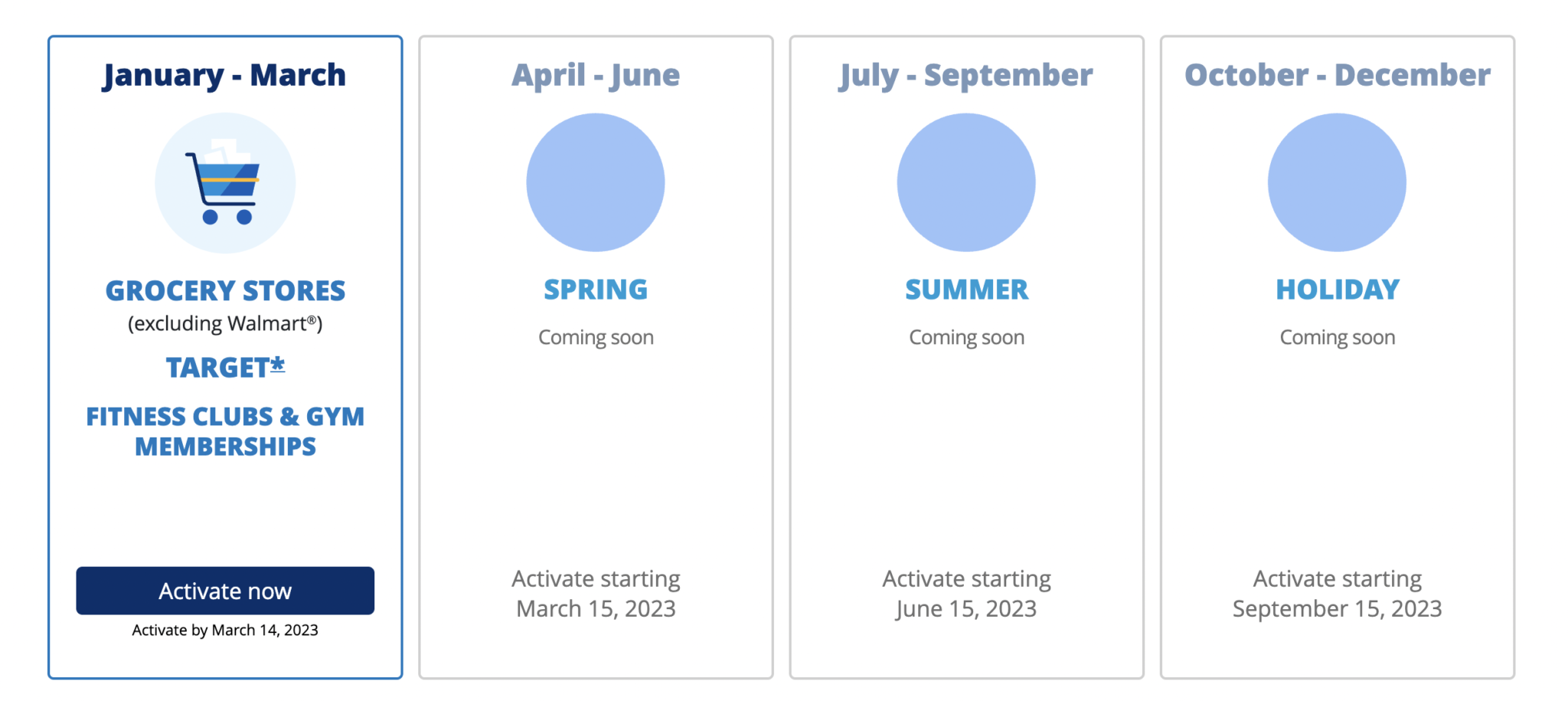

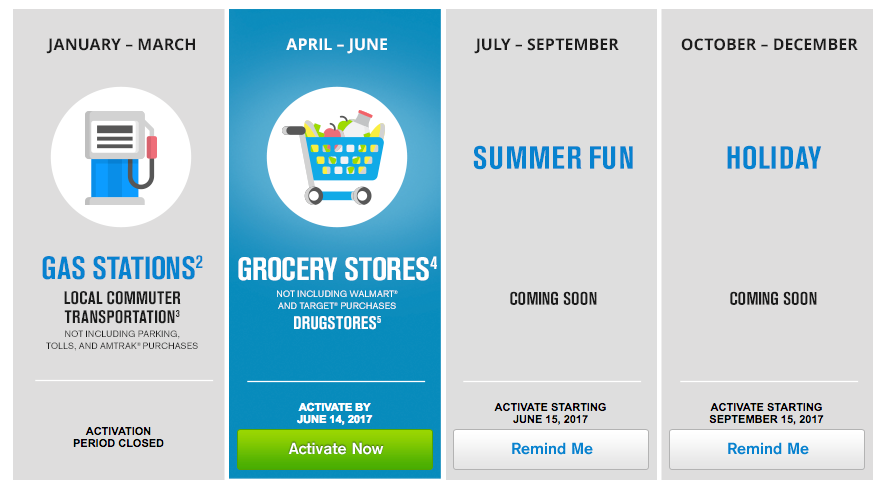

Chase Rewards Calendar 2022 – You have until the 14th day of the last month of the quarter to activate the categories. Activation is retroactive, so if you activate within the deadline, you’ll receive 5% on all eligible spend during the quarter.

Bankrate.com is an independent publisher and ad-supported comparison service. We are compensated in exchange for placing sponsored products and services or for your clicking on certain links posted on our site. Therefore, this compensation may affect how, where and in what order products appear in the listing category, except as applicable to mortgages, home equity and other home loan products.

Chase Rewards Calendar 2022

Source: monkeymiles.boardingarea.com

Source: monkeymiles.boardingarea.com

Prohibited by law. Other factors, such as our own proprietary site rules and whether a product is offered in your area or your self-selected credit score range, may also affect how and where products are displayed on this site.

How To Redeem Rewards With Freedom Flex

There are. While we strive to provide a wide range of offerings, Bankrate does not include information on every financial or credit product or service. About Chase Chase JPMorgan Chase & Co. (NYSE: JPM) is a US consumer and commercial banking business, a leading global financial services company with assets of $3.7 trillion and operations around the world.

Chase serves more than 60 million American households with a wide range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: more than 4,700 branches in 48 states and the District of Columbia, 16,000 ATMs, mobile, online and by phone.

For more information, visit chase.com. You may be able to use some of your home’s value for an expansion or pay other bills with a home equity line of credit. Use our HELOC calculator and other HELOC resources to find out if you may qualify for a HELOC.

With 5% rotating categories, Freedom Flex Card members can earn cash back on a variety of other purchases, including: 5% cash back on travel purchased through Cheez Ultimate Rewards, 3% Food and Drug Store Cashback and 1% cash back

Spend Strategically

to everything . Other markets. In addition to these rewards, Freedom Flex Card members enjoy World Elite MasterCard benefits, including cell phone protection and rewards with Lyft, Shoprunner and more, along with priceless experiences. To redeem rewards, your account must be open and in good standing.

Rewards are tracked as points, and every dollar you earn in cash back is worth 100 points. Cash back can be redeemed as a statement credit or direct deposit into an eligible US bank checking or savings account.

There is a small, but important step to scoring that 5% win rate. You must “activate” bonus categories on the card every quarter. To do this, log into your Freedom Flex account and click on the small letters where it says “Details” next to where it says 5% cash back and the current month of the quarter.

Additionally, FreedomFlex usually has two or three 5 percent bonus categories at once, which is especially useful for smaller categories like streaming services. Its categories are also somewhat more diverse depending on the season. For example, you’ll typically earn 5 percent back each year at major online retailers like Amazon.com, but Citi Custom Cash doesn’t earn any rewards on online purchases.

Key Principles

At Bankrate, we strive to help you make better financial decisions. While we observe strictness. Editorial Integrity This post may contain references to our partners’ products. Here’s an explanation of how we make money. . The content of this page is correct as of the date of publication.

Source: image.cnbcfm.com

Source: image.cnbcfm.com

However, some of the offers listed may expire. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are solely the author’s and have not been reviewed, approved or otherwise endorsed by any card issuer.

Chase Freedom Flex earns 5% cash back up to $1,500 in categories that rotate quarterly (requires activation), 5% on travel purchased through Chase Ultimate Rewards®, 3% on food and drug stores, and 1% on all other markets.

We appreciate your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards to ensure this. Our editors and reporters check editorial content to make sure the information you read is accurate.

Advertiser Disclosure

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. One big difference between Discover’s program and Chase’s program is that with Discover, you get 5 percent cash back on bonus category purchases after activation (up to $1,500 in bonus category purchases per quarter and 1 percent after that).

With Chase, you earn 5 percent cash back on all bonus category purchases made within the designated quarter — even if you don’t activate the bonus categories by the deadline, which is usually There’s plenty of forgiveness.

Whichever cash back card you choose, make sure you activate these categories to avoid missing out on rewards. If this isn’t the right card for you, other credit cards offer valuable benefits and rewards. If you’re considering a new credit card and want to earn cash back or other rewards, check out our list of top credit cards to find the right card for your needs.

We are an independent ad-supported comparison service. Our goal is to help you make better financial decisions by providing interactive tools and financial calculators, publishing original and objective content, enabling you to do free research and compare information – so you can make confident financial decisions.

Compare Chase Categories With Discover

For example, if your bonus category includes groceries, many supermarkets will typically sell gift cards to Amazon, chain restaur

ants, and retail stores. So you can put a few dollars toward a gift card for your next night out to dinner or a gift for a special occasion.

Or, if you have the storage space, buy household items like paper towels, toilet paper and cleaning products for the year, up to $1,500. Many or all of the products featured here are from our partners who pay us.

This affects which products we write about and where and how the product appears on the page. However, this does not affect our assessment. Our opinions are our own. Here’s a list of our partners and how we make money.

This cash back bonus lets you earn up to $75 in cash back with interest until you reach your $1,500 spending limit every quarter. Purchases made outside the bonus category will earn unlimited 1% cashback. The card earns 5% cash back on all categories that change every three months.

Source: i.pinimg.com

Source: i.pinimg.com

Bottom Line

You must “activate” the categories each time to qualify for the 5% reward rate, and you earn 5% on the first $1,500 you spend in the category each quarter. Below is the current Chase 5% calendar.

Once you activate a category, you’ll get 5 percent cash back on all purchases in the category during the quarter — even those made before activation that quarter — up to $1,500 in quarterly purchases, and 1 percent after that.

If you have multiple Chase accounts, make sure you’ve turned on categories for each one. We believe that everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product on the market, we pride ourselves on the guidance we offer, the information we provide, and the tools we create to be objective, independent, simple, and free.

An older version of the card, the Chase Freedom®, has the same 5% quarterly categories, with the same activation requirement and the same $1,500 quarterly limit on 5% qualifying spending. However, this version does not have the 5% and 3% rewards on travel, restaurants and pharmacies.

The Bottom Line

All other spending with this card earns 1%. (The original Chase Freedom® is no longer accepting applications, but existing cardholders may continue to use it.) The website and/or Chase Mobile’s terms, privacy policies and security do not apply to this website or

application you will visit. Please read the Terms, Privacy and Security Policies to see how they apply to you. Chase is not responsible for (and does not provide) any products, services, or content on this third-party website or application, except for those products and services that expressly bear the Chase name.

“Expert verified” means that the Financial Review Board has thoroughly reviewed the article for accuracy and clarity. The Review Committee consists of a group of financial experts whose aim is to ensure that our content is always objective and balanced.

The composition has evolved over time. Restaurants, for example, used to be a 5% category every year, but that hasn’t happened since 2017. The category may actually be dead.) Meanwhile, for a few years, Chase used 5% categories to make

How To Maximize Cash Back

people to adopt the (now defunct) Chase Pay digital wallet app. If you own both Chase Freedom Flex℠* and Discover it® Cash Back and want to see which card offers bonuses in which categories for the quarter, or if you’re trying to decide which card to apply for, this might be helpful.

To see a side-by-side comparison. Grocery shopping is something everyone does, so it’s a great opportunity to earn extra rewards. If you spend more than $1,500 for the quarter with qualifying purchases, you’ll earn $75. You have to shop anyway, so don’t forget to activate these bonus categories and pay with your card to maximize your rewards.

We strongly believe in the Golden Rule, which is why editorial opinions are solely our own and have not been previously reviewed, endorsed or approved by the advertisers involved. Ascent does not cover all offers on the market.

Source: cdn-images-1.medium.com

Source: cdn-images-1.medium.com

The Ascent’s editorial content is separate from The Motley Fool’s editorial content and is created by a different team of analysts. The Motley Fool has a Disclosure Policy. The author and/or Motley Fool may have an interest in the companies mentioned.

How We Make Money

While custom cash categories are geared more toward everyday spending and have rare offers like live entertainment rewards, you’ll likely get increased cash for grocery purchases or other expensive categories (like food) each billing cycle, especially if it’s yours.

Basic credit card. After you activate your bonus categories for the quarter, your card will earn 5% back up to $1,500 on combined purchases in those activated categories. This is one of the highest rates on the market, giving you the chance to win big rewards.

These rotating bonus categories are also available with the Chase Freedom, a card that is no longer open to new applicants. It is important to note that Target and Walmart purchases are excluded from grocery expense revenue.

But if you usually shop for groceries at other stores, you can benefit. You’ll earn 5% up to $1,500 in total spend between the two categories from January 1 through March 31, 2022. Your cash back rewards should appear on your credit card account immediately after redemption.

Editorial Independence

When you review your statement, you’ll see the bonus tier rewards listed as “5 percent First Quarter Tier Bonus.” As long as your account is open and in good standing, your points will not expire. Lyle Daly is a personal finance writer specializing in credit cards, travel rewards programs and banking.

He writes for The Ascent and The Motley Fool, and his work has appeared in USA Today and Yahoo! financing. He was born in California, but currently lives as a digital nomad based in Colombia. Cash back on a credit card with no annual fee is a great money saver.

Think of it as a discount every time you shop. And 5% cashback definitely beats 1% cashback. Of course, you should never buy things you don’t need

just to earn rewards, and there will likely be times when a certain quarter’s categories don’t match your spending habits.

One of the easiest activation methods is to use the Chase Mobile app. You can also activate rewards through your Account Hub, by phone, email, or at a designated Chase location. If you need a reminder to activate, try setting a reminder in your calendar to make sure you don’t miss a reward category.

Comparison Chase Freedom Flex Rotating Categories Vs Discover It Cash Back Bonus Categories

Speaking of available categories, you also get a wide variety of purchases that you can earn 5 percent with Citi Custom Cash. The Freedom Flex and other 5 percent revolving bonus category cards have about seven or eight bonus categories during the year, rather than a custom cash card’s 10.

chase credit card rewards calendar, chase 5% calendar 2022, chase freedom reward calendar 2022, chase freedom 5% cash back calendar, chase rewards calendar 2023, chase freedom flex calendar 2022, chase freedom 5 calendar 2023, chase 5 % calendar