Stock Split Calendar 2022 – Tesla stands out in the EV market for the large number of models it offers (16) and its technological innovations, including automatic driver assistance and over-the-air software updates to improve range, power, braking and other vehicle functions.

. Don’t be let down as other traders use the API to learn all about stock splits – minutes, seconds and milliseconds. The best distributed calendaring APIs can give you an advantage. Knowing this information can give you an edge in the market.

Stock Split Calendar 2022

Source: i0.wp.com

Source: i0.wp.com

In addition, understanding what this stock split means with Benzinga data can make your investments much more profitable. In addition, split shares also have a higher value because they are now available to more investors. Of course, whether you make money from a stock split depends on a number of factors specific to each company’s situation and the stock market as a whole.

Money Classic

Make sure the fields you need are in there, such as the date, company name, ticker symbol, starting range, starting price, etc. Choosing the right stock distribution calendar will ensure you get what you need. While the current pre-split value is about $150 less than half of its all-time high of $347.51 in January 2021, it’s still an astronomical advantage for the beleaguered retailer, as GameStop recently traded below $3.

as of April 2020. Stock splits usually occur when the stock price has risen to a point where the stock has become less liquid and investor interest has diminished due to its higher price, as high quality stocks typically have lower trading volume and participation.

Gordon Haskett analyst Chuck Groom expects the company to use the $2.0 billion in cash on its balance sheet to aggressively buy back stock or debt, noting that RH’s share price will have fallen sharply in 2022 (about 48% in

2022 has dropped). Now the 2-for-1 stock split allows investors to own it at a much lower price. Analysts are positive about the proposed stock split, pointing to the benefits Amazon could see if its stock price falls.

Stock Splits In

“Investors looking to acquire or grow may rush to buy,” Bank of America wrote in a note. As CNBC reported, the stock has doubled in value in less than two years since the initial stock split.

Like Amazon, GOOG has a high price of over $2,000 per share, making it a logical choice for a stock split. So far, the three highest-grossing dividends this year have all been in the technology sector.

This makes it somewhat difficult to analyze the impact of the split on each company’s share price, as the wider technology sector has been under a lot of pressure this calendar year as investors grapple with rising interest rates and high earnings expectations, while many companies are concerned about

Source: media.wcnc.com

Source: media.wcnc.com

. Consider a more likely recession. Another risk is ACM Research’s heavy dependence on customers in China, which purchase most of the semiconductor manufacturing equipment. Deteriorating trade relations with China could negatively impact the company’s financial results, but ACMR hopes to reduce business risk by finding new customers for its equipment outside the mainland.

Should You Buy Into A Stock Split?

A reverse stock split helps companies delist their shares from major stock exchanges with a minimum listing price. Such splits also indicate that the company may be in trouble, so if you’re considering buying stock in a company that has recently completed a reverse split, carefully research the company’s financials.

While not a tech stock, Tesla has been under pressure this year as investors ponder the implications of a slowing economy and as Mercurial CEO Elon Musk makes a sometimes controversial, time-and-again, off-again bid to buy Twitter.

private social media company. Shares of Tesla started the year at $1,199.78 and have since fallen nearly 38%. A few final things to find out as you do your research: This may seem simple, but the stock dividend calendar API is supposed to tell you the dividend ratio of a particular company.

For example, it should state whether it is a 5-to-1, 2-to-1, or 1-to-4 split, or some other type of split. If Dua is right, the split would provide exactly what Nintendo shareholders know the company needs.

This catalyst does not come into effect until October. A lot could change by then, but it also gives investors time to replenish NTDOY stock as the split approaches. While Google Cloud Services is still unprofitable, it remains a growth area for Alphabet, with revenue up 44% in the March quarter.

And GOOGL also plans to build out its cybersecurity capabilities by spending $5.4 billion to acquire Mandiant (MNDT (opens in a new tab)). Stocks have been up recently on brief speculation, but that probably won’t keep prices high for long.

The proposed stock split could give GameStop momentum that should prevent it from dropping below $100. A stock split “doesn’t make a company more valuable in and of itself,” said Keith Buchanan, senior portfolio manager at Globalt Investments in Atlanta.

“If it’s a stock that an investor believes has an attractive value, it should be an attractive value before and after the split.” Xignite offers a combo package: the revenue API also includes equity allocations. Xignite provides future earnings, dividends and event calendar data for trading and risk.

Source: cdn.geekwire.com

Source: cdn.geekwire.com

You’ll get information on 6,300 companies traded on US and global exchanges, the dates and times of earnings announcements, shareholder/board meetings, and upcoming distributions and dividends. To celebrate our 50th anniversary, we’ve combed through decades of our print magazines to f

ind hidden gems, interesting stories, and vintage personal finance tips that have stood the test of time.

Dive into the archives with us. Take Nvidia (NVDA (opens in a new tab)) for example. The chipmaker said in May 2021 that it will split its shares 4-for-1. Shares rose 20% between the May 21 announcement and July 19, the date of the actual distribution.

Dexcom led the way in this market with the G6 continuous glucose monitor (CGM) and recently launched the Dexcom One, a simpler and less expensive model that will help the company increase its share in emerging markets such as Eastern Europe.

Private investors — and sometimes professionals — often enjoy stock splits, which lower a company’s price by multiplying the number of shares available. But experts say investors should remember that performance alone doesn’t change a company’s fundamentals.

The company is expanding its capacity to meet expected demand. Tesla opened its Gigafactory in Texas earlier this year, which is expected to produce 500,000 Model Y SUVs per year, as well as a Gigafactory in Berlin, Germany.

To improve supply chain control, Tesla is also bringing some battery production in-house, a move that is expected to increase flexibility and improve margins. It Doesn’t Matter Which Company You Buy Stock From: Whether you already own shares of a particular company or are considering investing in the company – most likely you probably want to know if the stock is about to split or break up in the past

. Tesla has a history of missing important deadlines. But for now, it looks like all systems are going for the early August session. The TSLA stock split was well advised before the stock hit. Now it will probably be the catalytic converter that saves it.

In a statement released that day, Kinetic said it “expects the stock split to increase trading liquidity in the company’s stock and make its stock more accessible to its employees and investors.” UBS recently added Dexcom to its list of stocks expected to recover when market volatility eases.

In addition, Earlier this year, Wells Fargo upgraded DXCM shares from Equal Weight to Overweight (equivalent to Buy and Hold, respectively), citing the upcoming opening of the G7 as a major driver of growth. Wells Fargo Group believes the company can potentially double the addressable market for CGM devices.

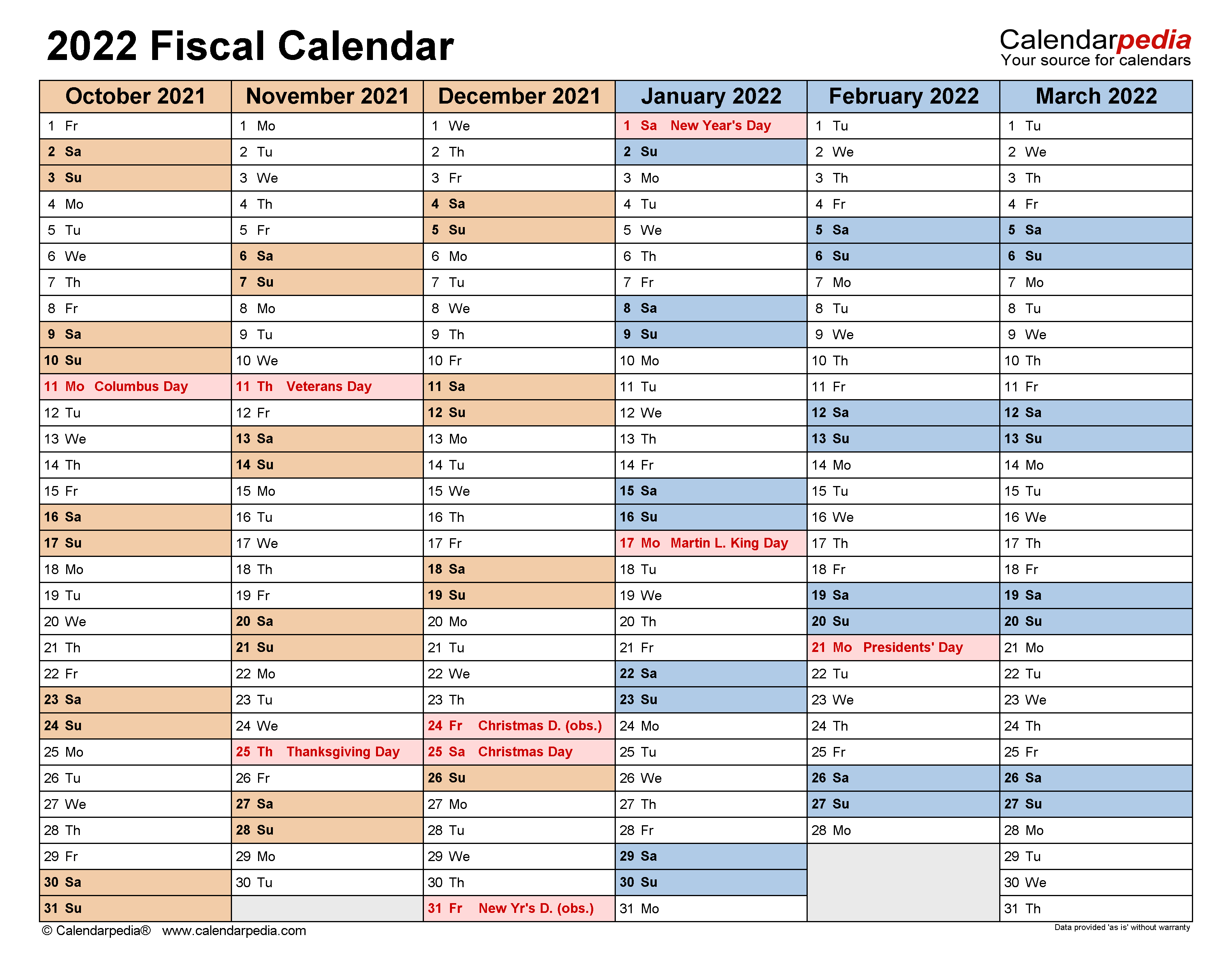

Source: www.calendarpedia.com

Source: www.calendarpedia.com

A stock split occurs when a company decides to split its existing stock into additional new stock. While the number of shares increases, the total dollar amount of the shares and the company’s market capitalization usually remain constant because the split does not add value to the shares.

Despite the company’s strong historical growth, Amazon’s stock returns have underperformed the S&P 500 over the past three years. To attract new private investors, Amazon announced a 20-for-1 stock split on June 3, driving its share price lower

from about $2,100 to $101 (based on current levels). A stock split is unusual for AMZN, and this is the company’s first since 1999. The split was announced at the same time as a new $10 billion share buyback.

Building a successful broker comes down to a three-pronged approach. First, you must obtain a license from FINRA (Financial Industry Regulatory Authority), SIPC (Securities Investor Protection Corporation), and NASAA (North American Securities Administrators Association). You must also file Form BD with the SEC and wait for approval.

Here are some other notable names that completed stock splits or reverse splits this year. SMART Global Holdings Inc. (NASDAQ: SGH) 20:1 ACM Research Inc (NASDAQ: ACMR) 3:1 Empire Petroleum Corporation (NYSE: EP) 1:4 P.A.M. Transportation Services, Inc.

(NASDAQ: PTSI) 2:1 Tootsie Roll Industries, Inc. (NYSE:TR) 1.03:1 Enovis Corp. (NYSE:ENOV) 1:3 MFA Financial, Inc. (NYSE: MFA) 1:4 Prenetics Global Ltd (NASDAQ: PRE) 1.29:1 A-Mark Precious Metals Inc (NASDAQ:AMRK) 2:1 Brookfield Infrastructure Corp (NYSE: BIPC) 3:2 DexCom, Inc.

(NASDAQ: DXCM) 4:1 Invesco Mortgage Capital Inc (NYSE: IVR) 1:10 Kinetik Holdings Inc (NASDAQ: KNTK) 2:1 Shares of Alphabet when it traded on Monday, July 18 at the split price of approximately $113 got off to a rocky start and fell by more than 2%.

Some analysts expected it to recover to higher value, just as Apple and Tesla both did after their most recent stock splits in 2020. Dexcom made its way onto this list of dividend stocks after announcing a 4-for-1 correction in late March

. The split will increase the number of shares from 200 million to 800 million effective June 10. At the current price of $315, this would bring DXCM’s share price down to about $74. Home furnishings retailer RH (RH (opens in new tab), $279.45) – a member of Berkshire Hathaway’s stock portfolio – sells high-end furniture

, lighting, textiles and home accessories through a network of 67 shopping arcades and 38 department stores. United States and Canada.

announced stock splits 2022, upcoming reverse stock splits, stock split history, recent stock splits, what stocks will split soon, upcoming stock splits 2023, fidelity stock split calendar 2022, reverse split calendar