Dividend Capture Strategy Calendar – MarketBeat identifies Wall Street’s top-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. Marketbeat has identified five stocks that top analysts are quietly telling their clients to buy before the broader market hits … and Alphabet wasn’t on the list.

Have you ever thought about dividends as a reward for long-term investors? Every quarter, some public companies pay dividends to their shareholders, who can then use them as cash or reinvest them in the company. But since the company’s stock only needs to be captured on the ex-dividend date, many short-term traders like to play a game called “capture the dividend.”

Dividend Capture Strategy Calendar

Source: www.thestreet.com

Source: www.thestreet.com

A dividend capture strategy is designed to allow investors looking for capital to hold a stock long enough to capture its dividends. Although this strategy is relatively easy in theory, it can be difficult to execute correctly in many cases.

How Is The Dividend Capture Strategy Taxed?

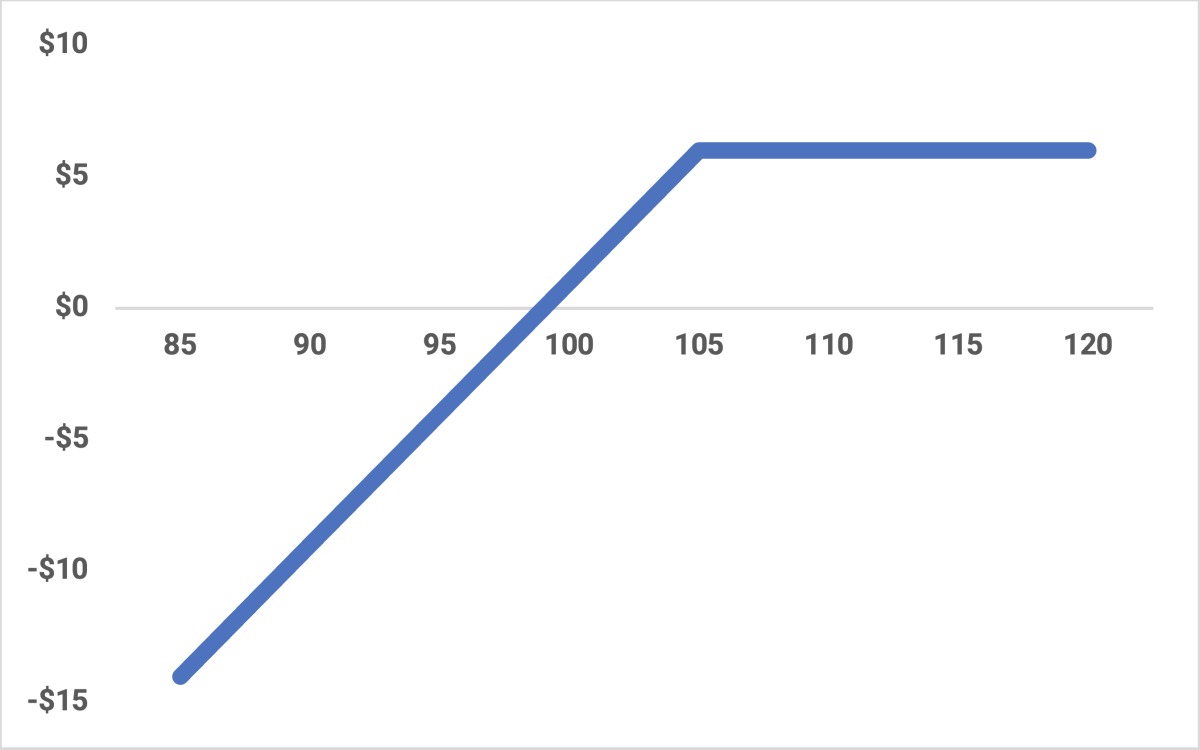

On December 3, 2013 – the day before WMT’s first dividend, the stock closed at $88. Let’s say you bought a stock at this price that day. On the ex-dividend date, the stock sold off (as it should have), but you sold the stock near $80.22.

This screener provides several options to choose the right stock for your goals and risk tolerance. It’s not necessary to look at the fundamentals when analyzing stocks, but you may have certain investment strategies that you want to stick to.

If you want to understand how to reap and participate in dividends, you’ll first need a solid understanding of how and when companies pay dividends. This article will give you an insight into how to start using this particular dividend strategy.

For example, if you buy a stock with a dividend yield in mind, and then it falls below your dividend payout, you might want to hold on long enough to break even. However, there is no guarantee that the stock will be completed quickly enough for you to avoid losses and opportunity costs.

Is Dividend Harvesting Profitable?

Market Action Many stock strategists are counting on the stock price not falling along with the overall value of the sector due to foreign market forces. For example, a stock that closes at $30.00 the day before an ex-dividend date of $1 should open at $29.00 on the ex-dividend date.

But, yes, supply and demand and other factors like company and market news affect stock prices. Traders looking for a dividend option should do so to be aware of brokerage fees, tax treatment, and any other issues that may affect profitability.

There is no guarantee of profit. In fact, if the stock price declines significantly after acquiring the shares because the trader is not fully related to the shares, the trader may suffer a significant loss. Since you hold the shares purchased using the dividend option for a day or two, the payout will be less than the investor’s normal income.

You have to hold the stock for at least 60 days to get profitable income, which is too long for most short-term traders to cover the money. Dividend harvesting can be profitable for investors who follow a few important steps.

How Effective Is Dividend Capture?

It is important to buy a stock before the ex-dividend date and sell it later. The trade may not be profitable if the stock declines more than the dividend amount. WMT’s last and annual dividend per share was $0.47.

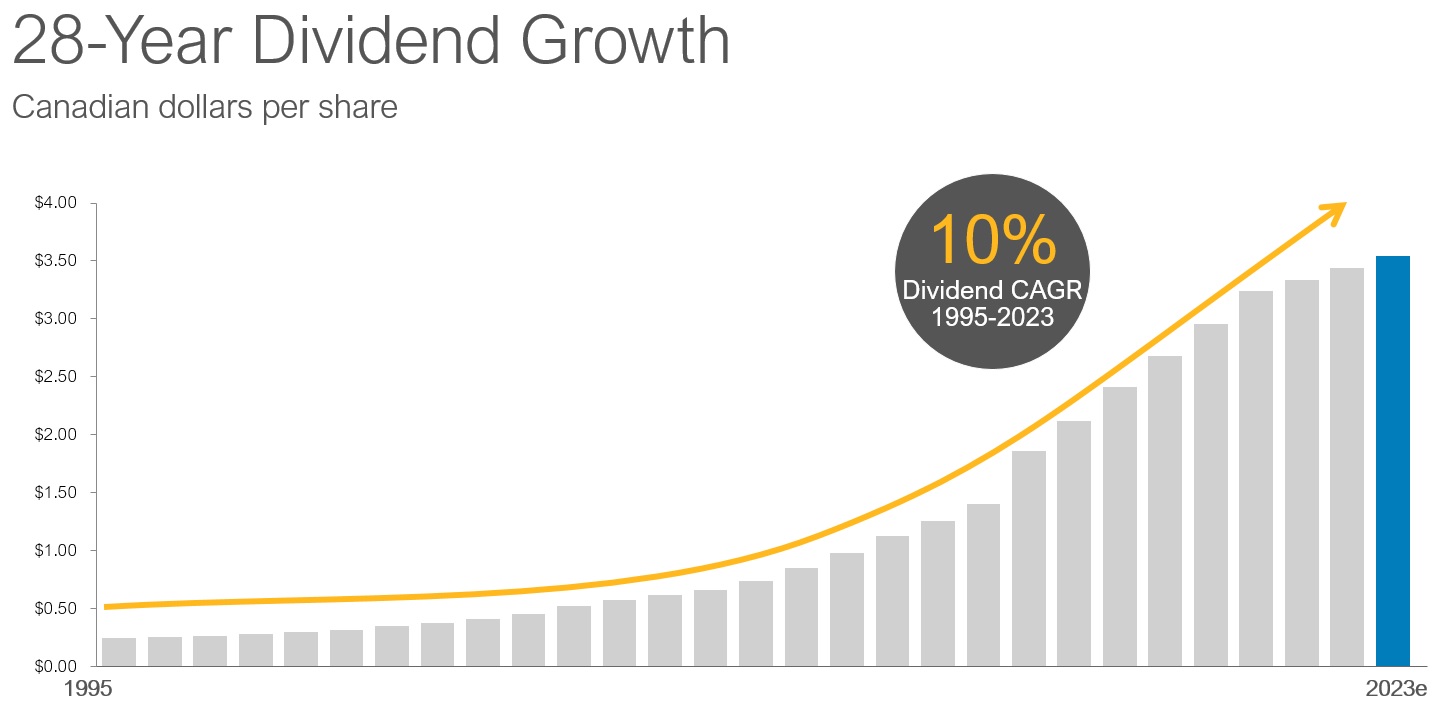

Source: www.enbridge.com

Source: www.enbridge.com

Actually, the dividend holding is not enough to cover the loss on sale. The trader could only profit on this trade if the stock sold above $80.75 on the previous day of the distribution, which occurred between 10:00 AM and 12:00 PM.

This is a good example of how important punctuality is. The effectiveness of dividend capture is controversial. In some markets, you can take dividends without the stock taking a huge hit on the ex-dividend date. But in bear markets, dividend payments can be negated by the stock price falling the previous day.

This method is interesting because it does not include the information needed to read charts or fundamentals, such as the earnings ratio. It’s simply a matter of tracking dividend capture stocks through a calendar, or a dividend capture strategy calendar.

How Does The Dividend Capture Strategy Work?

Keep in mind, however, that amid all the ups and downs the stock experiences during the trading session, you won’t really notice a 25-cent adjustment. Stocks may close higher in the session, which is normal. A dividend buyout works by buying stock before the ex-dividend date and then selling it on or after the ex-dividend date.

While it is important to understand the distribution calendar to know how much the dividend will be and if you will receive a payment, the ex-dividend date is the most important date to know when using this strategy.

Long-term investors benefit the most from the shares as they hold the shares for a long time to meet the eligibility criteria. To be considered a qualified dividend, the shareholder receiving the dividend must have held the shares for at least 60 days.

Any 60 days during the specified 121-day window are eligible for dividends, but for investors who use dividend capture, this catch-up period does not apply to their strategy. Therefore, investors who receive dividends will likely pay full ordinary income tax on their dividend income.

How Does The Dividend Capture Strategy Work?

As always, consider these factors when deciding when to sell dividend stocks. The potential gain from a pure dividend taking strategy is usually small, while the potential loss can be substantial if there is a bad market move during the holding period.

A decline in the stock price on the ex-date that exceeds the amount of the dividend may compel the investor to hold the position for an extended period of time, introducing systematic and company-specific risk to the plan

.

Negative market movements can quickly wipe out any potential gains from this dividend capture approach. To mitigate these risks, the strategy should be focused on short-term holdings of large blue-chip companies. A dividend buyout works by buying stock before the ex-dividend date and then selling it on or after the ex-dividend date.

While it is important to understand the distribution calendar to know how much the dividend will be and if you will receive a payment, the ex-dividend date is the most important date to know when using this strategy.

:max_bytes(150000):strip_icc()/businessman-using-a-mobile-device-to-check-market-data-1027438182-5c4caec5c9e77c0001f321d0.jpg) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

Overview Dividend Basics

A dividend holding strategy offers constant profit opportunities because there is at least one stock that pays a dividend almost every trading day. A large holding in a stock can be routinely rolled into new positions, participating at every step along the way.

With a large initial investment, investors can take advantage of both small and large returns as returns from successful operations are often compounded. However, it is often better to focus on mid-yield (~ 3%) large-cap firms to reduce the risks associated with smaller companies even when seeing significant returns.

© 2023 Market data provided with a 10 minute delay and managed by Barchart Solutions. INFORMATION IS PROVIDED ‘AS IS’ AND FOR INFORMATIONAL PURPOSES ONLY, NOT FOR COMMERCIAL PURPOSES OR ADVICE, AND IS LIMITED. Please see Barchart’s disclaimer for all exchange delays and terms of use.

Before starting with dividend earning strategies, “What are dividends?” It is important to understand the answer to Dividends are payments that shareholders receive from companies. Whether you own an exchange-traded fund or a mutual fund that contains stocks, you’ll receive income from the stocks in the dividend-paying portfolio.

Step Sell On Or After The Ex-Dividend Date

The fund pays out this form of money as a fund dividend. To claim your shares, you must sell sometime after the ex-dividend date. Let’s say you are concerned about income tax treatment. Consider limiting your dividend-capture trades to qualified accounts such as IRAs or Roth IRAs.

First, your contributions are not paid until you take the required distribution from your IRA. If you hold your shares in a Roth IRA, your shares are not subject to tax. Since you hold the shares purchased using the dividend option for a day or two, the payout will be less than the investor’s normal income.

You have to hold the stock for at least 60 days to get profitable income, which is too long for most short-term traders to cover the money. Ideally, the stock price reflects the expected dividend payout date.

Since investors who buy the stock on the ex-dividend date do not receive the dividend, the stock price should decrease by the amount of the dividend. Dividend holdings can be a successful short-term trading strategy in some markets, but they are not a long-term wealth acquisition strategy.

How Is The Dividend Capture Strategy Taxed?

Dividend harvesting can provide stable and reliable income without worrying too much about volatile market gyrations or disrupting technical analysis. However, dividend-taking strategies are not very tax efficient and have not proven to outperform long-term strategies for the traditional dividend investor.

Many investors look for companies that pay a certain amount of profit in the form of dividends. Investing in these companies makes sense, as the shares comprise a significant portion of the S&P 500’s annual return.

The dividend capture strategy is an income-based stock trading strategy that is popular among day traders. Unlike traditional methods, which focus on buying and holding fixed-paying stocks for steady income, this is an efficient trading method that requires constant buying and selling of stocks, only for short periods of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Need to keep Enough time to reap the dividends that the stock pays. Ground stock can sometimes be held for a day. A dividend capture strategy has its risks. For example, if the stock falls more than the dividend paid, it can reduce your net profit.

Dividend Capture May Not Outperform Other Techniques

You want to wait for the stock to return to the purchase price before selling, but it will continue to decline before you return. Long-term investors benefit the most from the shares as they hold the shares for a long time to meet the eligibility criteria.

To be considered a qualified dividend, the shareholder receiving the dividend must have held the shares for at least 60 days. Any 60 days during the specified 121-day window are eligible for dividends, but for investors who use dividend capture, this catch-up period does not apply to their strategy.

Therefore, investors who receive dividends will likely pay full ordinary income tax on their dividend income. As always, consider these factors when deciding when to sell dividend stocks. Dividends make up the majority of a company’s profits.

The company can reinvest its profits back into the firm or reward shareholders through cash distributions. The shares are usually of established companies with no intention of spurring growth or increasing market share, which is why old blue chip stocks pay so much.

Is It Good To Collect Dividends?

To collect dividends effectively, it is important to understand the general system under which all stock dividends are paid. There are four important dates in the dividend payment cycle, each of which can be found on all of our dividend ticker pages (as pictured below).

On June 13, the dividend was declared and the stock price rose to $65. This will be a good exit point for the seller who will not only be able to get a share but also see an income.

Unfortunately, this type of situation is not consistent across equity markets. Instead, it carries the main meaning of the i

dea. This screener provides several options to choose the right stock for your goals and risk tolerance.

It’s not necessary to consider the fundamentals when evaluating stocks, but you may have certain investment strategies that you want to stick to. Shares can be a great way to make money from your stocks. ਇੱਥੋਂ ਤੱਕ ਕਿ ਜਦੋਂ ਸਟਾਕ ਦੀਆਂ ਕੀਮਤਾਂ ਘੱਟ ਹੁੰਦੀਆਂ ਹਨ, ਬਹੁਤ ਸਾਰੀਆਂ ਕੰਪਨੀਆਂ ਕਰਜ਼ੇ ਦਾ ਭੁਗਤਾਨ ਕਰਨਾ ਜਾਰੀ ਰੱਖਦੀਆਂ ਹਨ, ਜੋ ਕਿ ਮਾਰਕੀਟ ਦੀ ਗਿਰਾਵਟ ਵਿੱਚ ਘਾਟੇ ਨੂੰ ਪੂਰਾ ਕਰਨ ਵਿੱਚ ਮਦਦ ਕਰਦੀਆਂ ਹਨ।

Tax Implications Of The Dividend Capture Strategy

ਇਹ ਤੁਹਾਡੇ ਪੋਰਟਫੋਲੀਓ ਜੋਖਮ ਨੂੰ ਘਟਾਉਣ ਵਿੱਚ ਮਦਦ ਕਰਦਾ ਹੈ।

dividend capture strategy reddit, dividend capture with options, dividend capture strategy pdf, dividend trading strategy, dividend capture strategy with options, dividend capture fund, dividend harvesting strategy, dividend stock investment strategy

“Printable Calendar is a website that provides high-quality and customizable calendars for individuals and businesses. Founded in 2022, the website offers many printable calendars to help people stay organized and manage their time effectively.

Our team of experienced professionals is passionate about creating calendars that are not only functional but also visually appealing. We understand the importance of time management in today’s fast-paced world and strive to make it easier for our customers to plan and schedule their daily activities.

At Printable Calendar, we believe in offering our customers the best possible experience. We constantly update our website with new designs and features to ensure our customers can access the latest and most innovative calendars. We also provide excellent customer support to ensure our customers can get their help whenever needed.

Whether you’re looking for a monthly, weekly, or yearly calendar, Printable Calendar covers you. Our calendars are available in various formats and sizes, making choosing the one that best suits your needs easy. So why wait? Visit Printable Calendar today and start organizing your life!”