Ex Dividends Calendar – The company pays dividends if its management wants to distribute its excess cash to shareholders instead of keeping it for other business purposes. Some good reasons to pay dividends to shareholders include retaining the interest of current investors and attracting new interest.

Paying dividends also provides the company’s investors with attractive income on their investment and can provide support for the company’s stock price. The ex-dividend date is set for shares one business day before the record date, according to the current T+2 settlement cycle, except in certain cases.

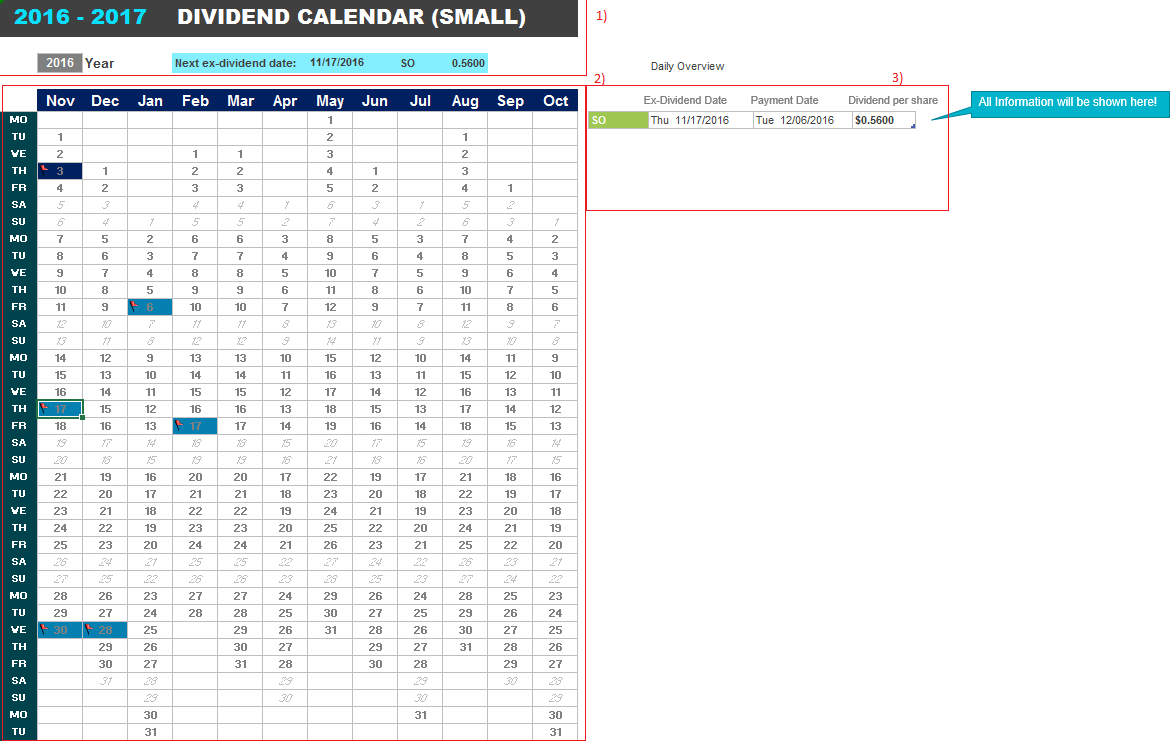

Ex Dividends Calendar

Source: static.seekingalpha.com

Source: static.seekingalpha.com

The Ex-Date Dividends Report discloses cases where the ex-date is not set one business day before the record date, such as when the date is floating or when the account is late attached. All dividend payment and date information on this website is provided for informational purposes only.

Dividend Calendar And Ex Dividend Dates

We cannot and do not guarantee the accuracy of dividend dates or payment amounts. dividend dates and payouts can always be changed. Always check with your broker first before buying any security. A profitable company’s cash assets must be distributed in a certain way if the company wants a balanced distribution of assets.

This can be done by reinvesting in the company’s business or through distribution to shareholders in the form of dividends. The ex-dividend date is used as the sole basis for determining who will receive future dividend distribution payments.

The requirement of the Capital Market Commission is that investors must be included in the list of shareholders of the company, which is prepared and completed from the date of registration of the company, in order to receive dividends.

Therefore, the board of directors of a company will choose the record date, which will determine the eligibility of the shareholders to receive dividend payments. The ex-dividend is then set for the day before the record date and announced to the shareholders.

Source: www.getquin.com

Source: www.getquin.com

Best Ex-Dividend Date Search Tool In

Additionally, a company may decide to use its excess cash to buy back its stock instead of paying dividends. This reduces the volatility of its shares, adds value to existing shares and increases earnings per share (EPS).

Traders and investors who borrow shares to open must pay dividends received to the owner of the shares who loaned the shares. Hence, the dividend amount is first received by the company and then deducted from the retailer’s account on the ex-dividend date to be paid to the holders of the borrowed shares.

Dividend history information for this company is not currently available. This may indicate that the company has never paid dividends or that dividends are pending. The dividend calendar provides a daily view of ex-dividend stocks and stocks that will provide compensation to help investors predict ownership requirements and income streams.

You can search for dividend information by specific stock symbol or search for all stocks with predicted or declared Ex-Dividend on a calendar date. A useful filter program allows you to filter stocks based on characteristics such as your personal watch list, Dividend type, guide note, Equity type and if there is an option, as well as the latest data to determine the predicted or announced cut-off date.

Premium subscribers can also download this information. Our proprietary Dividend Tracker ™ tool is ready for you to find ex-dividend calendar dates, dividend record dates and dividend payment dates for thousands of stocks on the NYSE®, NASDAQ®, AMEX® and OTCBB®.

You can search a 20-year calendar of dividend stock dates by selecting a specific date range, market cap, dividend yield and exchange of your choice. Unlike corporate bonds that require the issuing company to pay a contractual or default amount, dividend payments depend on decisions made by top management and the company’s board of directors, so they are not guaranteed.

Source: www.emerald.com

The cut-off date, also known as the cut-off date, is when the security’s trading price is reduced by the amount of future dividend distributions. Investors who purchase a security after the ex-dividend date are not entitled to receive current dividend distributions.

If there is an ex-dividend transaction, the seller of the security will receive the dividend payment. Certain financial information contained on Dividend.com is the property of Mergent, Inc. (“Mergent”) Copyright © 2014. Reproduction of such information in any form is prohibited.

Due to the possibility of human or mechanical errors by Mergent, Mergent or other sources, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results that can be obtained from the use of such information.

“What is the ex-dividend date?” is a question we see frequently here at Dividend.com. The ex-dividend date is the day on which all shares bought and sold are not related to the right to pay the newly declared dividend.

This is an important date for companies with many shareholders, including those traded on the stock exchange, as it makes it easier to agree who will be paid dividends. More details about Dividend Date The ex-dividend date is set relative to the record date.

The long-standing rule that the ex-dividend must be two days before the record date has been changed to align with the T + 2 settlement period of the new SEC policy that took effect on September 5, 2017. The new requirement is the ex date.

Source: cdn.benzinga.com

Source: cdn.benzinga.com

-the dividend date must be one business day before the record date. Companies that pay dividends typically use four dates to determine which investors will receive dividends, when investors must be in the company’s books, and when dividends will be received.

These dividend dates are as follows: Many companies refrain from paying dividends for various reasons. For example, if a company plans to buy another company to expand its operations, then collecting its earnings as retained cash may be more suitable for the company than paying dividends to shareholders.

Dividend is defined as the distribution of a portion of the company’s income to the shareholders of certain shares. When a company makes a profit, a portion of that profit can be set aside as retained earnings to reinvest in the company’s business and the rest is paid out to shareholders in the form of dividends.

Home · About Site · About Money · Groups · Content · Contact · Reviews The ex-dividend date is the day that determines whether the seller or buyer of the stock will receive the next dividend distribution.

Buying or selling early or late dividend stocks may cause investors to miss the ex-dividend date and the corresponding dividend distribution that shareholders will receive. The Dividend History page provides a single page to review all aggregate dividend payment information.

Visit our Dividend Calendar: Our partner Quotemedia provides upcoming ex-dividend dates for the next month (other OTC and OTCBB stocks are not included in our Dividend History coverage). Note that dividend history may also include the company’s preferred securities.

The price/earnings ratio is a widely used measure of stock valuation. For safety, the price/earnings ratio is given by dividing the Last Sale Price by the actual EPS (Earnings per Share). Nasdaq data is provided by Nasdaq Data Link, a leading source for financial, economic and alternative data sets.

Data Link’s cloud-based technology platform enables you to search, discover and access data and analytics for seamless integration through cloud APIs. Register for your free account today at data.nasdaq.com.

fidelity ex dividend date calendar, fidelity dividend calendar 2022, upcoming ex dividend stocks, ex dividend dates for stocks, ex dividend calendar fidelity, what is ex dividend date, stocks going ex dividend this week, fidelity investments dividend calendar