Green Dot Calendar 2021-2022 – Class A common stock, $0.001 par value; 100,000 shares authorized from December 31, 2022 and December 31, 2021; 51,674 and 54,868 shares issued and outstanding as of December 31, 2022 and December 31, 2021 respectively Not a gift card. Must be 18 or older to purchase. Online access, mobile number verification (via text message) and identity verification (including SSN) are required to open and use your account. Mobile number verification, email address verification and mobile app are required to access all features. Represents the tax effect for the related non-GAAP benchmark adjustments using Greenpoint’s year-to-date non-GAAP effective tax rate. It also excludes both the impact of excess tax benefits related to stock-based compensation and the IRC §162(m) limitation that applies to performance-based restricted stock units and stock option costs as of December 31, 2022. During the three and twelve months ended December 31, 2021, Green Dot recorded costs of $0.6 million and $4.5 million, respectively, related to severance benefits, which were paid in connection with the transition and employment agreements of certain former executives and other personnel. Although severance expenses are a normal part of its operations, the scale and magnitude of these costs are not indicative of its core operating performance. This expense is included as a component of compensation and benefits expense on Greenpoint’s consolidated statements of operations. The Corporate and Other segment consists primarily of net interest income, certain other investment income earned by Green Dot’s bank, interest profit sharing arrangements with certain BaaS partners (a reduction of income), eliminations of intersegment income and expenses, and unallocated corporate expenses, which include Green Dot’s fixed expenses such as salaries, wages and related benefits for its employees, professional service fees, software licenses, telephone and communication costs, rent, utilities and insurance that are not taken into account when calculating Green Dot’s CODM segment performance is not evaluated. Non-cash expenses such as stock-based compensation, depreciation and amortization of long-lived assets, impairment charges and other non-recurring expenses that are not considered by Green Dot’s CODM when evaluating overall consolidated financial results are excluded from unallocated corporate expenses. Greenpoint does not evaluate performance or allocate resources based on segment asset data, and therefore such information is not presented. Represents commissions and certain processing-related costs associated with Banking as a Service (“BaaS”) products and services where Groen Kol does not control customer acquisition. This adjustment is offset against Green Dot’s B2B services revenue when evaluating segment performance. Green Dot® Cards are issued by Green Dot Bank, member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. And by Mastercard International Inc. Mastercard and the circle design are registered trademarks of Mastercard International Incorporated. “I’m proud of the team and our 2022 achievements, which included strong profit growth, the signing of a major new BaaS channel partner and the completion of our first significant platform conversion,” said George Gresham, Chief Executive Officer of Green Dot. “As we brace for some near-term challenges and continue to focus on improving operational efficiencies, I am confident in our ability to navigate headwinds and remain very optimistic about our path forward and the opportunities that lie ahead.” Represents the weighted average of the unvested balance of restricted stock issued to Walmart in January 2020. Walmart is entitled to voting rights and participates in any dividends paid on the unvested balance and therefore the shares are included in the calculation of non-GAAP diluted earnings per share. Green Dot provided its financial outlook for 2023. Green Dot’s outlook is based on a number of assumptions that management believes to be reasonable at the time of this earnings release. In particular, its outlook reflects various considerations, including but not limited to, the expected impact of the previously announced loss of certain partnerships and programs, negative trends within certain channels of its business, the current macroeconomic environment including rising interest rates, the expected timing of expected cost savings from its platform conversion, and its investment in strategic initiatives. Information regarding potential risks that could cause actual results to differ from these forward-looking statements is set forth below and in Groenpunt’s filings with the Securities and Exchange Commission. To supplement Green Dot’s consolidated financial statements presented in accordance with GAAP, Green Dot uses measures of operating results adjusted to exclude various, primarily non-cash, expenses and charges. These financial measures are not calculated or presented in accordance with GAAP and should not be considered alternatives to or substitutes for operating income, operating income, net income or any other measure of financial performance calculated and presented in accordance with GAAP. These financial measures may not be comparable to similar measures from other organizations because other organizations may not calculate their measures in the same way as Green Dot. These financial measures are adjusted to eliminate the impact of items that Groenpunt does not consider indicative of its core operating performance. You are encouraged to evaluate these adjustments and the reasons why Groen Kol considers them appropriate. The Corporate and Other segment consists primarily of net interest income earned by its bank, eliminations of intersegment income and expenses, unallocated corporate expenses, and other costs that are not considered when management evaluates segment performance. such as salaries, wages and related benefits for our employees, professional service fees, software licenses, telephone and communication costs, rent and utilities, and insurance. Non-cash expenses such as stock-based compensation, depreciation and amortization of long-lived assets, impairment charges and other non-recurring expenses that are not considered by our CODM when evaluating our overall consolidated financial results are excluded from our unallocated corporate expenses. Greenpoint does not evaluate performance or allocate resources based on segment asset data, and therefore such information is not presented. The following table shows Green Dot’s quarterly key business statistics for each of the last eight calendar quarters on a consolidated basis and by each of its reportable segments. Please refer to Green Dot’s latest Quarterly Report on Form 10-Q for a description of the key business metrics, as well as additional information on how Green Dot organizes its business by segment. Green Dot has provided its financial outlook for 2022. Green Dot’s outlook is based on a number of assumptions that management believes to be reasonable at the time of this earnings release. Information regarding potential risks that could cause actual results to differ from these forward-looking statements is set forth below and in Groenpunt’s filings with the Securities and Exchange Commission. Green Point excludes certain income and expenses resulting from acquisitions. These acquisition-related adjustments include items such as transaction costs, the amortization of acquired intangible assets, changes in the fair value of contingent consideration, settlement of contingencies established at the time of acquisition and other acquisition-related costs, such as integration costs and professional and legal fees, which result in Greenpoint recording expenses or fair value adjustments in its GAAP financial statements. Green Dot analyzes the performance of its operations without considering these adjustments. In determining whether any acquisition-re

lated adjustment is appropriate, Green Dot considers, among other things, how such adjustments will or will not assist in understanding the performance of its operations. These items are included as a component of other general and administrative expenses on Green Dot’s consolidated statements of operations, as applicable for the periods presented. To supplement Green Dot’s consolidated financial statements presented in accordance with GAAP, Green Dot uses measures of operating results adjusted to exclude various, primarily non-cash, expenses and charges. These financial measures are not calculated or presented in accordance with GAAP and should not be considered alternatives to or substitutes for operating income, operating income, net income or any other measure of financial performance calculated and presented in accordance with GAAP. These financial measures may not be comparable to similar measures from other organizations because other organizations may not calculate their measures in the same way as Green Dot. These financial measures are adjusted to eliminate the impact of items that Groenpunt does not consider indicative of its core operating performance. You are encouraged to evaluate these adjustments and the reasons why Groen Kol considers them appropriate. All third party names and logos are trademarks of their respective owners. These owners are not affiliated with Green Dot Corporation and have not sponsored or endorsed Green Dot Bank products or services. Nor Green Dot Corporation, Visa U.S.A. nor any of their respective affiliates are responsible for the products or services provided by Ingo® Money and Plaid, Inc. Partner’s terms and conditions apply. “While much has been accomplished over the past two years at Green Dot, 2022 will be a pivotal year as we begin transitioning the company to a new technology environment that we believe will not only drive improved efficiencies and margins, but also lead to numerous strategic benefits that we expect to add to our top line and bottom line growth in the coming years,” said George Gresham, Chief Financial Officer and COO of Green Dot. Represents the weighted average of the unvested balance of restricted stock that issued to Walmart in January 2020. Walmart is entitled to vote and participate in any dividends paid on the unvested balance and therefore the shares are included in the calculation of non-GAAP diluted earnings per share Class A common stock, $0.001 par value; 100,000 shares authorized as of December 31, 2021 and December 31, 2020; 54,868 and 54,034 shares issued and outstanding as of December 31, 2021 and December 31, 2021 respectively ember 2020 Green Dot’s management will host a conference call today at 5:00 p.m. to discuss the fourth quarter 2022 financial results. E.T. The conference call can be accessed live from Green Dot’s investor relations website at http://ir.greendot.com/. Green Dot uses this website as a tool to disclose important information about the company to investors and comply with its disclosure obligations under Regulation Fair Disclosure. A replay of the webcast will be available on the same website following the call. The replay will be available until Thursday, March 2, 2023. Green Dot offers a broad set of financial services to consumers and businesses, including debit, check, credit, prepaid and payroll cards, as well as robust money processing services, tax refunds, cash deposits and payouts . Its flagship digital banking platform GO2bank offers consumers simple and accessible mobile banking services designed to help improve financial health over time. The company’s banking platform services business enables a growing list of the world’s largest and most trusted consumer and technology brands to deploy customized, seamless, value-driven money management solutions for their customers. Green Dot offers a broad set of financial services to consumers and businesses, including debit, check, credit, prepaid and payroll cards, as well as robust money processing services, tax refunds, cash deposits and payouts. Its flagship digital banking platform GO2bank offers consumers simple and accessible mobile banking services designed to help improve financial health over time. The company’s banking platform services business enables a growing list of the world’s largest and most trusted consumer and technology brands to deploy customized, seamless, value-driven money management solutions for their customers. “2021 delivered growth as we invested in key areas, including people, processes and technology – moves that will transform Green Dot to be a more efficient and scalable business, and deliver significant benefits to our customers, partners and shareholders in the years to come will unlock,” said Dan Henry, CEO of Green Dot. “I’ve never been more excited about our growth prospects and path forward as we make progress on our mission to empower all people to bank seamlessly, affordably and with confidence.” The following table shows Green Dot’s quarterly key business statistics for each of the last eight calendar quarters on a consolidated basis and by each of its reportable segments. Please refer to Green Dot’s latest Quarterly Report on Form 10-Q for a description of the key business metrics, as well as additional information on how Green Dot organizes its business by segment. For additional information, see reconciliations of forward-looking guidance for these non-GAAP financial measures to their respective, most directly comparable projected GAAP financial measures provided in the tables immediately following the reconciliation of Net Income to Adjusted EBITDA. Green Dot Corporation (NYSE: GDOT) is a financial technology and registered bank holding company committed to empowering all people to bank seamlessly, affordably and with confidence. Green Dot’s technology platform enables it to build products and features that address the most pressing financial challenges of consumers and businesses, change the way they manage and move money, and make financial empowerment more accessible to all. Founded in 1999, Green Dot has served more than 33 million customers directly and many millions more through its partners. The Green Dot Network of more than 90,000 retail distribution locations nationwide, more than all remaining bank branches in the US combined, enables it to operate primarily as a “branchless bank.” Green Dot Bank is a subsidiary of Green Dot Corporation and member of the FDIC. For more information about Green Dot’s products and services, please visit www.greendot.com. These amounts represent estimated adjustments for items such as non-operating net interest income, income taxes, depreciation and amortization, employee stock-based compensation and related employer taxes, transaction costs, impairment charges, severance costs related to extraordinary staff reductions, earnings and losses from equity method investments, realized gains and losses from investment securities, legal settlement profits and expenses and other income and expenses. Employee share-based compensation expense includes assumptions about the future fair value of the Company’s Class A common stock (which is affected by external factors such as the volatility of public markets and the financial performance of the Company’s peers). Green Dot’s management will host a conference call today at 5:00 p.m. to discuss the fourth quarter 2021 financial results. E.T. The conference call can be accessed live from Green Dot’s investor relations website at http://ir.greendot.com/. Green Dot uses this website as a tool to disclose important information about the company to investors and comply with its disclosure obligations under Regulation Fair Disclosure. A replay of the webcast will be available on the same website following the call. The replay will be available through Thursday, March 3, 2022. Represents the tax effect for the related non-GAAP benchmark adjustments using Greenpoint’s year-to-date non-GAAP effective tax rate. It also excludes both the impact of excess tax benefits related to stock-based compensation and the IRC §162(m) limitation that applies to performance-based res

tricted stock units and stock option costs beginning December 31, 2021. Green Dot excludes certain income and expenses resulting from acquisitions. These acquisition-related adjustments include items such as transaction costs, the amortization of acquired intangible assets, changes in the fair value of contingent consideration, settlement of contingencies established at the time of acquisition and other acquisition-related costs, such as integration costs and professional and legal fees, which result in Greenpoint recording expenses or fair value adjustments in its GAAP financial statements. Green Dot analyzes the performance of its operations without considering these adjustments. In determining whether any acquisition-related adjustment is appropriate, Green Dot considers, among other things, how such adjustments will or will not assist in understanding the performance of its operations. These items are included as a component of other general and administrative expenses on Green Dot’s consolidated statements of operations, as applicable for the periods presented. Founded in 1999, Green Dot has served more than 33 million customers directly and many millions more through its partners. The Green Dot Network of more than 90,000 retail distribution locations nationwide, more than all remaining bank branches in the US combined, enables it to operate primarily as a “branchless bank.” Green Dot Bank is a subsidiary of Green Dot Corporation and member of the FDIC. For more information about Green Dot’s products and services, please visit www.greendot.com. Reconciliations of total operating income to non-GAAP total operating income, net income to adjusted EBITDA, net income to non-GAAP net income, and diluted earnings per share to non-GAAP diluted earnings per share, respectively, are provided in the tables immediately following of the unaudited consolidated financial statements. Additional information about the Company’s non-GAAP financial measures can be found under the heading “About Non-GAAP Financial Measures” below. Represents other non-interest investment income earned by Green Dot Bank. This amount is included with operating interest income in Green Dot’s Corporate and Other segment as the return earned on these investments is generated on a recurring basis and is earned similarly to its available-for-sale investment securities.

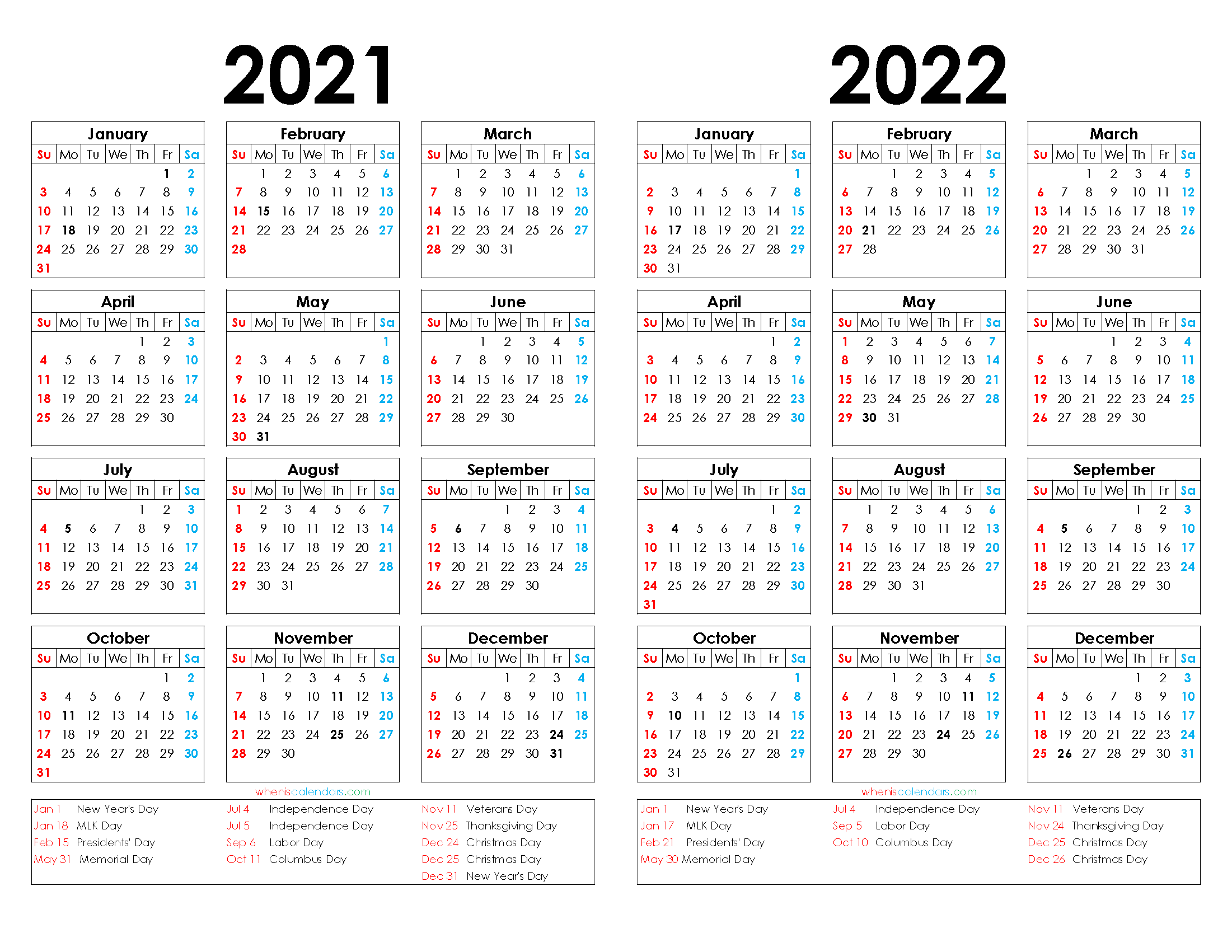

Green Dot Calendar 2021-2022

Source: www.wheniscalendars.com

Source: www.wheniscalendars.com

2021 and 2022 calendar printable, calendar 11 2022, calendar 2021 2022 calendar template, calendar dates 2022, dot week 2022 dates, need calendar for 2022