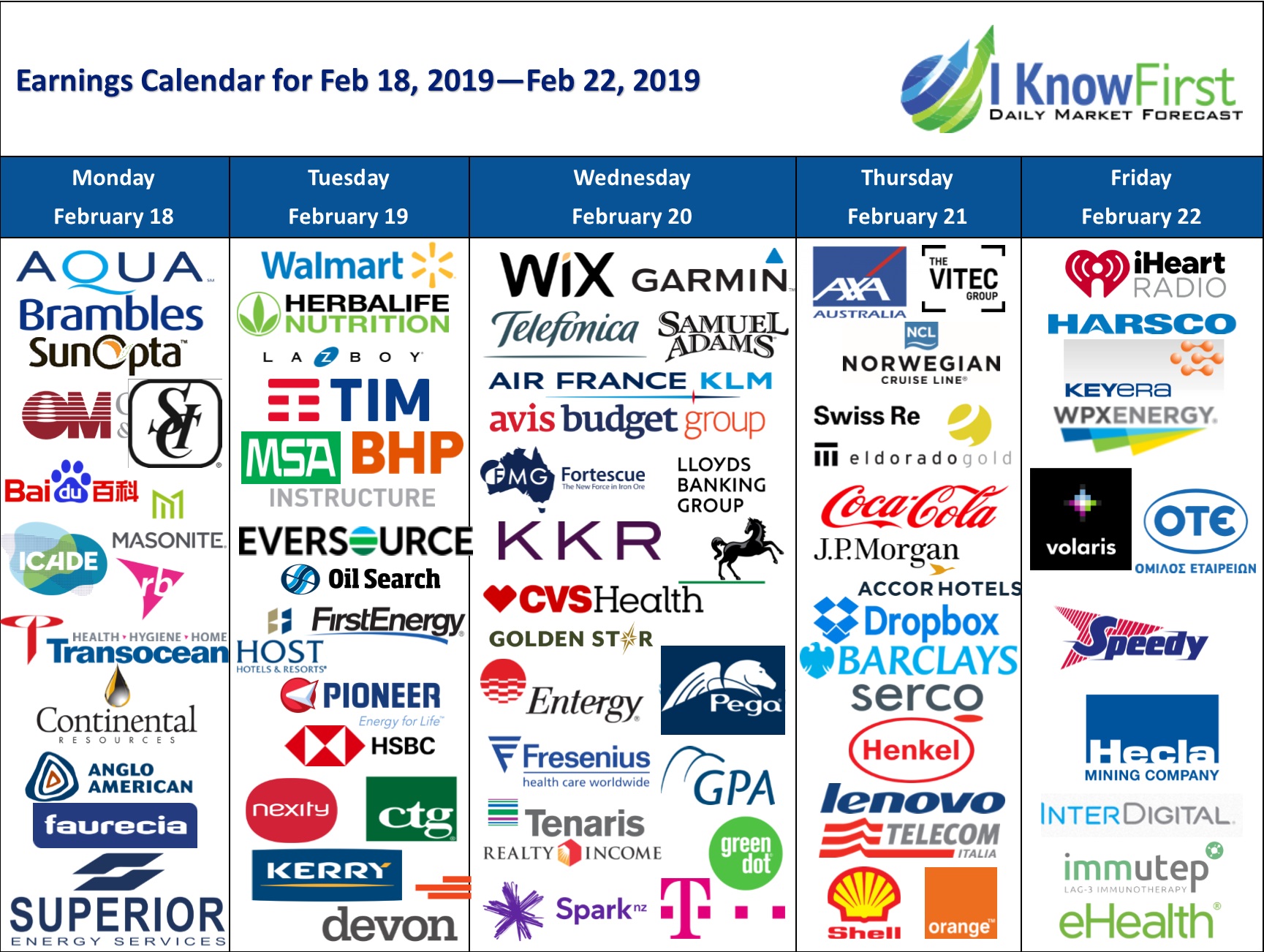

Sp500 Earnings Calendar – Overall, 29% of companies in the S&P 500 have reported actual Q4 2022 results to date. Of these companies, 69% reported actual EPS above estimates, which is above the percentage of 67% at the end of last week, but below the 5-year average of 77% and below the 10-year average of 73%.

Collectively, companies reported earnings that were 1.5% above estimates, which was below the 3.3% rate at the end of last week, below the 5-year average of 8.6% and below the 10-year average of 6.4 %. If 1.5% is the true percentage surprise for the quarter, it would mark the second-lowest percentage surprise reported by the index since Q3 2012, trailing only Q1 2020 (1.1%).

Sp500 Earnings Calendar

Source: upload.wikimedia.org

Source: upload.wikimedia.org

This list includes investment products traded on certain exchanges that are currently linked to this selection of indices. Although we have attempted to include all such products, we do not guarantee the completeness or accuracy of such listings.

The Earnings Reports Role In Fundamental Analysis

Please see the disclaimers here for more information about S&P Dow Jones Indices’ relationship with such third-party product offerings. The second component of the earnings report (sometimes called “other information”) goes over some of the potential problems the company may be facing.

This can be difficult to read as it has undoubtedly been vetted by the company’s legal team so the wording is very precise. The important thing to consider when looking at this information is the risks the company faces, either from lawsuits or from general market conditions.

Are the risks specific to this company or are other companies in the sector experiencing the same problems? If so, is this company in a better or worse position to manage that risk? The S&P 500 Earnings is currently at 187.23, down from 188.91 last month and higher than 175.43 a year ago.

This is a change of -0.89% from last month and 6.73% from a year ago. It’s also important to understand that an earnings report is not the same as a company’s 10-Q document. Form 10-Q is a “just the facts” document required by the SEC and contains detailed financial information that a company must provide.

The Bottom Line On Earnings Reports

Because the 10-Q is also a public document, companies will only provide abbreviated information from the 10-Q in their earnings report. In terms of earnings, 60% of S&P 500 companies reported actual earnings above estimates, which is below the 5-year average of 69% and below the 10-year average of 63%.

Collectively, companies reported earnings that were 1.0% above estimates, below the 5-year average of 1.9% and below the 10-year average of 1.3%. We have become a society obsessed with numbers and analytics. Interestingly, however, investors will spend a lot of time looking at statistics, picking a tight end for their football team, but few minutes looking at a company’s earnings report.

Looking ahead, analysts expect earnings to decline for the first half of 2023, but earnings to grow for the second half of 2023. For Q1 2023 and Q2 2023, analysts forecast earnings declines of -3.0% and -2.4%, respectively.

For Q3 2023 and Q4 2023, analysts forecast earnings growth of 3.7% and 10.3%, respectively. For the full year CY 2023, analysts forecast earnings growth of 3.4%. But it’s still a document with a lot of numbers and legal content that requires translation, and that’s why we created this article.

We’ll take a look at what an earnings report is and how investors can mine for gold and get the information they want. We’ll also look at why earnings reports are important, why you can rely on them for accurate data, and quantitative metrics that can help with your fundamental analysis.

Source: embed-ssl.wistia.com

Source: embed-ssl.wistia.com

As a result, the index today reports lower earnings for the fourth quarter compared to the end of last week and compared to the end of the quarter. The combined (combining actual results for companies that have reported and estimated results for companies that have yet to report) fourth quarter earnings decline is -5.0% today, compared to a -4.9% earnings decline last week and

the drop in earnings of -3.2% at the end of the fourth quarter (December 31). No company is going to lie in its earnings reports (well, very few anyway). That’s because the information in the earnings report must match the company’s Form 10-Q, which is a legal document the company must file with the Securities and Exchange Commission.

So every number in the earnings report must match what’s in the 10-Q. The earnings report, however, gives companies an opportunity to comment on the numbers. In the case of numbers that were below the company’s forecasts, they will offer an explanation for the miss that they hope will mitigate the shortfall.

If 3.9% is the true growth rate for the quarter, it would mark the lowest revenue growth rate reported by the index since Q4 2020 (3.2%). Eight sectors recorded year-on-year revenue growth, led by the energy and industrial sectors.

Three sectors report year-on-year declines in revenue, led by the utilities sector. Mr. John Butters is Vice President and Senior Earnings Analyst at FactSet. His weekly research report, Earnings Insight, provides analysis and commentary on trends in corporate earnings data for the S&P 500, including estimate revisions, year-over-year growth, performance against expectations and valuations.

He is a widely used media source and has appeared on CNBC, Fox Business News and the Business News Network. In addition, he has been quoted by numerous print and online publications such as The Wall Street Journal, The Financial Times, The New York Times, MarketWatch and Yahoo!

Finances. Mr. Butters has over 15 years of experience in the financial services industry. Prior to FactSet in January 2011, he worked for more than 10 years at Thomson Reuters (Thomson Financial), most recently as Director of USEarnings Research (2007-2010).

That’s why the earnings report is so valuable to investors. Although the information contained therein may not be bedtime reading, an inves

tor can rely on the earnings report for accurate, no-nonsense information that can help them make wise investment choices.

© 2023 Market data is at least 10 minutes late and is hosted by Barchart Solutions. The information is provided “as is” and for informational purposes only, not for commercial purposes or advice and is deferred.

To view all exchange delays and terms of use, please see Barchart’s disclaimer. If -5.0% is the true decline for the quarter, it would mark the first time the index has reported a year-over-year earnings decline since Q3 2020 (-5.7%).

Four of the 11 sectors saw year-over-year earnings growth, led by the energy and industrials sectors. On the other hand, seven sectors report a decline in earnings compared to the previous year, led by the Materials, Consumer Discretionary, Communication Services and Financials sectors.

Source: calendarinspirationdesign.com

Source: calendarinspirationdesign.com

In some cases, the company may try to project much better earnings than analysts think is justified. In this case, you may see a situation where the company misses its estimates, but still comes in higher than what analysts expected.

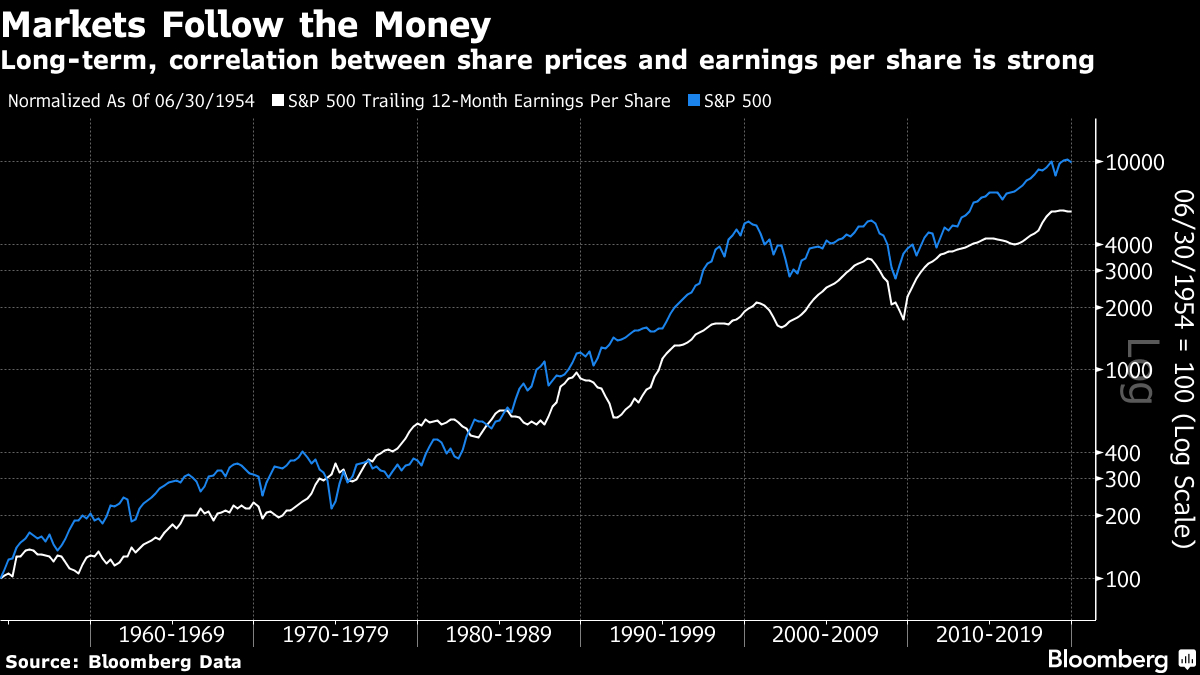

The basic truth about earnings reports is that they move the markets. Analysts have expectations and when those expectations are met, stocks generally rise. However, when these are not met, stocks generally fall. As an individual investor, it is your responsibility to decide whether the price movement is justified.

One reason for this is that the income statement is an intimidating document, and unless you’re a financial professional, it’s likely to be a little boring. That is unless you know what to look for. Because as an analytical society, an earnings report is about as clean as it gets.

An earnings report contains valuable information that can go a long way in helping an investor decide whether or not to invest or continue investing in a company. And what should be most important to investors is that the data in the earnings report is required by SEC regulations to be accurate.

Simply put, earnings reports move the market. During “earnings season” analysts and institutional investors rely on the information contained in the earnings report to make projections for the next quarter or year. Analysts form their own valuations independent of the company’s valuations and a change in analyst sentiment can have a large impact on stock prices.

All rights reserved. Financial market data powered by Quotemedia.com. All rights reserved. See the Terms of Use. NYSE/NYSE MKT (AMEX) data delayed 20 minutes. NASDAQ and other data are delayed 15 minutes unless otherwise noted. Copyright © 2023. All market data provided by Quotemedia.com.

Future: at least 10 minutes late. The information is provided “as is” and for informational purposes only and not for commercial purposes or advice. To see all exchange delays and terms of use, please see the disclaimer.

Real-time cryptocurrency market data provided by Cryptocompare.com S&P 500 Earnings is currently at 187.23, down from 188.91 last month and higher than 175.43 a year ago. This is a change of -0.89% from last month and 6.73% from a year ago.

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investment and assumes no responsibility for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

Although the earnings reports do not have to be identical, they follow a general structure. The first part of the report contains the company’s financial information in a condensed format. As mentioned above, this will not give investors all the information found in the 10-Q document, but it will provide them with enough information to get a sense of the company’s performance.

After presenting the raw data, there will usually be a section where the company provides commentary on the data. Some questions you may want to consider are the following: The average 12-month P/E ratio is 17.8, which is below the 5-year average (18.5) but above the 10-year average (17.2).

Source: iknowfirst.com

Source: iknowfirst.com

It’s also above the forward P/E ratio of 16.7 seen at the end of the fourth quarter (Dec. 31), as the price index rose while the 12-month EPS estimate declined as of Dec. 31. When you buy stock in a company, you are buying a part of that company.

Fundamental analysis looks at both quantitative and qualitative factors in determining whether or not a company belongs in your portfolio. An earnings report typically won’t deliver the qualitative factors, but because it’s so data-intensive, it can go a long way in helping you understand important quantitative metrics, including: Use the earnings calendar to get the latest earnings news and results from

the earnings reports. Including the latest live earnings blogs and earnings analysis posts. Bookmark the Markets Insider earnings calendar to keep up with the latest earnings reports for the companies you care about. Negative earnings surprises reported by companies in the financials and industrials sectors were largely offset by positive earnings surprises reported by companies across multiple sectors, resulting in a slight increase in earnings declines for the index over the past week.

Negative earnings surprises and downward revisions to earnings estimates for companies in the financial sector were the biggest contributors to the increase in overall earnings declines for the index as of December 31. As we have become more sophisticated consumers, we are less impressed by marketing “spin” and instead look for data to answer questions.

If it can be measured, we try to measure it. The downside is that, in many cases, data has become its own marketing tool and there are so many numbers, that we become overwhelmed with data without a clear understanding of what the data is really telling us.

Earnings announcements are a public statement about a company’s profitability for a specific period of time, such as a quarter (90 days) or a year. Equity research analysts will issue estimates of a company’s earnings numbers ahead of the release date, which

is usually set weeks or months in advance.

If a company reports better results than analysts predict, its stock price will generally rise after the announcement. Below you will find a list of public companies that are announcing their earnings results today. Learn more about earnings reports.

If you use our datasets on your site or blog, we ask that you provide attribution by linking back to this page. We’ve provided some examples below that you can copy and paste onto your site: When earnings reports are released, analysts look to see not only if a company beat their own estimates, but if it beat analysts’ expectations as well.

Most companies under-promise and over-promise their approach to future revenue, but not all. The S&P 500 is widely regarded as the best single gauge of large-cap stocks in the US. Over $9.9 trillion is indexed or benchmarked to the index, with indexed assets accounting for approximately $3.4 trillion of this total.

The index includes 500 leading companies and covers approximately 80% of the available market capitalization. Positive earnings surprises reported by companies from multiple sectors (led by the energy sector) were the biggest contributors to the slight increase in the index’s earnings growth rate over the past week.

As of December 31, positive and negative earnings surprises in multiple sectors have offset each other, resulting in no change in the overall growth rate. Earnings reports are a subset of a company’s 10-Q filing and contain items such as net income, earnings per share (EPS), earnings from continuing operations, and net income/sales.

You’ll usually hear things about how the company performed relative to analyst expectations for top and bottom numbers. These numbers can be found directly in the earnings report.

s p 500 earnings calendar, earnings reports this week, s&p 500 companies earnings calendar, zacks earnings calendar, s&p 500 earnings schedule, s&p 500 earnings calendar 2022, sp500 earnings 2022, earnings calendar nasdaq