Fidelity Earnings Calendar – Fidelity National’s acquisition of Perex is likely to support the benefits of its banking solutions unit. The Zacks Consensus Estimate for the unit’s third-quarter adjusted EBITDA suggests a 3.2% increase from the prior quarter’s reported number.

Furthermore, consensus estimates for the segment indicate a 3.7% year-over-year increase. Before considering how you might trade a stock around an earnings announcement, you need to determine which direction you think the stock might go. This is basically a review of part 2.

Fidelity Earnings Calendar

%20(2).png) Source: arizent.brightspotcdn.com

Source: arizent.brightspotcdn.com

You should develop insight into the informational content of the ad, as well as how that information compares to market consensus. Over the past four quarters, MQ has beaten revenue estimates twice, hitting it once and missing it the other time, with an average surprise of 13.8%.

Finding Opportunities

Information about when companies will report their earnings is readily available to the public. More in-depth research is needed to develop an idea of how these gains will be perceived by the market. You can find more information, including analyst opinions, on Fidelity.com by searching for a specific stock.

The Commerce 360 product will provide customers with an easy-to-use portal, allowing them to better manage their websites, inventory and marketing. It also has the potential to simplify the payment process for small businesses, which may attract more customers.

The new solution is expected to help customers in their online and in-store efforts. Volatility is an important concept to understand when trading options. The chart below shows the implied volatility (IV) versus the 30-day historical volatility (HV) leading up to the earnings announcement for a given stock.

Historical volatility is the actual volatility experienced by a security. Implied volatility can be viewed as the market’s expectation of future volatility. Income periods for July, October and January are shaded. Because of the potential for relatively large valuations, investor returns can be greatly affected by how a company’s earnings report is received by the market.

Earnings Whispers

1 It is not unusual for stock prices to rise or fall significantly immediately after an earnings report. The potential for a stock to move broadly in a particular direction in response to an earnings report can create active trading opportunities.

Note that there was an approximately 14% historical increase in IV during the period of entry of the result and, when the result was released, the IV returned to approximately the 30-day HV. The purpose is to show that volatility can have a huge impact on the price of trading options and ultimately on your profit or loss.

Fidelity National Financial last released its quarterly earnings data on February 22, 2023. The financial services provider reported $1.06 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.28 by $0.22. The company earned $2.55 billion during the quarter, compared to analyst expectations of $2.98 billion.

Its revenue for the quarter was down 46.8% compared to the same quarter last year. Fidelity National Financial generated $4.07 earnings per share ($4.07 diluted earnings per share) last year and currently has a price/earnings ratio of 9.4.

Source: d12pmmbqk6r2v2.cloudfront.net

Source: d12pmmbqk6r2v2.cloudfront.net

Stocks To Consider

Fidelity National Financial’s earnings are expected to grow 27.53% next year, from $4.94 to $6.30 per share. Fidelity National Financial has not officially confirmed its next earnings release date, but the company’s expected earnings date is Tuesday, May 9, 2023, based on the previous year’s reporting date.

The Zacks Consensus Estimate for TTEC Holdings’ earnings for the reporting quarter is set at 61 cents a share. TTEC has beaten earnings estimates in each of the last four quarters, with an average surprise of 10.5%.

In the most recently reported quarter, the financial solutions provider’s adjusted earnings per share of $1.73 beat the Zacks’ consensus estimate by 1.8% due to strong performance across all segments. Winning major customers and growing sales were some of the main strengths of the quarter despite an uncertain macro environment.

Providing such customized products is likely to provide Fidelity National and GoDaddy with a competitive advantage over their respective peers. This could hurt FIS’s shrinking customer base and GoDaddy’s footprint in the strong domestic market. The Zacks Consensus Estimate for Shift4’s earnings results for the next quarter indicates a 61.5% year-over-year increase.

Actively Monitor

Four has beaten earnings estimates twice in the past four quarters, meeting it once and missing it once, with an average surprise of 4.2%. Of course, traders can be at considerable risk if they are wrong about their expectations.

The risk of a larger-than-normal loss is significant because of the potential for large price changes following earnings announcements. We use cookies to understand how you use our website and to improve your experience. This includes content personalization and advertising.

To learn more, click here. By continuing to use our website, you accept our use of cookies, privacy policy and terms of service. The Zacks Portfolio Tracker on Zacks.com provides 24/7 monitoring of your stocks and will give you the information you need to help you decide when to buy, hold or sell your stocks.

You’ll constantly receive Zacks Style and Ratings Scores, revised earnings estimates, broker recommendation changes, earnings surprises and more. Note that you should also add your mutual fund and ETF positions to monitor changes in your Zack Rank.

Advanced Options Strategies

Fidelity National relies on mergers and acquisitions to grow its portfolio on an unregulated basis. Its acquisitions such as Pyrex, World Pay and others expand the scope of e-commerce offerings to companies of all sizes in every industry.

The latest partnership with GDDY is another of those feathers in his cap. A company’s earnings report is an important time of year for investors. Expectations can change or be confirmed, and the market can react in different ways.

Source: preview.redd.it

Source: preview.redd.it

If you want to trade earnings, do your research and understand what tools are at your disposal. Last quarter, Fidelity National Financial (NYSE:FNF) missed analyst consensus estimates of $1.28 by $0.22, with reported earnings per share (EPS) of $1.06.

Find out more about FNF’s actual earnings compared to analyst earnings estimates. With that said, if you want to open a position for an income ad trade, one of the simplest ways is to buy or sell a stock short.

Factors To Note

If you believe that a company will show strong earnings and you expect the stock to rise after the announcement, you can buy the stock in advance. On the other hand, if you believe that a company will post disappointing earnings and you expect the stock to decline after the announcement, you can sell the stock short.

It is very important to understand that short selling carries significant risk. Only experienced investors who fully understand the risks should consider short selling. Our robust model does not predict earnings growth for Fidelity National this time around.

A combination of positive earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Buy) increases the chances of winning. This is not the case here, as you will see below. Some of the top-ranked stocks in the business services sector are Marketa, Inc.

MQ and Visa Inc. V, each currently has a Zacks Rank #2 (Buy). You can see the full list of Zacks #1 Rank (Strong Buy) stocks for today here. You are directed to ZacksTrade, a division of LBMZ Securities and a licensed broker.

Trend In Estimate Revision

ZacksTrade and Zacks.com are separate companies. A web link between two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or endorse any particular investment strategy, analyst opinion/rating/report or approach to valuing individual securities.

In the third quarter, cross-border travel is likely to witness a sharp increase. This is expected to generate demand for FIS’ e-commerce payment gateway and new payment platform. As such, consensus estimates for Adjusted EBITDA at Merchant Solutions point to a 4.5% year-over-year increase.

It is estimated that the company is positioned for revenue growth during the year. The consensus estimate for segment revenue is 4.1% higher year-over-year. The move is expected to combine GoDaddy’s easy-to-use business tools with Fidelity National’s strong global payments experience to offer e-commerce products to small and medium-sized businesses (SMBs).

This will allow customers to use the latest technologies while maintaining their existing banking relationships. While the earnings signal looks uncertain for Fidelity National, here are some companies in the broader business services space you might want to consider, as our model shows they have the right elements to post earnings around this time.

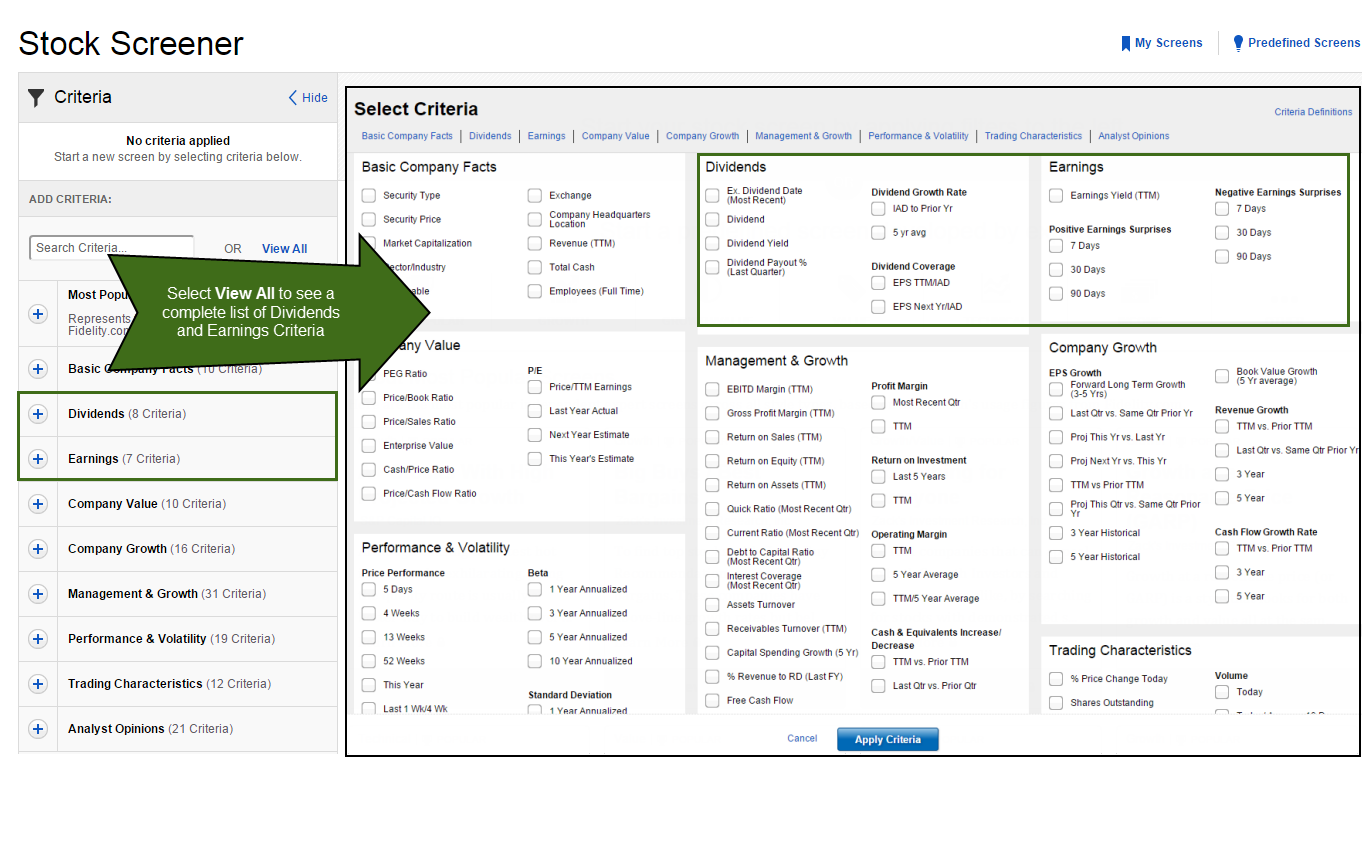

Source: www.fidelity.com

Source: www.fidelity.com

Compounding: In addition, the impact of earnings on stocks is not limited to the issuing company. In fact, the earnings of similar or related companies often have an indirect effect. For example, if you own stocks in the materials sector, the earnings report for Alcoa () is of particular importance because it is one of the largest companies in that sector, and Alcoa’s impact trends affect the same business.

. As a result of any new information that may appear in the earnings report, sector rotation and other business strategies need to be reevaluated. Additionally, Alcoa’s earnings are of particular importance because their debut marks the unofficial start of earnings season.

© 2023 Market data provided is at least 10 minutes late and hosted by Barchart Solutions. THE INFORMATION IS PROVIDED ‘AS IS’ AND FOR INFORMATIONAL PURPOSES ONLY, NOT FOR TRADING OR ADVISORY PURPOSES, AND IS PROVIDED AS IS.

For complete exchange delays and terms of use, please see Barchart’s announcement. Want the latest recommendations from Zacks Investment Research? Today, you can download the top 7 stocks for the next 30 days. Click for this free report Fidelity National Information Services, Inc.

(FIS): Free TeleTech Holdings, Inc. (TTEC): Free Corruption Blockchain, Inc. (RIOT): Free Shift4 Payments, Inc. (FOUR): To read this article on Zacks.com’s free inventory analysis report, click here. Zacks Investment Research If you’re considering trading around an earnings announcement, or you have an open position in a company’s stock that’s about to report earnings, you should stay ahead of time on related company news.

Actively monitor (and follow) postings, in addition to reporting results. An earnings announcement and market reaction can reveal a lot about a company’s underlying fundamentals, with the potential to change expectations about how the stock will perform.

This page is not authorized, sponsored or otherwise approved or endorsed by the companies represented here. Any company logos shown herein are trademarks of Microsoft Corporation; Dow Jones & Company; Nasdaq, Inc.; Forbes Media, LLC; Investors Business Daily, Inc.

and Morningstar, Inc. However, the consensus benchmark for Adjusted EBITDA for the Capital Markets Solutions unit indicated a 2.2% year-over-year decline. In addition, platform and application updates are expected to increase the company’s spending in the quarter ending in September.

National Fidelity Information Services, Inc. FIS recently announced that its Global Payments and GoDaddy Inc. GDDY has teamed up to launch a multi-channel solution called Commerce 360. An omni-commerce solution is expected to allow small businesses to easily reach customers and provide a better experience.

Earnings season, which usually lasts a few weeks each quarter, is when most public companies release earnings reports. There aren’t many other things that affect a stock like when a company reports earnings. A trader can use options to hedge or reduce existing po

sitions before the earnings announcement.

For example, if a trader has a long position in a stock (ie, you own the stock) and expects the stock to become volatile immediately after the next earnings announcement, the trader can Take an option to close.

Expected volatility is because if the value of the stock falls, the put option will likely rise in value.

us earnings calendar 2022 fidelity, fidelity earnings report, fidelity earning calendar 2022, fnf earnings, cnbc earnings calendar, earnings whispers earnings calendar, fidelity earning calendar september 2020, earnings calendar q2 2022