2023 Nfc Pay Period Calendar – The optional 2023 TSP deferral limit increased to $22,500. The combined total after-tax deferred traditional and Roth contributions cannot exceed the elective deferral limit in any year. Allowed biweekly benefit amounts or percentages will automatically carry over from 2022 to 2023 unless changed or canceled by the employee.

Employees who reach the maximum IRS contribution limit before the end of the year will not be eligible for additional employee contributions and may lose all government contributions until the end of the year. Deduction changes for PP 2023-01 can be made now through Employee Express by entering “12/18/2022” in the Future Effective Date field.

2023 Nfc Pay Period Calendar

Source: link.usps.com

Source: link.usps.com

Employee Express allows effective date changes up to 90 days in advance. Employees can change their deductions at any time in Employee Express. Some localities require that employee benefits tax be collected from employees in their jurisdiction.

Thrift Savings Plan Tsp – Traditional And Roth Contributions

Employee income tax is collected when they work in a certain district. While some localities withhold tax in the first full payment period of the year, the actual deduction will depend on local withholding requirements. NFC consumers should not rely on their financial institution to send a “polite notice” on Saturday with pay information for direct deposits.

The actual final payment for direct deposit transactions is the first business day after the payroll processing weekend. Financial institutions are not required by law to account for funds before the payment date. (Source) Dental and vision coverage approved in 2022 automatically continues into 2023, although some premiums may change for 2023. For more information, to view new rates or seasonal changes, employees can visit www.benefeds.com.

The Social Security base for OASDI for 2023 increased to $160,200. There is no wage base limit for Medicare tax. For 2023, the Social Security rate remains at 6.2% and the Medicare tax remains at 1.45% for all wages.

In addition, any earnings above $200,000 are subject to an additional 0.9% Medicare tax. The above tax rates do not include this additional 0.9%. For more information about this tax, see Social Security Changes for 2023 – COLA Fact Sheet.

Occupational Privilege Tax

Daily locations with district definitions include “all locations within or entirely surrounded by the corporate limits of a key city, as well as the boundaries of said districts, including independent entities located within the boundaries of a key city and said districts.”

(unless otherwise stated).” Official websites use .gov .gov websites belong to an official government organization in the United States. Secure .gov pages use HTTPS Lock (LockA lock) or https:// means that you are securely connected to the .gov page.

Only share sensitive information on official, secure websites. Annual leave year 2023 is from PP 2023-02, January 1, 2023, to PP 2024-02, January 13, 2024 (27 pay periods). Employees in the six-hour leave category will receive their four additional hours for 2023 in PP 2024-01, the last full pay period of the calendar year.

Form 1095-C, Offer and Coverage of Employer-Provided Health Insurance will be available to view and print in Employee Express until January 13, 2023. To ensure the protection of personally identifiable information (PII), select an electronic 1095-C in EEX before 23

Dental And Vision Benefits

.December 2022. In addition, a paper Form 1095-C will be mailed no later than March 2, 2023 to all employees who have not elected to opt out of the paper form. The printed Form 1095-Cs will be sent to the employee’s official address.

Source: rancholasvoces.com

Source: rancholasvoces.com

More information can be found on the IRS website at https://www.irs.gov/forms-pubs/about-form-1095-c. FEHB coverage allowed in 2022 automatically continues into 2023, although some premiums may change for 2023. Coverage under the new health plan will take effect on the first day of a payment period beginning on or after January 1, 2023;

for IBC and its clients it will be January 1, 2023, payment period 2023-02. Enrollees will remain insured and receive benefits in 2022 from the previously elected plan until coverage under the new plan becomes effective.

Because these awards are remitted to the local community on behalf of the employee, the amount of “estimated” tax credits withheld through the voluntary tax award will be shown on Form W-2, Box 14, Item 8 – Estimated Local Tax.

Social Security Oasdi Tax

These amounts are estimates only. Reconciliation occurs when the employee submits the appropriate tax return to the location. As a reminder, for 2023 the annual premium limits defined in 5 U.S.C. Designation 5547(b). For FLSA-exempt employees, if the regular pay for the year plus Title 5 overtime, night differential, on-call pay, on-call pay, administratively uncontrolled overtime, Sunday bonus, or holidays worked reaches the limits, no additional bonus may be paid.

Unpaid overtime cannot be replaced by compensatory time. The annual salary limitation is more than the GS-15 annual rate, step 10 for each location or level V executive plan. The 2022 taxable profit year is from PP 2022-01, beginning December 19, 2021, through PP 2022-26, which

ends December 17, 2022. The 2023 taxable profit year is from PP 2023-01, December 18, 2023 to PP 2022, -26 , December 16, 2023. Up to $7,500.00 in compensation contributions can be made annually in 2023.

Once the optional TSP deferral of $22,500 is reached, any additional contributions are “rolled over” to the additional $7,500 reimbursement limit. There will be no need to enter EEX through elections as in previous years. However, rollover contributions should be included in regular traditional and/or Roth contributions when electing to EEX.

Form -C

See the “Thrift Savings Plan (TSP) – Traditional and Roth Contributions” section above regarding state contributions and when

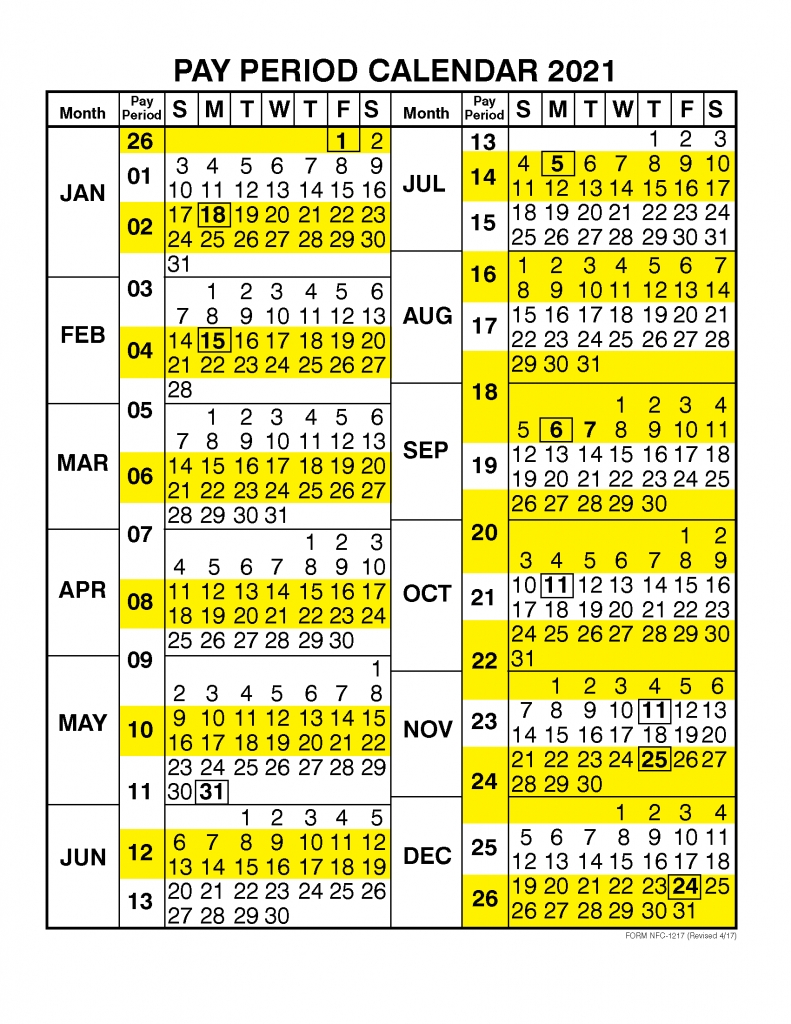

updates should be made to Employee Express. 2023 NFC Payroll Calendar – The National Finance Center (NFC) manages biweekly payroll transactions for the federal government for approximately 650,000 employees.

On rare occasions, the biweekly payroll schedule will change to meet client needs and ensure employees are paid during payroll weeks with little payroll processing. Starting January 1, 2021, the Federal Retirement Savings Investment Board introduced a new method for matching contributions called “rollovers.”

The transfer will apply to all active employees who are over the age of 50 and exceed the annual IRS deferral limit. Employees receive matching government contributions on a trickle-down basis. For eligible employees, contributions are automatically counted against the IRS reimbursement limit.

If a military installation or a government installation (whether listed or not) is partially located within the territory of more than one city or county, the applicable daily rate for the entire installation or installation is higher than the rates applicable to cities.

Source: library.sportingnews.com

Source: library.sportingnews.com

Health Benefits

and/or district, although part(s) of such activities may be located outside the place defined for daily nutrition. Adding the GSA Payroll Calendar to your personal Google Calendar: Use the “Add by URL” feature to import the GSA Payroll ICS file into your Google Calendar.

Follow these step-by-step instructions in Word [DOC – 632 KB] or PDF [PDF – 402 KB] with screenshots. If you choose this option, you agree and acknowledge that you will receive your W-2 directly from EEX and that a hard copy will not be mailed to you.

Terminating employees will automatically receive a hard copy in the mail. For assistance with EEX user IDs and passwords, submit a request to the Help Desk by clicking the help icon, the question mark, located in the upper right corner of the login page on the Employee Express website.

We encourage each employee to review their Leave and Earnings report to ensure that taxes have been withheld in the correct state and/or locality. If taxes have been withheld for the wrong state or location, you should immediately correct the information in Employee Express and contact the Customer Service Center as soon as possible.

Voluntary Tax Allotments

Payroll has a limited ability to correct prior year tax errors, and errors from 2022 that are not discovered until 2023 may require the employee to file a tax return for a withholding tax refund for the wrong tax entity.

Wages for tax-free states are not shown on W-2s. Financial institutions often deposit cash into an employee’s account early and post it as “pending” or “notice” activity with a settlement date of Monday. Some financial institutions provide this advance posting to personal bank accounts, but not all.

Payment for work performed is the basis of the employer/employee relationship. It’s almost a completely implicit expectation (imagine, for example, being asked during a job interview if you’ll be paid accurately and on time) until something goes wrong, when the whole message is at stake.

That’s why payroll is important. But it’s also stressful, time-consuming, somewhat complicated and never-ending. Even small compensation mistakes cause big headaches, and the biggest ones can lead to serious legal and financial problems with employees or the government.

Annual Premium Pay Limitation

However, despite its critical nature, even basic payroll knowledge is relatively rare outside of groups or individuals involved in payments. All federal employees participating in the CFC are directed to one centralized donation system. To register, select charities and set up new donations, visit cfcgiving.opm.gov/welcome no later than January 14, 2023. Pursuant to 5 C.F.R.

950,701, payroll deductions begin with the first pay period after January 15, 2023 (PP 2023-04) and end with the last pay period that includes January 15 of the following year (PP 2024-03) for 26 pay periods.

The IRS has not yet released rates for 2023 because they depend on legislation that has not been finalized. When the rates are available, they will be listed in Publication 15-B (2023), Employers’ Tax Guide to Fringe Benefits.

Source: library.sportingnews.com

Source: library.sportingnews.com

In order to maintain the withholding exemption in 2023, the Internal Revenue Service (IRS) requires those claiming the withholding to complete a new Form W-4 no later than February 10, 2023. If the new Form W-4 has not entered EEX or

Calendar Tax Year

FPPS between January 1 and February 10, 2023, the employee’s federal withholding status will change to the highest possible withholding tax. The IRS has not yet updated the 2023 Form W-4, but you can view it when it becomes available at www.irs.gov/pub/irs-pdf/fw4.pdf.

The federal withholding tax formula for wages paid in 2023 will be updated soon on our payroll website. Employees contributing pre-tax deductions should deduct their fortnightly pre-tax contributions from their fortnightly gross pay before applying the formula.

Pre-tax deductions for the Flexible Spending Accounts program will automatically end after pay period 2022 26, unless reauthorized by the employee. A new FSA election would have to be made during the open season (November 14 to December 12, 2022) to reflect the 2023 pre-tax deductions.

For more information and/or seasonal changes, visit www.opm .gov/healthcare-insurance/flexible-spending-accounts. As a reminder for 2023, the statutory wage cap applies to most employees exempt from the Fair Labor Standards Act (FLSA) (see 5 U.S. Code 5307). Although base pay is never reduced, some allowances, differentials, bonuses or awards may even be reduced and deferred to the following year.

Spillover Method For Tsp Catch-Up Contributions – Formerly Thrift Catch-Up Contributions Tcc And Roth Savings Catch-Up Rsc

Retention, hiring, or relocation incentives permitted under 5 U.S.C. Codes 5753 and 5754, which may cause employees to exceed the total wage limits, may also be reduced or suspended. The overall salary cap i

s generally Level 1 of the Executive Plan.

Official websites use .gov The .gov website belongs to an official government organization in the United States. The chart below shows two examples (contributions in dollars) for calculating the amount of PP election in EEX. In each scenario, the traditional TSP maximum contribution must be met before any contributions catch up and “spill over”: What is ICS?

The Universal Calendar Format (ICS) is used by several email and calendar programs, including Microsoft Outlook, Google Calendar, and Apple iCal. Allows users to publish and share calendar information on the web and via email. The 2022 annual leave year ends on PP 2023-01, December 31, 2022. Employees in the six-hour leave category will earn their four additional hours on PP 2023-01, the last full pay period of the calendar year.

The official payment date of the Ministry of Finance is the Thursday after two weeks of NFC salary processing. However, the payment will take effect on Monday after two weeks of NFC payroll processing. To encourage employee participation in direct deposit, the settlement date for all direct deposit payments has been changed to the Monday following the completion of the PAYROLL process.

State And Local Taxes

2023 federal payroll calendar printable, 2023 payroll and holiday schedule, 2023 federal calendar with pay periods, 2023 payroll calendar, gsa payroll calendar 2023, opm pay period calendar 2023, 2023 government pay calendar, nyc 2023 pay calendar