A monopolistic competitor wishing to maximize profit – For a monopolistic competitor seeking to maximize profits, understanding the market dynamics and implementing strategic pricing is crucial. This guide will delve into the intricacies of profit maximization, exploring the factors that influence pricing decisions and the strategies employed to achieve optimal profitability.

We’ll examine the impact of market demand, cost structure, and competition on pricing, analyzing various pricing strategies such as price skimming, penetration pricing, cost-plus pricing, and value pricing. We’ll also discuss the role of product differentiation in monopolistic competition and how it affects market power and pricing.

Market Structure

Monopolistic competition is a market structure characterized by a large number of sellers offering differentiated products. Each firm has a small market share and faces competition from many other firms. This market structure is common in industries such as retail, restaurants, and clothing.

The key differences between monopolistic competition and perfect competition are:

- Number of sellers:In perfect competition, there are a large number of sellers, while in monopolistic competition, there are a moderate number of sellers.

- Product differentiation:In perfect competition, all firms sell identical products, while in monopolistic competition, firms sell differentiated products.

- Market share:In perfect competition, each firm has a very small market share, while in monopolistic competition, firms have a small but non-negligible market share.

- Barriers to entry:In perfect competition, there are no barriers to entry, while in monopolistic competition, there are some barriers to entry, such as product differentiation and economies of scale.

Profit Maximization

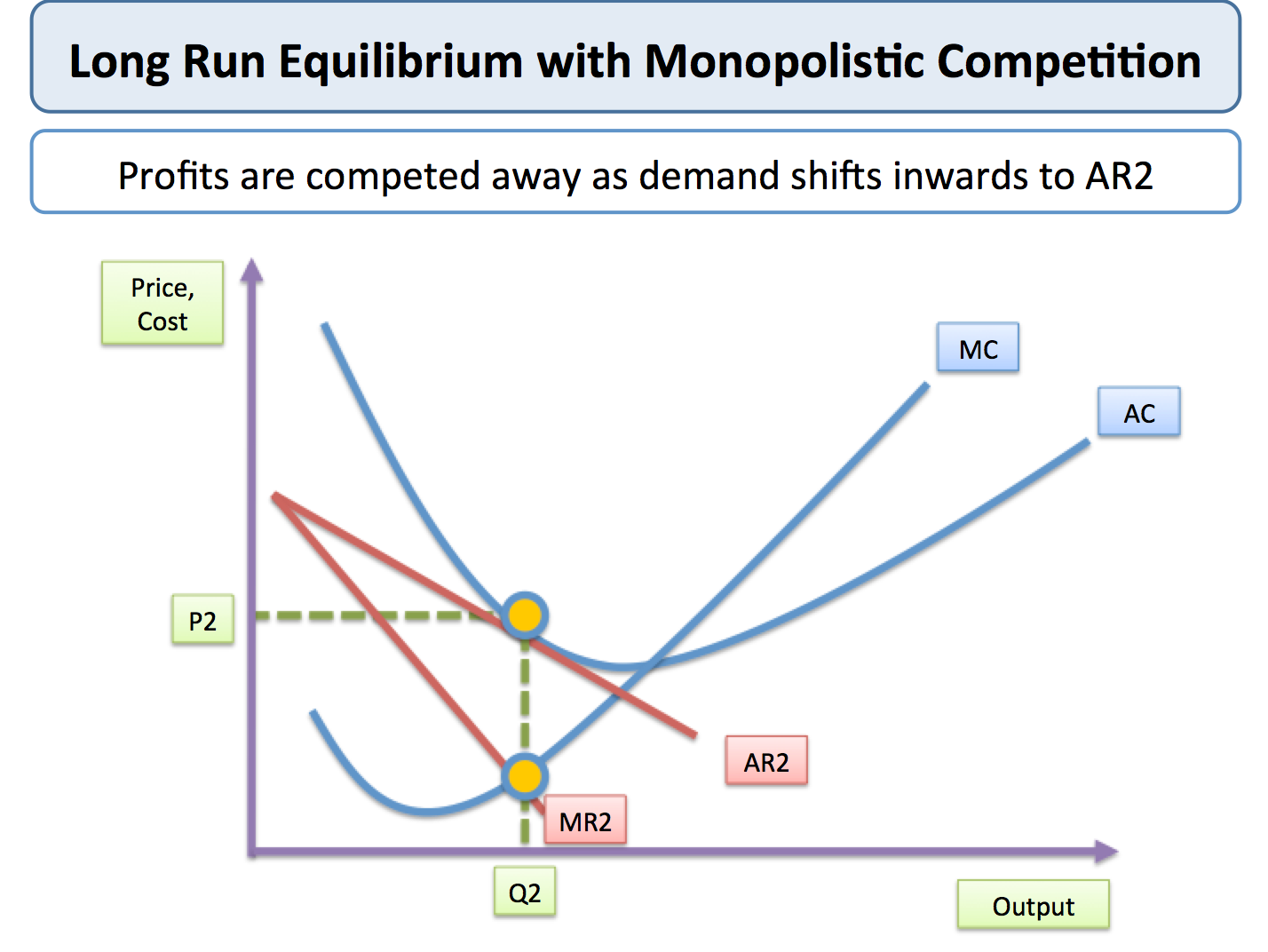

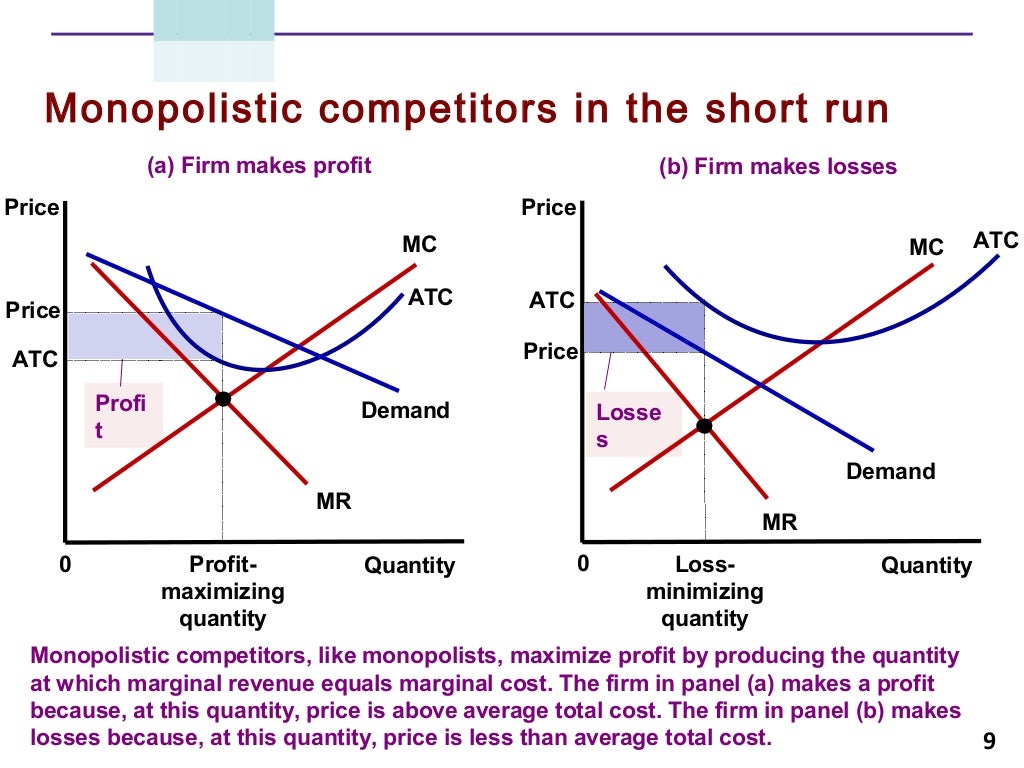

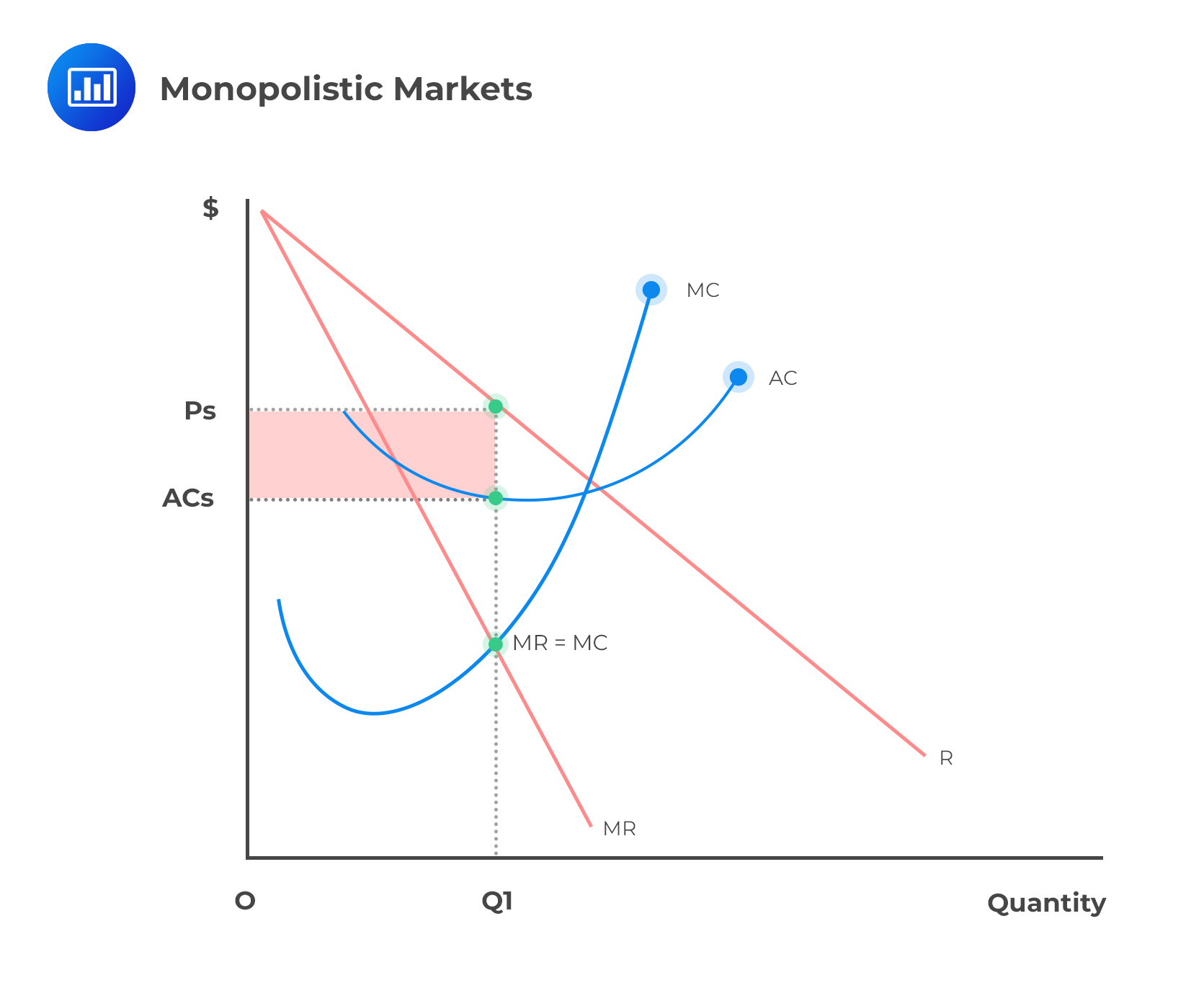

Monopolistic competitors strive to maximize their profits, and they achieve this by setting prices and output levels that align with specific conditions. Understanding these conditions is crucial for comprehending the behavior of firms in monopolistic competition.

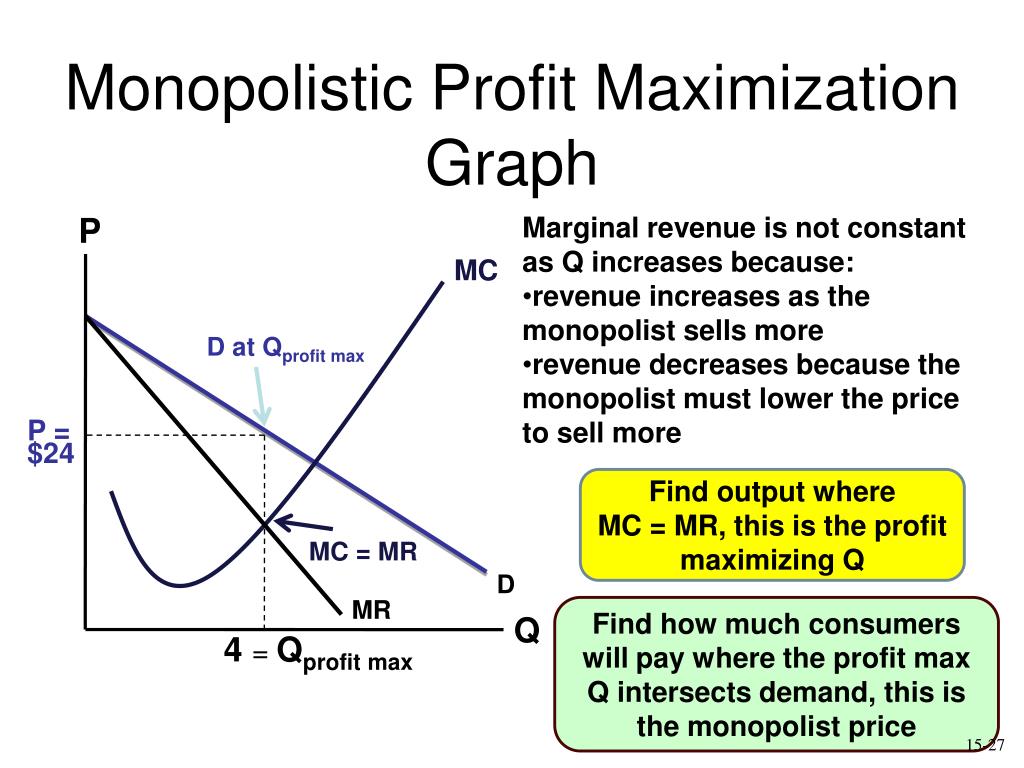

For a monopolistic competitor to maximize profits, it must satisfy two key conditions:

- Marginal Revenue equals Marginal Cost:The profit-maximizing output level is where the marginal revenue (MR) derived from selling an additional unit of output is equal to the marginal cost (MC) of producing that unit.

- Price exceeds Marginal Cost:In monopolistic competition, firms have some market power, allowing them to set prices above marginal cost. This difference between price and marginal cost, known as markup, contributes to the firm’s profit.

Price and Output Determination

To determine the profit-maximizing price and output, a monopolistic competitor can follow these steps:

- Calculate Marginal Revenue:Determine the marginal revenue for each output level, which represents the change in total revenue resulting from selling one more unit.

- Calculate Marginal Cost:Estimate the marginal cost of producing each additional unit of output, considering variable costs like raw materials and labor.

- Equate Marginal Revenue and Marginal Cost:Find the output level where marginal revenue equals marginal cost. This output level represents the profit-maximizing quantity.

- Set Price:Knowing the profit-maximizing output level, the firm can set a price that is above marginal cost but below the price that would be charged under perfect competition. This markup ensures that the firm earns a positive profit.

Pricing Strategy

In the realm of monopolistic competition, pricing plays a pivotal role in maximizing profits. Unlike pure monopolies, monopolistic competitors operate in markets with numerous firms offering similar but differentiated products. Understanding the factors that influence pricing decisions and the various pricing strategies available is crucial for these firms to succeed.

Factors Influencing Pricing Decisions

- Market Demand:Higher demand typically leads to higher prices, as customers are willing to pay more for a desired product or service.

- Cost Structure:The costs associated with production, such as raw materials, labor, and overhead, directly impact pricing decisions. Higher costs may necessitate higher prices to maintain profitability.

- Competition:The presence of competing firms can exert downward pressure on prices. Monopolistic competitors must consider the pricing strategies of rivals to avoid undercutting or being undercut.

Pricing Strategies

Monopolistic competitors employ various pricing strategies to maximize profits and appeal to target customers:

- Price Skimming:Setting a high initial price to capture early adopters and gradually lowering it over time.

- Penetration Pricing:Setting a low initial price to attract customers and gradually raising it over time.

- Cost-Plus Pricing:Setting a price based on the cost of production plus a desired profit margin.

- Value Pricing:Setting a price based on the perceived value of the product or service to customers.

Advantages and Disadvantages of Pricing Strategies

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Price Skimming | High profits early on | May alienate price-sensitive customers |

| Penetration Pricing | Attracts new customers | May reduce perceived value of the product or service |

| Cost-Plus Pricing | Simple and easy to implement | May not maximize profits |

| Value Pricing | Aligns with customer perceptions | May be difficult to determine the perceived value of the product or service |

Profit Maximization

To maximize profits, monopolistic competitors must carefully consider the interplay of market demand, cost structure, competition, and perceived value. By setting a price that balances these factors, they can achieve optimal profitability.

Product Differentiation

Product differentiation plays a crucial role in monopolistic competition. It refers to the ability of firms to distinguish their products from those of their competitors based on unique attributes, such as design, quality, features, or branding. This differentiation allows firms to create a sense of exclusivity and loyalty among their customers.

Market Power and Pricing

Product differentiation gives monopolistic competitors some degree of market power. By creating unique products, firms can reduce the elasticity of demand for their products, meaning that customers are less likely to switch to competitors’ products even if prices increase. This allows firms to charge higher prices than they could in a perfectly competitive market.

However, the extent of market power and the ability to charge higher prices depends on the degree of product differentiation. The more differentiated a product is, the greater the market power and pricing power the firm has.

Entry and Exit Barriers

Entry and exit barriers are critical factors that shape the dynamics of a monopolistic competitive market. These barriers influence the number of firms in the market, the level of competition, and ultimately, the market structure.Barriers to entry refer to factors that make it difficult for new firms to enter a market.

These barriers can include economies of scale, patents, government regulations, and brand loyalty. Economies of scale occur when the average cost of production decreases as the quantity of output increases. This makes it challenging for new entrants to compete with established firms that have already achieved economies of scale.

Patents provide legal protection for inventions, giving firms a monopoly over the production and sale of those inventions. Government regulations, such as licensing requirements or environmental standards, can also increase the costs of entry for new firms. Finally, brand loyalty can make it difficult for new entrants to gain market share, as consumers are already familiar with and prefer the products of established firms.Barriers to exit, on the other hand, refer to factors that make it difficult for firms to leave a market.

These barriers can include sunk costs, contractual obligations, and government regulations. Sunk costs are costs that have already been incurred and cannot be recovered if the firm exits the market. Contractual obligations, such as long-term leases or supply contracts, can also make it difficult for firms to exit the market without incurring significant losses.

Government regulations, such as environmental cleanup requirements or employee severance packages, can further increase the costs of exit.The presence of entry and exit barriers can have a significant impact on the market structure and competition. High barriers to entry can limit the number of firms in the market, leading to a more concentrated market structure.

This can reduce competition and allow firms to exercise market power, resulting in higher prices and lower output. High barriers to exit can also make it difficult for firms to leave the market, even when they are no longer profitable.

A monopolistic competitor with the aim to maximize profit often falls into the trap of believing that “what you wish for will come true.” This is a dangerous mindset, as it leads to unrealistic expectations and can ultimately result in disappointment.

As the article what you wish for won’t come true bl points out, the world doesn’t always work the way we want it to. There are external factors, such as competition and economic conditions, that can influence our outcomes. Therefore, it is important for a monopolistic competitor to be realistic about their goals and to have a backup plan in case things don’t go their way.

This can lead to market inefficiencies, as resources are allocated to firms that are not operating efficiently.Examples of industries with high entry and exit barriers include the automobile industry, the pharmaceutical industry, and the telecommunications industry. In the automobile industry, economies of scale and brand loyalty make it difficult for new entrants to compete with established manufacturers.

In the pharmaceutical industry, patents and government regulations create significant barriers to entry. In the telecommunications industry, government regulations and the high cost of infrastructure make it difficult for new entrants to compete with established providers.Understanding entry and exit barriers is crucial for businesses operating in monopolistic competitive markets.

Firms can use this knowledge to make informed decisions about entering or exiting the market, and to develop strategies to overcome or mitigate the impact of these barriers.

– Analyze the role of advertising and marketing in monopolistic competition.: A Monopolistic Competitor Wishing To Maximize Profit

In monopolistic competition, advertising and marketing play a crucial role in enhancing product differentiation and market power. By communicating unique product attributes, creating brand awareness, and influencing consumer preferences, firms can establish a distinct position in the market and increase their sales volume.

Enhancing Product Differentiation

Advertising and marketing campaigns can highlight the unique features and benefits of a product, differentiating it from competitors’ offerings. This can involve emphasizing specific product attributes, showcasing product usage scenarios, or creating emotional connections with consumers.

- Example: Coca-Cola’s “Share a Coke” campaign personalized its product by printing consumers’ names on its bottles, creating a unique and memorable experience.

- Example: Apple’s “Think Different” campaign positioned its products as innovative and aspirational, differentiating them from competitors in the technology industry.

Non-Price Competition

In monopolistic competition, non-price strategies play a crucial role in differentiating products and influencing consumer choices. These strategies focus on creating value beyond price, appealing to consumers’ preferences and emotions.

One common non-price strategy is product differentiation. By creating unique features, designs, or qualities, monopolistic competitors can distinguish their products from rivals. This differentiation can justify higher prices or attract customers who value specific attributes.

Product Quality

- Enhancing product quality improves performance, durability, or reliability, creating perceived value for consumers.

- Higher quality products can command premium prices and foster brand loyalty.

Product Design

- Appealing design elements, such as aesthetics, ergonomics, or user-friendliness, can differentiate products and attract consumers.

- Design can enhance functionality, improve user experience, or evoke emotional connections.

Customer Service

- Excellent customer service builds strong relationships with customers, fostering loyalty and repeat purchases.

- Responsive, personalized, and helpful support can differentiate a business from competitors.

Marketing and Advertising

- Effective marketing and advertising campaigns create brand awareness, communicate product benefits, and shape consumer perceptions.

- Targeted advertising can reach specific customer segments and influence their purchase decisions.

Brand Image

- Building a strong brand image through consistent messaging, values, and visual identity creates a distinct perception in consumers’ minds.

- Positive brand associations can influence purchase decisions, even at higher prices.

Compare and contrast monopolistic competition with oligopoly.

Monopolistic competition and oligopoly are both market structures that exhibit elements of both perfect competition and monopoly. However, there are key differences between the two structures in terms of market structure, pricing behavior, and competition.

Market Structure

Monopolistic competition is characterized by a large number of sellers offering differentiated products. This means that each seller has a small market share and faces competition from many other sellers. Oligopoly, on the other hand, is characterized by a small number of large sellers who control a significant portion of the market.

This gives each seller more market power than in monopolistic competition.

Pricing Behavior

In monopolistic competition, each seller sets its own price for its product. This price is typically higher than the marginal cost of production, as each seller has some market power. In oligopoly, prices are often set through collusion, where the sellers agree to charge a common price.

This price is typically higher than the marginal cost of production, as the sellers have more market power than in monopolistic competition.

Competition

Monopolistic competition is characterized by intense competition, as each seller tries to differentiate its product from the products of other sellers. This competition can lead to innovation and lower prices for consumers. Oligopoly, on the other hand, is characterized by less competition, as the large sellers have more market power.

This can lead to higher prices and less innovation for consumers.

A monopolistic competitor looking to increase profit can observe market trends like the popularity of a christmas wish bet cast to analyze how consumers are likely to behave in the market, allowing them to make informed decisions about pricing and production.

| Characteristic | Monopolistic Competition | Oligopoly |

|---|---|---|

| Number of Sellers | Large | Small |

| Market Share | Small | Large |

| Product Differentiation | Yes | Yes |

| Pricing Behavior | Independent | Collusive |

| Competition | Intense | Less intense |

“Oligopoly is a market structure in which a small number of large firms control a significant portion of the market. This gives each firm more market power than in monopolistic competition, and can lead to higher prices and less innovation for consumers.”

Professor John Sutton, University of Oxford

Government Intervention

Government intervention in monopolistic competitive markets aims to address potential market failures and promote competition.

Antitrust Policies

Antitrust policies are designed to prevent anti-competitive practices that can harm consumers. These policies prohibit mergers and acquisitions that create monopolies or reduce competition significantly.

Benefits:

- Promote competition and innovation.

- Prevent monopolies from exploiting consumers.

Drawbacks:

- Can be costly and time-consuming to enforce.

- May stifle innovation if regulations are too strict.

Real-World Examples

Monopolistic competition is a common market structure in many industries. Here are some real-world examples:

Retail Industry

- Grocery stores: Many grocery stores operate in a monopolistically competitive market, offering similar products but differentiating themselves through factors such as store ambiance, customer service, and product selection.

- Clothing stores: The clothing industry is another example of monopolistic competition, with numerous brands and stores offering a wide range of clothing items that cater to different tastes and preferences.

- Restaurants: The restaurant industry is a classic example of monopolistic competition, with countless restaurants offering various cuisines, atmospheres, and price points.

Service Industry

- Hair salons: Hair salons operate in a monopolistically competitive market, providing similar services but differentiating themselves through factors such as stylists’ expertise, salon ambiance, and product offerings.

- Law firms: Law firms compete in a monopolistically competitive market, offering legal services that are often similar but differentiated by factors such as specialization, reputation, and client relationships.

- Consulting firms: Consulting firms operate in a monopolistically competitive market, providing similar services but differentiating themselves through factors such as industry expertise, team experience, and methodology.

Manufacturing Industry

- Automobile industry: The automobile industry is an example of monopolistic competition, with numerous car manufacturers offering vehicles that are similar in function but differentiated by factors such as design, features, and performance.

- Consumer electronics industry: The consumer electronics industry is another example of monopolistic competition, with many companies offering similar products such as televisions, smartphones, and laptops but differentiating themselves through factors such as brand reputation, product features, and design.

- Pharmaceutical industry: The pharmaceutical industry operates in a monopolistically competitive market, with numerous companies developing and marketing drugs that are similar in therapeutic effects but differentiated by factors such as efficacy, side effects, and patents.

Key Characteristics

The monopolistic competitive industries share several key characteristics:

- Many firms: Monopolistic competitive markets typically have a large number of firms, each with a small market share.

- Product differentiation: Products in monopolistic competition are differentiated, meaning that they are not perfect substitutes for each other.

- Barriers to entry: Barriers to entry are typically low in monopolistic competition, allowing new firms to enter the market relatively easily.

Implications

Monopolistic competition has several implications for consumers and society:

- Consumer choice: Monopolistic competition provides consumers with a wide variety of choices, as firms differentiate their products to appeal to different tastes and preferences.

- Innovation: Monopolistic competition encourages firms to innovate and develop new products and services to differentiate themselves from competitors.

- Economic efficiency: Monopolistic competition can lead to economic inefficiency as firms may spend resources on product differentiation and advertising rather than on cost reduction.

Historical Perspective

The concept of monopolistic competition has its roots in the early 20th century, emerging as an alternative to the traditional models of perfect competition and monopoly.

In 1933, Edward Chamberlin’s seminal work, “The Theory of Monopolistic Competition,” laid the foundation for understanding this market structure. Chamberlin introduced the concept of product differentiation, highlighting how firms can differentiate their products to create a monopoly-like advantage within a competitive market.

Key Economic Theories and Empirical Studies

- Theory of Monopolistic Competition (1933) by Edward Chamberlin:Defined the concept and key features of monopolistic competition.

- The Economics of Imperfect Competition (1933) by Joan Robinson:Developed the concept of product differentiation and its impact on market behavior.

- Empirical Study of Monopolistic Competition in the U.S. Manufacturing Sector (1956) by Joe Bain:Provided empirical evidence for the existence and prevalence of monopolistic competition.

- Empirical Analysis of Product Differentiation and Market Power (1980) by Michael Porter:Examined the relationship between product differentiation and market power in various industries.

These theories and studies have played a crucial role in shaping our understanding of monopolistic competition and its characteristics.

Timeline of Key Events

| Year | Event |

|---|---|

| 1900 | Early theories of imperfect competition emerge |

| 1933 | Chamberlin and Robinson publish their seminal works on monopolistic competition |

| 1956 | Bain’s empirical study provides evidence for the prevalence of monopolistic competition |

| 1980 | Porter’s analysis highlights the importance of product differentiation |

| Present | Monopolistic competition remains a significant market structure in many industries, influenced by technological advancements and globalization |

Mathematical Modeling

To mathematically represent the profit-maximizing behavior of a monopolistic competitor, we can use the following model:

Π = TR – TC

Where:

- Π is profit

- TR is total revenue

- TC is total cost

Total revenue is equal to price multiplied by quantity:

TR = P – Q

Total cost is equal to fixed cost plus variable cost multiplied by quantity:

TC = FC + VC – Q

To maximize profit, the monopolistic competitor will set marginal revenue equal to marginal cost:

MR = MC

Where:

- MR is marginal revenue

- MC is marginal cost

Assumptions and Limitations of the Model

The following assumptions and limitations apply to this model:

- The market is perfectly competitive, meaning that there are many buyers and sellers and no single firm has market power.

- The firm’s products are differentiated, meaning that they are not perfect substitutes for each other.

- The firm has some control over price, but not complete control.

- The firm’s costs are constant, meaning that they do not change with output.

- The firm is profit-maximizing, meaning that it will choose the output level that maximizes its profit.

Case Study Analysis

This case study examines a monopolistic competitor that has achieved notable success in maximizing profits. Through in-depth analysis, we aim to identify the key factors that have contributed to their success, evaluate their market share and pricing strategy, and assess their financial performance.

Company Overview

The company in question operates in the [industry name] industry and has consistently outperformed its competitors in terms of profitability. It has a strong brand reputation and a loyal customer base. The company’s products are differentiated from those of its competitors through unique features and superior quality.

Key Factors for Success

- Product Differentiation:The company has invested heavily in research and development to create products that are unique and desirable to customers.

- Brand Building:The company has built a strong brand reputation through effective marketing and advertising campaigns.

- Operational Efficiency:The company has implemented efficient production and distribution processes, allowing it to keep costs low while maintaining high quality.

Market Share and Pricing Strategy, A monopolistic competitor wishing to maximize profit

The company has a significant market share in its industry, which it has maintained over time. Its pricing strategy is based on value pricing, where customers are willing to pay a premium for the company’s differentiated products.

Competition and Differentiation

The company faces competition from both large and small firms. It differentiates itself from its competitors through its focus on product quality, customer service, and brand loyalty.

Financial Performance

The company has consistently reported strong financial performance, with high profit margins and increasing revenue. Key drivers of its success include its differentiated products, strong brand reputation, and operational efficiency.

Key Learnings

- Product differentiation is essential for success in monopolistic competition.

- Building a strong brand reputation can create a loyal customer base.

- Operational efficiency can help companies keep costs low while maintaining quality.

Essay: Key Findings

The case study analysis reveals that the company’s success in maximizing profits can be attributed to its focus on product differentiation, brand building, and operational efficiency. By creating unique and desirable products, building a strong brand reputation, and implementing efficient processes, the company has been able to gain a significant market share and maintain high profitability.

These findings suggest that companies in monopolistic competition can achieve success by focusing on creating differentiated products, building strong brands, and operating efficiently.

Current Research and Future Directions

Current research in monopolistic competition focuses on understanding the role of advertising, product differentiation, and entry barriers in shaping market outcomes. Researchers are also exploring the impact of digital technologies and globalization on monopolistic competition.

Areas for Future Research

* The impact of social media and online advertising on market power and consumer behavior.

- The role of innovation and R&D in sustaining competitive advantage in monopolistic markets.

- The effects of government regulation and antitrust policy on the dynamics of monopolistic competition.

- The impact of globalization on the structure and conduct of monopolistic industries.

- The development of new analytical tools and models to study monopolistic competition.

Final Wrap-Up

In conclusion, a monopolistic competitor’s ability to maximize profits hinges on a comprehensive understanding of market dynamics and the strategic implementation of pricing strategies. By considering the factors discussed in this guide, businesses can optimize their pricing decisions, enhance their market position, and achieve their profit maximization goals.

Questions and Answers

What is the key to profit maximization for a monopolistic competitor?

Balancing market demand, cost structure, competition, and the perceived value of the product or service.

How does product differentiation impact a monopolistic competitor’s pricing?

It allows for higher prices due to the unique features or characteristics of the product.

What is the advantage of price skimming as a pricing strategy?

It generates high profits early on by targeting early adopters willing to pay a premium.

Our website has become a go-to destination for people who want to create personalized calendars that meet their unique needs. We offer a wide range of customization options, including the ability to add your own images, logos, and branding. Our users appreciate the flexibility and versatility of our calendars, which can be used for a variety of purposes, including personal, educational, and business use.